The Top 5 Enterprise Risk Management (ERM) Tools For 2025

- Risk Management

- 29 April 24

Introduction

In today's global economy, where uncertainty is the only constant, navigating risks has never just been about avoiding the pitfalls. It's about strategically anticipating and mitigating them to steer organizations toward sustainable growth and turn them into strategic advantages.

At the heart of this crucial endeavor lies Enterprise Risk Management (ERM), a systematic approach designed to identify, assess, manage, and monitor risks across an organization. But what truly breathe life into ERM, transforming it from a theoretical concept into an effective system with well-defined workflows and processes providing actionable insights, are ERM tools.

Findings show that companies with effective ERM programs on average experience a 63% reduction in the frequency of risk events and up to a 35% reduction in operational losses.

ERM tools provide the necessary infrastructure to gather, analyze, and report on risk data across the enterprise. They support the decision-making process by offering proactive insights, allowing organizations to anticipate potential risks before they materialize. This predictive capability in Enterprise Risk Management can make all the difference between staying ahead of the competition and falling behind due to unforeseen challenges.

Key Features of ERM tools

Here are the key features that CROs and risk managers should keep in mind while selecting an ERM tool:

- Risk identification and assessment capabilities

The best ERM platforms provide a centralized place to log risks from across the organization. With an easy-to-use interface, they make it easy for the first line of defense to report any observation, issue, or warning signal which can be further analyzed by the second line. Features like risk questionnaires, heat maps, and automatic risk correlation provide a holistic view of your risk landscape. - Scenario analysis and risk quantification

To prepare for uncertainty, organizations need tools that can simulate 'what-if' scenarios. Simulating and testing plausible scenarios help them better understand potential risks, devise effective response strategies, and identify control gaps and other weaknesses. Tools supporting risk quantification help transform range-based estimates into more accurate values, enabling businesses to prioritize investments better, drive alignment between risk programs and business goals, and understand why and how recovery processes and priorities operate. - Integration with strategic planning processes

These ERM tools provide dashboards, reports, and analytics that give executives insight into how various risks might affect key business objectives. - Automated reporting and analytics

ERM software should make risk data easy to understand and share across the organization. This requires solutions that offer capabilities to generate custom reports, interactive risk dashboards, and risk analytics powered by data visualization. Incorporating AI-powered processes can further enhance the accuracy of risk assessment and decision-making, analyzing vast amounts of data to identify patterns, trends, and correlations that might not be immediately apparent via human efforts.

Top 5 ERM Tools For 2025

Here are some well-known vendors that are recognized as leaders in the ERM landscape.

