Energy Industry

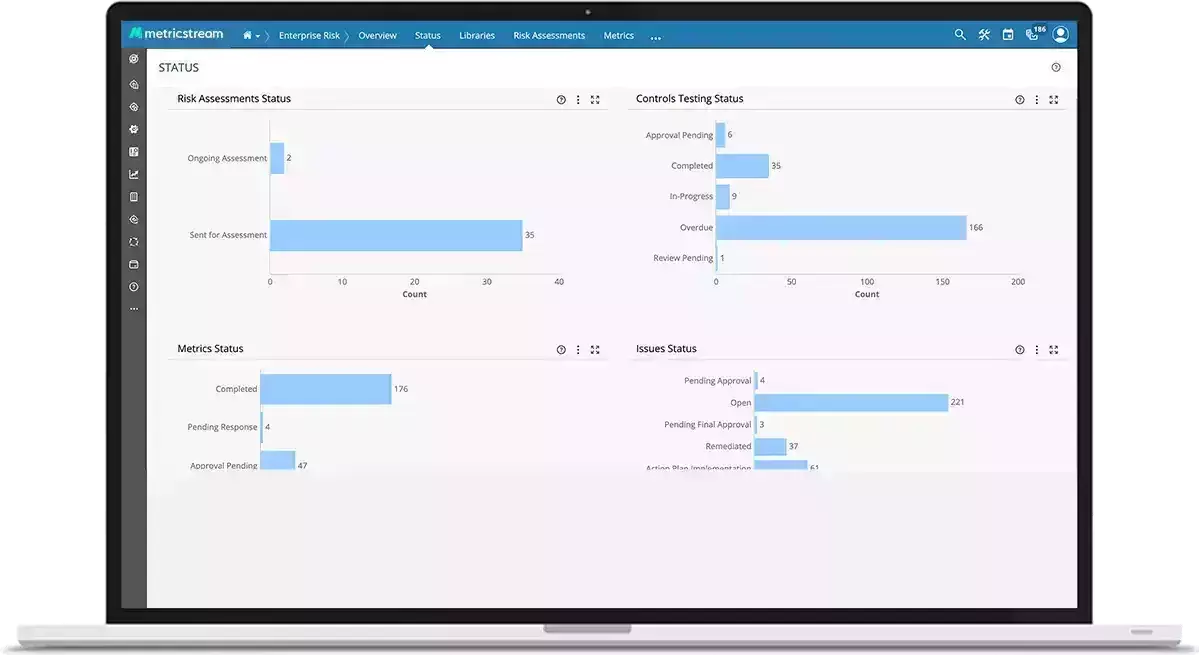

Measure Your Program Outcomes

- 90%

compression in compliance management timelines

- 80%

reduction in third-party onboarding time

- 90%

improvement in time spent on audit review

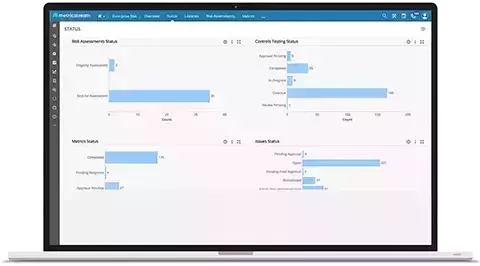

Drive Innovation by Turning Risk into a Strategic Business Advantage

The energy industry is currently operating in a high-risk and vulnerable landscape shaped by price volatility, evolving demand, cyber risk, supply chain disruptions, sustainability concerns, and innovative trends. In addition, they need to comply with state and regional public service commissions as well as cross-industry regulations. To stay ahead, organizations need a cohesive approach to mitigate enterprise risks, ensure compliance to avoid fines, optimize audit efforts, and protect from cyber risks and threats. MetricStream governance, risk management, and compliance solutions for the energy industry enables organizations to adopt an integrated approach to operational and enterprise risks, build compliance processes, and effectively mitigate cyber and third-party risk.

How MetricStream Software Solutions Help You

Manage and Mitigate Cyber Risk

Take proactive measures to manage and mitigate cyber risks, ensure compliance, and build resilience. Build cyber resilience and ensure IT and cyber risk compliance with industry best practices and frameworks such as ISO 27001, NIST CSF, and NIST SP800-53. Leverage real-time identification, assessment and mitigation of cyber risks and third-party risks. Easily map policies to controls and perform compliance and control assessments. Effectively determine cyber risk exposure in monetary terms with cyber risk quantification.

Build Enterprise Resilience

Ensure timely visibility into risks and insights that can drive actionable results to finding new ways to deliver greater customer and investor value while also reducing operating costs. Enable energy companies to gain a real-time aggregated view of risk and streamline risk identification, assessment, aggregation, mitigation, and reporting across the enterprise. Effectively manage capabilities to support risk-aware decision making. Leverage powerful analytics and reporting tools to facilitate consistent and uniform risk assessments.

Measure and Track ESG Performance

Ensure your organization’s key metrics around carbon footprint and sustainability goals are effectively captured and analysed and increase the confidence and trust of investors, consumers, and regulators. MetricStream’s ESGRC software empowers organizations to define and manage ESG standards, frameworks, and disclosure requirements. Easily link standards to organizational entities, key metrics and automate the collection and aggregation of data, with real-time analytics and dashboards.

Track and Manage Third-Party Risk Exposure

Effectively manage the risk associated with third-party vendors and suppliers. Manage, monitor, and track multiple stages of your third-party relationships. MetricStream Third-Party Risk Management software provides organizations with visibility into third-party risks and protects against disruptions and vulnerabilities. Effectively manage third-party risks by simplifying the due diligence processes across the third-party lifecycle. Use reports and analytics to dive deeper into third-party risk, compliance, and performance.

How MetricStream Benefits Your Business

- Gain real-time visibility across cyber risks and threat exposures through risk quantification and contextual risk information from across the enterprise

- Establish a strong risk management program with data governance and reporting to support informed decision-making with real-time monitoring of risks, controls, and losses

- Deliver comprehensive metrics on the organization’s current ESG score and strategize next steps

- Strengthen operational resilience with improved risk preparedness across internal and external business functions, operations, and third parties