Insurance Industry

Measure Your Program Outcomes

- 67%

improvement in risk reporting visibility and efficiency for the executive management and board

- 90%

compression in compliance management timelines

- 60%

faster response time to regulatory changes

Enhance Governance, Risk Management, and Compliance (GRC) Processes

The insurance industry faces multi-dimensional risks including cyber risk, operational risk, and compliance risk, which are not only constantly evolving but also leading to strict regulatory measures across the globe. Traditional ways of managing them will not work as the risks today are becoming increasingly complex and interconnected with the accelerated pace of digital transformation. MetricStream enables insurance companies to embrace a connected approach to managing enterprise risk, regulatory compliance, internal audit, third-party risk, and cyber risk. Our products and software solutions support effective decision-making by standardizing GRC processes, improving visibility into top risks, providing real-time insights on risk, compliance, internal controls, and more.

How MetricStream Software Solutions Help You

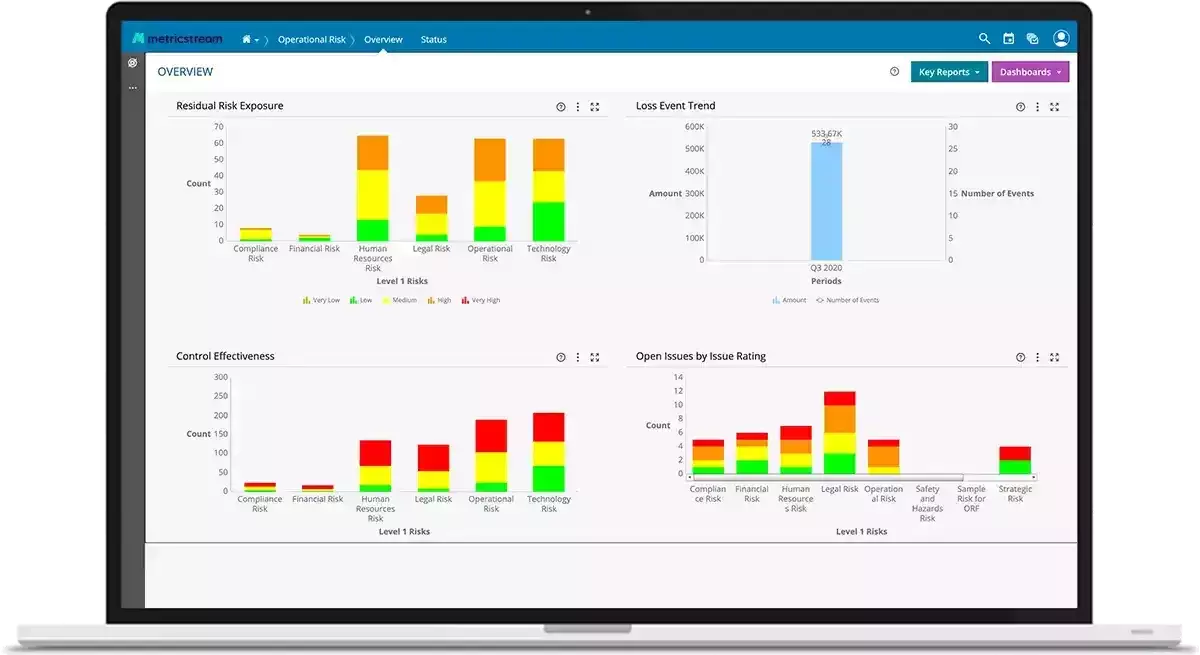

Gain an Integrated Approach to Enterprise Risk

Implement an integrated and automated approach toward managing enterprise risks faced by insurance companies. With MetricStream Enterprise and Operational Risk Management products, strengthen risk management programs by improving risk identification, risk tolerance, and risk assessment in accordance with the organizational risk appetite. Transform risk into strategic advantage and make well-informed business decisions with enhanced risk visibility and foresight and a better understanding of risk exposure.

Strengthen Regulatory Compliance

Stay compliant with various federal and state regulations with MetricStream Regulatory Compliance to support operations spanning multiple geographies and insured product types. Proactively identify potential gaps and areas of concern by mapping policies to regulations, risks, and controls. Simplify and streamline the compliance process by quickly adapting to regulatory changes and efficiently managing compliance assessments, control testing, policies, case investigations, and regulatory engagements.

Stay on Top of Cyber Risks

Identify, aggregate, analyze, and manage IT and cyber risks, threats, and vulnerabilities while ensuring compliance with regulatory requirements such as NAIC, PRA, FCA, and industry standards like ISO 27001, COBIT, and others. Evaluate cyber risk exposure in monetary terms with cyber risk quantification. Strengthen cyber resilience by transforming raw risk data into actionable IT risk intelligence, providing comprehensive visibility and deeper insights into the top cyber risks affecting the enterprise.

Effectively Manage Third-Party Risks

Enhance visibility into security and compliance across all third parties including vendors, suppliers, and contractors. With MetricStream Third-Party Risk Management, gain an integrated, real-time view of the third-party risks and protect your business from third-party or fourth-party risk exposure. Effectively manage third-party risks throughout their lifecycle, from onboarding through offboarding. Leverage historical data on third parties to confidently make sourcing and negotiation decisions.

How MetricStream Benefits Your Business

- Reduce risk exposure, minimize compliance violations, and build confidence with regulators and executive management

- Unify risk and compliance activities to enable full risk visibility across the enterprise

- Real-time visibility into IT and cyber risks and exposure in monetary value, effectiveness of controls, and progress of mitigation action plans

- Enable integrated assurance and better collaboration across compliance, audit, and risk management teams