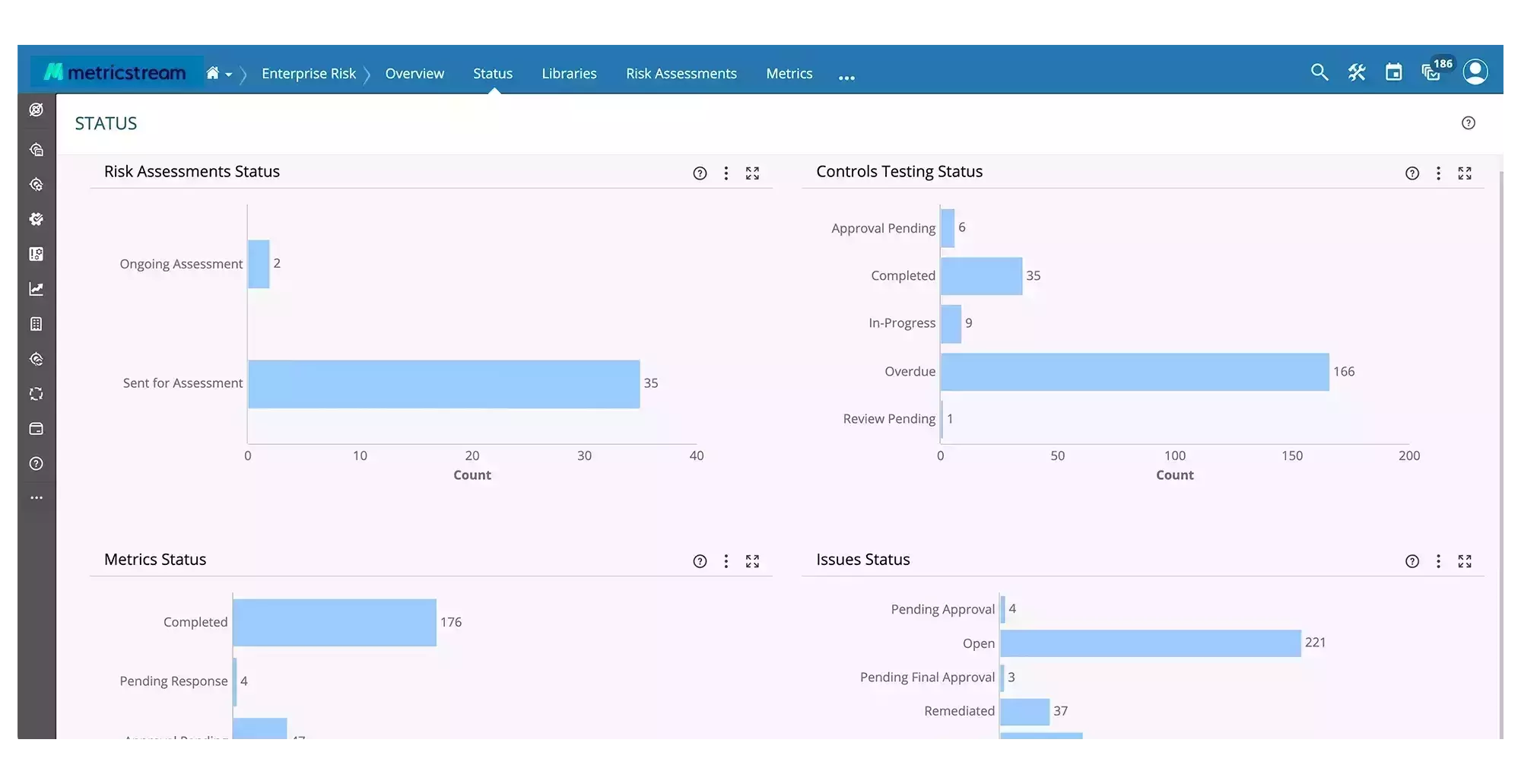

MetricStream

MetricStream has carved its place as an indispensable ERM tool for businesses aiming to bolster their enterprise risk management capabilities. This ERM software is crafted with an eye for integrating various aspects of risk management under a single umbrella, making it a holistic platform for businesses aiming to stay ahead of uncertainties.

This tool is best suited for organizations seeking to streamline risk processes, gain real-time insights into their risk landscape, and drive informed decision-making to optimize business performance and resilience in dynamic environments.

Key Features:

- Centralized risk repository fostering a common language for risk across the organization, ensuring consistency and transparency.

- Standardized approach to risk assessment, enabling uniform risk identification and mitigation strategies.

- Advanced analytics with real-time insights into the risk landscape, facilitating informed decision-making.

- Visualization tools that transform complex data sets into comprehensible insights for proactive risk management.

- Configurable risk assessment capabilities, incident tracking, and reporting functionalities for comprehensive risk management.

MetricStream's accolades, such as being named a Leader in The Forrester Wave™: Governance, Risk, and Compliance Platforms, Q4 2023, highlight its effectiveness and reliability. Recognition from leading research and advisory firms attests to the platform's robust capabilities in IT/Cyber Risk Management, GRC Vision, and more

To read more, download your complimentary copy of The Forrester Wave™: Governance, Risk, and Compliance Platforms, Q4 2023.

