Introduction

Around the world, companies are being held accountable for their environmental and social impact. Investors, employees, customers, and regulators want to know that the firms they deal with are managing their carbon footprint well, treating their workers fairly, governing with transparency, and more. These insights are best articulated in a company’s environmental, social, and governance (ESG) reports.

Traditionally absent from financial disclosures, ESG reporting is now on its way to being mandated in many parts of the world. Not only does it help companies build trust and credibility with stakeholders, but it also provides the impetus for meaningful board-level conversations around risk, opportunity, and strategy.

"Good governance fosters trust, transparency, and longevity. To foster that trust and guard your organization, you need a clear line of sight to an ESG measure."

Gunjan Sinha, Co-Founder & Executive Chairman, MetricStream

ESG Reporting: More Than Another Compliance Requirement

For many investors, transparent ESG disclosure is a sign of healthy governance. It indicates that your business has a sense of a purpose that goes beyond profits. And it demonstrates that you’re committed to delivering long-term value to shareholders.

But what is ESG disclosure reporting?

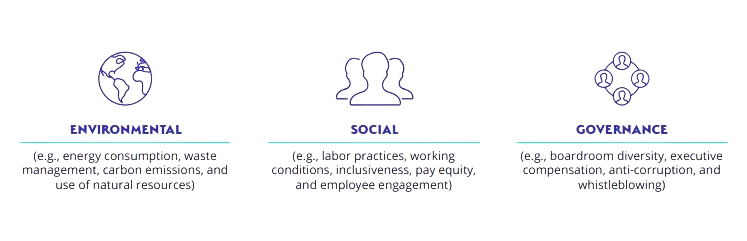

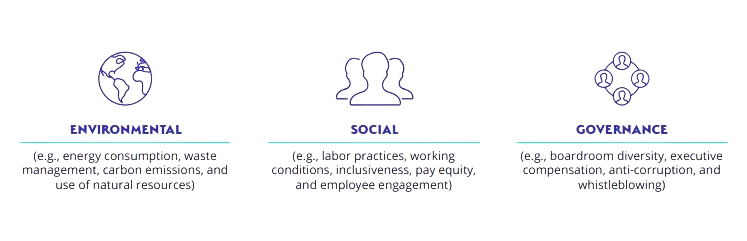

Simply put, it’s the process of declaring your company’s impact and performance across three key areas.

A number of compliance frameworks and standards have sprung up around ESG reporting, be it the widely used Global Reporting Initiative’s (GRI’s) sustainability reporting standards, or the 77 sustainability standards created by the Sustainability Accounting Standards Board (SASB) or, the climate risk reporting framework created by the Task Force on Climate-related Financial Disclosures (TCFD). SASB is also affiliated with the International Sustainability Standards Board (ISSB), which develops standards, in the public interest, that result in a high-quality, comprehensive global baseline of sustainability disclosures focused on the needs of investors and the financial markets. ISSB was created in 2021 to help meet the demand from global investment portfolios of increasing calls for high-quality, transparent, reliable, and comparable reporting by companies on climate and other ESG matters. The MetricStream Platform is purpose-built to support and scale a broad range of disclosure standards. As SASB transitions into the ISSB framework, MetricStream ESGRC offers innovative functionality to help customers seamlessly adapt to such changes.

But why is ESG reporting important right now?

For one, the risks associated with climate change, biodiversity loss, and other ESG-related factors are higher than ever. Wildfires, hurricanes, and floods are devastating communities worldwide. If we as businesses don’t act now to help mitigate the impact of these issues, we run the risk of total ecosystem collapse.

ESG factors can also affect your company’s financial health and reputation. For example, a failure to reduce your carbon footprint could lead to rating downgrades and share price losses. Similarly, a failure to improve employee wages could result in a loss of productivity and high worker turnover.

Today, the pressure to report and strengthen ESG metrics comes from several quarters. Consumers – especially Millennials and Gen Z’ers – prefer to engage with brands that care about ESG issues. In fact, 35% of consumers are willing to pay 25% more for sustainable products.

Investors, on their part, are increasingly demanding information on the social and environmental impact of the companies they partner with. Among institutional asset owners, 95% are integrating or considering integrating sustainable investing in all or part of their portfolios.

Regulators are also upping their scrutiny of corporate ESG practices. From the EU’s new Sustainable Financial Disclosure Regulation (SFDR), to the UK’s upcoming climate risk reporting regime, to the US’s proposed ESG Disclosure Simplification Act of 2021, ESG-related mandates around the world are steadily increasing.

All of this means that ESG data must be embedded into a company’s strategic and technology decisions, right up to the board level. Future-focused firms understand that ESG reporting isn’t just about ensuring compliance – it’s about creating a competitive edge. Transparent ESG disclosures can lead to better investor relations, greater market opportunities, and stronger consumer loyalty.