Pricing will be available on request to the vendors.

Diligent

Diligent offers a compelling narrative for ERM, emphasizing the importance of aligning leadership with the full spectrum of risks that impact an organization.

This strategic alignment is pivotal in transforming risk into actionable insights, enabling data-driven decision-making at every turn.

Diligent's approach revolves around cultivating a much more comprehensive understanding of risks across all levels of the organization, fostering a proactive risk management culture.Key Features:

- Utilizing advanced analytics, the platform automates risk monitoring, identifying patterns, and predicting threats to enhance operational efficiency without requiring additional personnel.

- By providing a unified risk viewpoint across teams, Diligent fosters collaboration, enhances scalability and improves visibility. Such a real-time perspective offers valuable insights into top risks, trends, and risk appetite for comprehensive risk portfolio management.

- Diligent employs a suite of detection, evaluation, and monitoring tools to identify and neutralize risks preemptively, preventing them from escalating into something worse.

- The tool also includes features to ensure regulatory compliance, offering built-in frameworks, controls, and workflows aligned with industry standards and regulations.

Pricing will be available on request to the vendors.

ServiceNow

ServiceNow is a robust platform that simplifies complex risk assessments and enhances decision-making capabilities across organizations.

It facilitates enhanced data communication using chat functionalities, web portals, and mobile applications, ensuring seamless sharing and dissemination of critical risk and compliance information across the organization.

This platform is ideal for organizations looking to centralize and optimize their risk management processes while enhancing overall operational resilience.Key Features:

- Self-assessment design and scheduling based on maturity levels to monitor risks continuously and ensure control accuracy as the organization expands.

- Incorporation of a comprehensive risk statement library for consolidating ratings and reporting through a common risk taxonomy, enabling effective communication across different organizational departments.

- Implementation of smart issue management capabilities driven by AI and machine learning, automating risk assignment, grouping, and remediation suggestions to reduce manual effort significantly.

- Access to advanced reporting features with interactive dashboards and Performance Analytics, providing deep insights into data and risk trends for informed decision-making.

Custom pricing will be available on request.

OneTrust

OneTrust is a comprehensive tool that specializes in compliance and vendor risk management, addressing critical niches within the risk management ecosystem. This tool is particularly valuable today, where data privacy regulations and third-party relationships are under increased scrutiny.

It has made its mark as a versatile cloud-based GRC platform, renowned for its customizable functionalities that cater to a wide range of risk management needs.Key Features:

- Its integrated GRC and security module stands out for enabling organizations to efficiently scale their risk and security functions, harmonizing risk assessment with mitigation efforts.

- OneTrust cleverly intertwines risk management with incident response, alongside automating the management of security standards, which can significantly ease the administrative burden on teams.

- OneTrust provides tools for vendor risk assessment and monitoring, enabling organizations to identify and mitigate risks associated with third-party relationships.

- The platform supports the management of security standards and frameworks such as ISO 27001 and NIST, assisting in aligning security policies and controls with industry best practices.

Pricing will be available on request.

LogicGate

LogicGate presents itself as a highly adaptive and modern ERM solution designed to meet the dynamic needs of contemporary businesses.Known for its flexibility and the ease with which it can be customized, LogicGate stands as a powerful tool in any risk manager's arsenal, particularly for those looking to streamline their ERM processes without being bogged down by complex technical requirements.

With LogicGate, businesses can forge ahead confidently, equipped with a versatile platform that aligns seamlessly with their risk management goals and operational strategies.

Key Features:

- Utilizing a modern graph database, LogicGate enables dynamic connections between risks, controls, and various business units and owners. This helps maintain reporting speed and ensures the adaptability of the risk management program without compromising on efficiency.

- It offers quick-start features such as pre-configured risk scoring and guidance for assessing inherent and residual risk ratings, simplifying the initial setup and ongoing management of risk assessments, and enhancing overall accuracy.

- Their Quantify feature introduces a new dimension to traditional quantification methods through Monte Carlo simulations. This in turn provides a financial context to risk decisions, offering executives a clearer understanding of risk impacts in tangible financial terms.

Pricing will be available on request to the vendors.

Criteria For Evaluating ERM Tools

When evaluating ERM tools, prioritize ease of use with intuitive interfaces that encourage user adoption. Consider the ROI beyond upfront costs, aiming for reduced risk event losses and improved efficiency. Assess functionality for alignment with specific needs, such as configurable risk assessments and reporting. Lastly, prioritize integration capabilities for smooth connectivity with existing platforms.

Gauging the success of your ERM implementation involves reviewing a range of criteria that validate its benefits. with some of them being:

- Ease of Use

An ERM solution is only effective if people use it. Organizations should choose a tool with an intuitive, user-friendly interface so it's easy for everyone to enter, access, and act on risk data. The easier it is to use, the more the user adoption and the more likely people will keep the tool up to date. - Return on Investment

While cost is a factor when choosing an ERM solution, organizations should not just look at the initial price tag but also consider the ROI the tool can provide, like reducing losses from risk events, lowering insurance premiums, and improving operational efficiency, all based on your industry. - Functionality

Organizations need to assess if the functionalities and capabilities of the ERM tool are aligned with their specific needs. They should look for features such as configurable risk assessment capabilities, risk registers, incident tracking, and reporting functionalities to support comprehensive risk management processes. - Integration Capabilities

Seamless integration with platforms such as enterprise resource planning (ERP) systems, project management tools, and data analytics platforms can enhance the efficiency and effectiveness of risk management processes by facilitating data sharing and streamlining workflows across different departments.

Benefits of Using an ERM Tool

Implementing an ERM tool brings a host of advantages to organizations seeking to enhance their risk management practices. Here are the top four benefits of using an ERM tool:

Improved Risk Visibility and Understanding

Implementing ERM tools enables organizations to peel back the layers of potential risks, revealing unseen threats and opportunities alike. This clarity enables businesses to anticipate challenges and navigate them with greater assurance.

Enhanced Decision-Making and Resource Allocation

With the insights garnered from these tools, organizations can make better-informed decisions that align closely with their goals. ERM tool offers the unique advantage of data-driven guidance, helping firms to allocate their resources more effectively, and ensuring that efforts are directed toward areas of highest impact.

Strengthened Resilience Against Uncertainties

ERM tools empower organizations with a proactive defense mechanism against potential disruptions. This robust preparedness doesn’t just mitigate risks, it also fosters an agile environment that can adapt and thrive in the face of uncertainties.

Regulatory Compliance and Governance Support

ERM tools serve as an invaluable ally, ensuring that compliance is maintained, and governance standards are met. This compliance is a strategic move that enhances credibility and stakeholder trust, paving the way for smoother operations and market growth.

Addressing Common Challenges in Implementation

Implementing ERM tools presents unique challenges that organizations must strategically address to ensure successful adoption and integration. From overcoming resistance to change and data quality issues to promoting cross-functional collaboration and enhancing risk assessment processes, navigating these challenges is essential for maximizing the effectiveness of ERM tools within companies.

Resistance to Change

Implementing ERM tools often requires changes in workflows and processes, which can be met with resistance from employees accustomed to traditional methods. Overcoming resistance to change involves effective change management strategies, such as stakeholder engagement, training programs, and transparent communication about its benefits.

Data Quality and Integrity

ERM tools rely heavily on accurate and reliable data to perform effective risk assessments and analyses. However, organizations may often struggle with data quality issues, including incomplete or outdated information, inconsistent data formats, and data silos.

Siloed thinking

Different departments often have narrow views of risk that don't account for how their risks might impact the rest of the organization. Organizations need to promote a culture of collaboration and an understanding of the interconnectedness of risks by establishing cross-functional risk committees and information-sharing protocols.