The International Finance Corporation (IFC) found that out of 656 companies in its portfolio, those with good environmental and social (E&S) practices outperformed clients with worse E&S practices by 210 basis points on return on equity, and by 110 basis points on return on assets.

4 Ways Technology Can Help You Optimize ESG Disclosure Reporting

ESG reporting is most effective when it’s real-time – when data on your social and environmental footprint is continually incorporated into strategic decision-making. Yet, for many companies, that’s easier said than done. ESG reporting is not a standalone activity. It’s the culmination of multiple processes, ranging from self-assessments and metrics collection, to compliance management and issue remediation. Coordinating all these processes manually can seem like a Herculean task. But technology can make things easier through process automation and data-driven insights.

Here’s a deeper look at how technology can help:

Simplify compliance through an integrated approach

Navigating the alphabet soup of regulations and reporting standards governing ESG can be challenging. Fortunately, efforts are being made towards establishing a single, standardized reporting framework but this could still be several years in the future. In the interim period, different investors still require companies to report against different ESG frameworks.

Technology can make the process easier by centrally capturing all your ESG disclosure requirements and mapping them to your business units and geographies. So, reporting becomes more structured and efficient. Through technology, you can map your component ESG data to various standards and frameworks to identify compliance gaps – collect component data once and let the technology intelligently map this data to the appropriate framework.

Meanwhile, regulatory change tracking tools can help you keep up with updates or modifications to ESG standards. And automated reporting can give you a faster, better understanding of your ESG compliance.

Improve visibility into ESG metrics with a single source of truth

For accurate ESG reporting, data needs to be aggregated and synthesized from multiple sources within and outside the enterprise. This data could range from carbon footprint emissions and renewable energy use to employee turnover and gender quality indexes. Since this data is often scattered across multiple systems and geographies, it can be difficult to consolidate.

Technology can help by automatically integrating ESG information from various sources onto a single platform. So, you gain a 360-degree view of your ESG impact to enable data-driven decision-making. With technology, you can also streamline and digitize the entire process of data collection. So, there’s better visibility into how and where each piece of information was gathered.

To top things off, technology can be integrated with third-party rating sources to build a clearer picture of your company’s ESG performance. This helps the board and leadership team be more transparent about the risks and opportunities their business faces.

Strengthen awareness around third-party ESG risks with real-time insights

Some of the biggest ESG risks emerge from third-party ecosystems. In fact, a CDP report found that companies’ supply chain greenhouse gas emissions are 5.5 times greater than their own impact from scope 1 and scope 2 emissions. Proactively mitigating these risks is key to improving ESG scores. However, today’s supply chains are complex and multi-tiered, with contractors increasingly outsourcing to sub-contractors. How do you efficiently track ESG risks across this vast network?

Here too, technology can help by providing a unified and real-time view of your extended enterprise. Processes such as third-party due diligence, ESG risk assessments, and audits can be streamlined and automated for optimal efficiency. You can also create a third-party portal to collect and manage supplier information easily.

By integrating with external content sources, technology can help you validate a supplier’s ESG information, and identify red flags faster. Powerful dashboards and analytics can give leadership teams a sound understanding of third-party ESG risks, compliance, and performance to drive informed decision-making.

Embed ESG into your corporate culture through seamless collaboration and issue reporting

Implementing ESG goals goes beyond writing a new policy or collecting data. It’s about building a culture where everyone is committed to environmental sustainability, social responsibility, and good governance. Companies with strong, purpose-driven cultures tend to create positive impact and higher returns.

With technology, you can unify everyone involved in ESG reporting on a single platform. So, they’re all working towards the same goals and objectives. Stakeholders from compliance, risk management, HR, investor relations, legal, and senior management can communicate and collaborate much more effectively when they have a single source of ESG truth. Roles and responsibilities can also be clearly defined and tracked. So, everyone feels a sense of accountability and ownership for ESG.

What’s more, technology can help create an environment that encourages employees to report ESG issues – be it workplace discrimination, bribery, or unsustainable business practices. Tools like browser plugins, conversational interfaces, and intuitive web forms provide a simple way for business users to record their ESG observations from the front line. This data can then be triaged and routed for further investigation. The result is that ESG incidents or risks are proactively identified and mitigated through a collective effort, thus improving your company’s overall ESG performance.