Inefficient risk assessment processes

Organizations need to assess risks timely, systematically, and objectively to strengthen risk preparedness and to be ready for the unexpected curveballs waiting to surface at the most inconvenient times. This requires developing comprehensive methodologies that consider risk likelihood, impact, velocity, and interconnectivity. Furthermore, organizations should update their risk profile regularly as conditions change.

Insufficient reporting and communication

Stakeholders can't make good risk-based decisions without timely and relevant information. It is imperative to establish risk reporting procedures to keep executives and risk owners in the loop. A risk dashboard or scorecard is a useful way to provide at-a-glance overviews and details on key risks.

How Do You Gauge the Success of Your Implementation?

Determining the success of your ERM implementation entails examining critical factors that showcase its achievements and improvements, such as:

- Key Performance Indicators (KPIs): Establishing measurable KPIs allows organizations to track the effectiveness of their ERM implementation. Metrics such as risk mitigation rates, incident response times, and compliance levels provide tangible evidence of success.

- Stakeholder Satisfaction: Keeping an ear to the ground and gathering feedback from stakeholders gives you a sense of how well our risk management efforts are working. When stakeholders are happy, it's a good sign that you’re on the right track with identifying and tackling risks throughout the organization.

- Adaptability: Success in ERM is closely linked to an organization's ability to adapt to change and withstand unforeseen disruptions. Monitoring the organization's resilience to emerging risks and its capacity to pivot strategies accordingly signifies effective ERM implementation.

- Financial Performance Improvement: By analyzing metrics such as cost savings from risk mitigation efforts, reduction in insurance premiums, and increased revenue from improved decision-making, organizations can gauge the effectiveness of their risk management strategies.

Trends Shaping the Future of ERM

Here are some of the latest trends that companies can look forward to, when it comes to boosting the effectiveness of ERM tools.

- Enhanced Predictive Analytics: These tools not only assess risks as they emerge but also forecast future threats and opportunities with a high degree of precision. For organizations, this means a more proactive stance in risk management, moving from reactive responses to strategic risk anticipation and mitigation.

- Adoption of cognitive, cloud, and other innovative technology: Organizations are increasingly adopting ERM tools that offer Artificial Intelligence (AI) and Internet of Things (IoT) capabilities, cloud support, integrations with external systems, and more. IoT devices feed real-time data into risk management systems, offering a live pulse on various risk factors while AI enhances decision-making with actionable insights, creating a highly responsive and dynamic risk management ecosystem. Cloud support is important as it is one of the key areas for organizations that are undergoing/considering digital transformation. It also enables seamless integrations with external systems which helps in a more comprehensive approach to ERM across an organization’s extended enterprise.

- Greater Emphasis on Interconnectedness of Risks Given the growing complexity of the risk landscape, the scope of ERM is expanding to include cyber risks, geopolitical risks, environmental, social, and governance (ESG) risks, and other risks. These various risks have multiple points of intersection with other risks, resulting in a labyrinth of risks and risk relationships. Organizations today need tools that can help them understand this interconnectedness of risks to better gauge their probable impact and devise appropriate response strategies.

- Continuous Improvement for Resilience: Enterprise risk management is not a one-time activity; it is a continuous, iterative process. Organizations need to implement tools that allow continuous testing and monitoring of controls, evidence collection, etc. that provide them regular insights into gaps and loopholes that need to be addressed for fine-tuning the risk strategy on an ongoing basis. This approach is important to improve risk visibility, foresight, and preparedness, and strengthen organizational resilience.

Conclusion

As we look forward to the trends of 2025, it’s clear that the future of ERM is not just about navigating uncertainties but about thriving in them. And when it comes to turning risks into rewards, MetricStream is a trusted partner, equipped to tackle the future of risk-management head-on.

To learn how MetricStream Enterprise Risk Management can help, request a personalized demo today.x