MetricStream ESGRC – Enabling Growth with Purpose

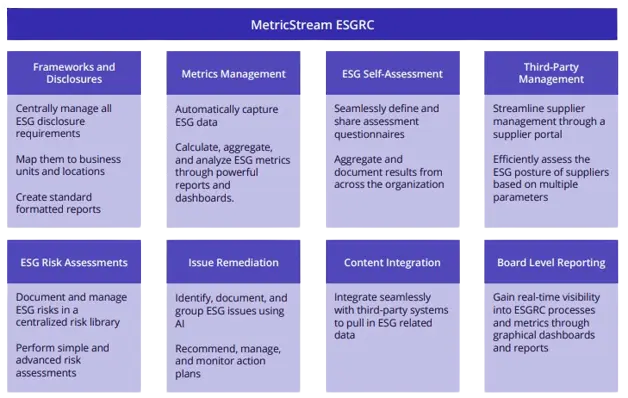

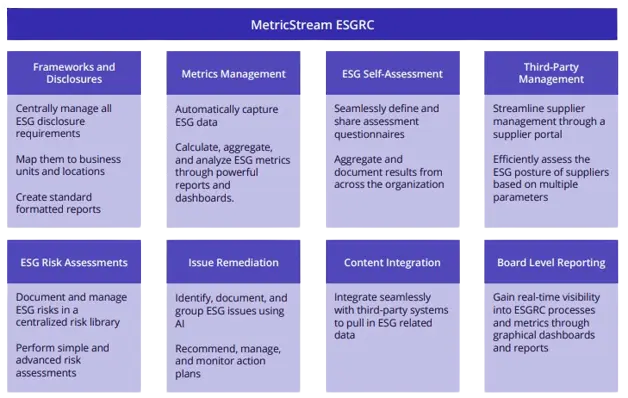

MetricStream’s Environmental, Social, Governance, Risk, and Compliance (ESGRC) software enables companies to effectively measure, report, and improve ESG performance. Through its integrated platform, you can capture disclosure requirements, conduct self-assessments, identify issues, and gain meaningful insights for decision-making.

Around the world, companies are being held accountable for their environmental and social impact. Investors, employees, customers, and regulators want to know that the firms they deal with are managing their carbon footprint well, treating their workers fairly, governing with transparency, and more. These insights are best articulated in a company’s environmental, social, and governance (ESG) reports.

Traditionally absent from financial disclosures, ESG reporting is now on its way to being mandated in many parts of the world. Not only does it help companies build trust and credibility with stakeholders, but it also provides the impetus for meaningful board-level conversations around risk, opportunity, and strategy.

"Good governance fosters trust, transparency, and longevity. To foster that trust and guard your organization, you need a clear line of sight to an ESG measure."

Gunjan Sinha, Co-Founder & Executive Chairman, MetricStream

For many investors, transparent ESG disclosure is a sign of healthy governance. It indicates that your business has a sense of a purpose that goes beyond profits. And it demonstrates that you’re committed to delivering long-term value to shareholders.

But what is ESG disclosure reporting?

Simply put, it’s the process of declaring your company’s impact and performance across three key areas.

A number of compliance frameworks and standards have sprung up around ESG reporting, be it the widely used Global Reporting Initiative’s (GRI’s) sustainability reporting standards, or the 77 sustainability standards created by the Sustainability Accounting Standards Board (SASB) or, the climate risk reporting framework created by the Task Force on Climate-related Financial Disclosures (TCFD). SASB is also affiliated with the International Sustainability Standards Board (ISSB), which develops standards, in the public interest, that result in a high-quality, comprehensive global baseline of sustainability disclosures focused on the needs of investors and the financial markets. ISSB was created in 2021 to help meet the demand from global investment portfolios of increasing calls for high-quality, transparent, reliable, and comparable reporting by companies on climate and other ESG matters. The MetricStream Platform is purpose-built to support and scale a broad range of disclosure standards. As SASB transitions into the ISSB framework, MetricStream ESGRC offers innovative functionality to help customers seamlessly adapt to such changes.

But why is ESG reporting important right now?

For one, the risks associated with climate change, biodiversity loss, and other ESG-related factors are higher than ever. Wildfires, hurricanes, and floods are devastating communities worldwide. If we as businesses don’t act now to help mitigate the impact of these issues, we run the risk of total ecosystem collapse.

ESG factors can also affect your company’s financial health and reputation. For example, a failure to reduce your carbon footprint could lead to rating downgrades and share price losses. Similarly, a failure to improve employee wages could result in a loss of productivity and high worker turnover.

Today, the pressure to report and strengthen ESG metrics comes from several quarters. Consumers – especially Millennials and Gen Z’ers – prefer to engage with brands that care about ESG issues. In fact, 35% of consumers are willing to pay 25% more for sustainable products.

Investors, on their part, are increasingly demanding information on the social and environmental impact of the companies they partner with. Among institutional asset owners, 95% are integrating or considering integrating sustainable investing in all or part of their portfolios.

Regulators are also upping their scrutiny of corporate ESG practices. From the EU’s new Sustainable Financial Disclosure Regulation (SFDR), to the UK’s upcoming climate risk reporting regime, to the US’s proposed ESG Disclosure Simplification Act of 2021, ESG-related mandates around the world are steadily increasing.

All of this means that ESG data must be embedded into a company’s strategic and technology decisions, right up to the board level. Future-focused firms understand that ESG reporting isn’t just about ensuring compliance – it’s about creating a competitive edge. Transparent ESG disclosures can lead to better investor relations, greater market opportunities, and stronger consumer loyalty.

The International Finance Corporation (IFC) found that out of 656 companies in its portfolio, those with good environmental and social (E&S) practices outperformed clients with worse E&S practices by 210 basis points on return on equity, and by 110 basis points on return on assets.

ESG reporting is most effective when it’s real-time – when data on your social and environmental footprint is continually incorporated into strategic decision-making. Yet, for many companies, that’s easier said than done. ESG reporting is not a standalone activity. It’s the culmination of multiple processes, ranging from self-assessments and metrics collection, to compliance management and issue remediation. Coordinating all these processes manually can seem like a Herculean task. But technology can make things easier through process automation and data-driven insights.

Here’s a deeper look at how technology can help:

Simplify compliance through an integrated approach

Navigating the alphabet soup of regulations and reporting standards governing ESG can be challenging. Fortunately, efforts are being made towards establishing a single, standardized reporting framework but this could still be several years in the future. In the interim period, different investors still require companies to report against different ESG frameworks.

Technology can make the process easier by centrally capturing all your ESG disclosure requirements and mapping them to your business units and geographies. So, reporting becomes more structured and efficient. Through technology, you can map your component ESG data to various standards and frameworks to identify compliance gaps – collect component data once and let the technology intelligently map this data to the appropriate framework.

Meanwhile, regulatory change tracking tools can help you keep up with updates or modifications to ESG standards. And automated reporting can give you a faster, better understanding of your ESG compliance.

Improve visibility into ESG metrics with a single source of truth

For accurate ESG reporting, data needs to be aggregated and synthesized from multiple sources within and outside the enterprise. This data could range from carbon footprint emissions and renewable energy use to employee turnover and gender quality indexes. Since this data is often scattered across multiple systems and geographies, it can be difficult to consolidate.

Technology can help by automatically integrating ESG information from various sources onto a single platform. So, you gain a 360-degree view of your ESG impact to enable data-driven decision-making. With technology, you can also streamline and digitize the entire process of data collection. So, there’s better visibility into how and where each piece of information was gathered.

To top things off, technology can be integrated with third-party rating sources to build a clearer picture of your company’s ESG performance. This helps the board and leadership team be more transparent about the risks and opportunities their business faces.

Strengthen awareness around third-party ESG risks with real-time insights

Some of the biggest ESG risks emerge from third-party ecosystems. In fact, a CDP report found that companies’ supply chain greenhouse gas emissions are 5.5 times greater than their own impact from scope 1 and scope 2 emissions. Proactively mitigating these risks is key to improving ESG scores. However, today’s supply chains are complex and multi-tiered, with contractors increasingly outsourcing to sub-contractors. How do you efficiently track ESG risks across this vast network?

Here too, technology can help by providing a unified and real-time view of your extended enterprise. Processes such as third-party due diligence, ESG risk assessments, and audits can be streamlined and automated for optimal efficiency. You can also create a third-party portal to collect and manage supplier information easily.

By integrating with external content sources, technology can help you validate a supplier’s ESG information, and identify red flags faster. Powerful dashboards and analytics can give leadership teams a sound understanding of third-party ESG risks, compliance, and performance to drive informed decision-making.

Embed ESG into your corporate culture through seamless collaboration and issue reporting

Implementing ESG goals goes beyond writing a new policy or collecting data. It’s about building a culture where everyone is committed to environmental sustainability, social responsibility, and good governance. Companies with strong, purpose-driven cultures tend to create positive impact and higher returns.

With technology, you can unify everyone involved in ESG reporting on a single platform. So, they’re all working towards the same goals and objectives. Stakeholders from compliance, risk management, HR, investor relations, legal, and senior management can communicate and collaborate much more effectively when they have a single source of ESG truth. Roles and responsibilities can also be clearly defined and tracked. So, everyone feels a sense of accountability and ownership for ESG.

What’s more, technology can help create an environment that encourages employees to report ESG issues – be it workplace discrimination, bribery, or unsustainable business practices. Tools like browser plugins, conversational interfaces, and intuitive web forms provide a simple way for business users to record their ESG observations from the front line. This data can then be triaged and routed for further investigation. The result is that ESG incidents or risks are proactively identified and mitigated through a collective effort, thus improving your company’s overall ESG performance.

MetricStream’s Environmental, Social, Governance, Risk, and Compliance (ESGRC) software enables companies to effectively measure, report, and improve ESG performance. Through its integrated platform, you can capture disclosure requirements, conduct self-assessments, identify issues, and gain meaningful insights for decision-making.