Introduction

It’s common knowledge that maintaining up-to-date compliance with regulations is akin to navigating a tangled maze. The complexity and the perpetual evolution of compliance requirements can often feel overwhelming, necessitating continuous vigilance and adaptability.

Organizations are under constant scrutiny to ensure they are meeting a wide array of regulations that govern everything from data privacy to financial transactions. According to a report by Thomson Reuters, organizations must comply with an average of 200 global regulatory alerts daily. That’s a dread no one wants to fumble.

So what does an effective compliance strategy look like? Let’s discuss.

Key Takeaways

- A compliance strategy is a systematic approach to ensuring adherence to laws, regulations, and internal policies, aimed at avoiding legal issues and promoting a culture of integrity and accountability within the organization.

- An effective compliance strategy includes a thorough risk assessment, clear policies and procedures, regular training programs, robust monitoring and auditing processes, and continuous improvement to adapt to new regulations and business environments.

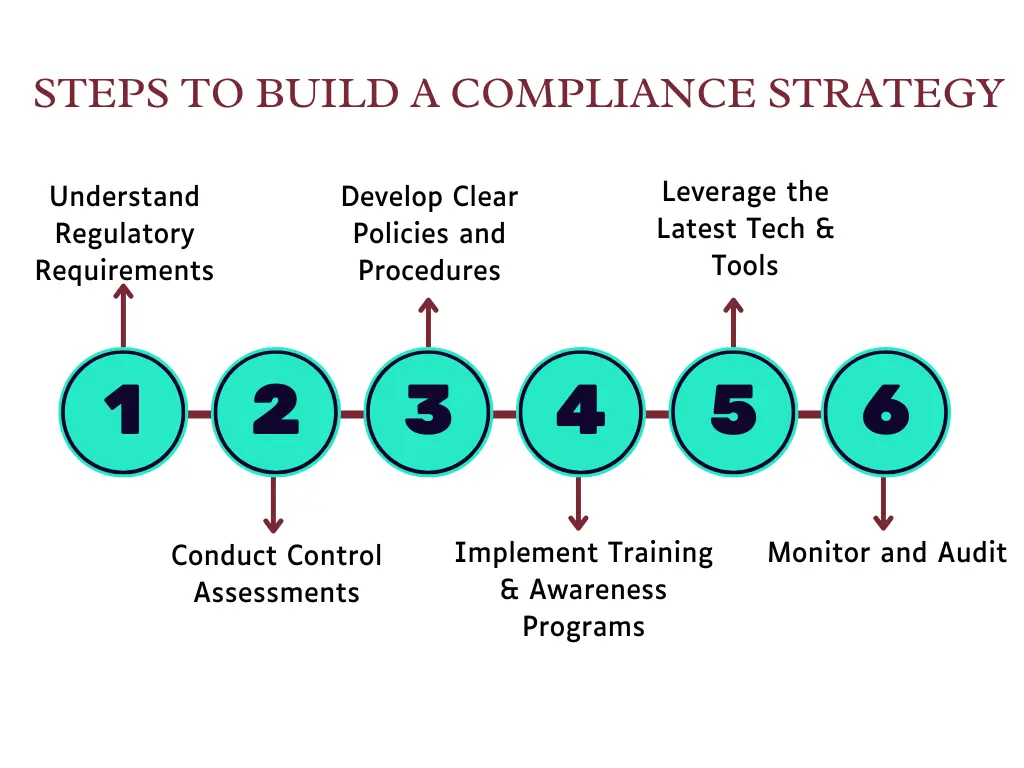

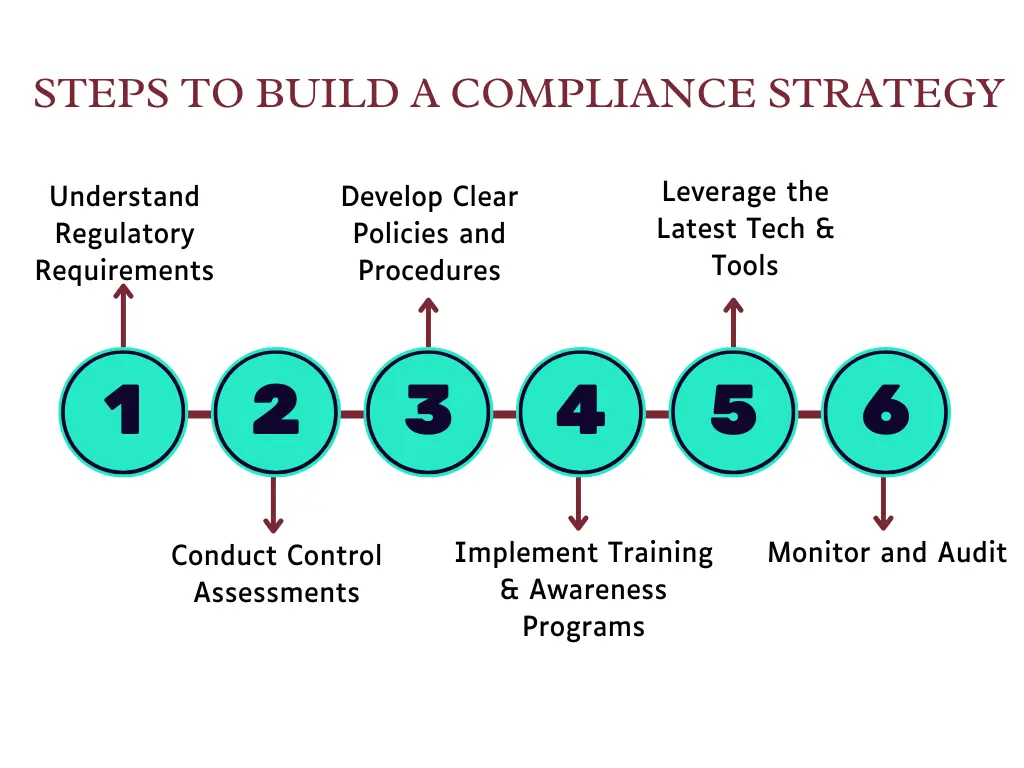

- Building a compliance strategy requires understanding regulatory requirements, conducting risk assessments, developing clear policies, implementing training and awareness programs, leveraging technology, and continuous monitoring and auditing.

- A robust compliance strategy is crucial for organizations as it provides legal and financial protection, enhances reputation and trust, promotes a positive workplace culture, offers a competitive advantage, and leads to financial savings by avoiding penalties and improving operational efficiency.

What is a Compliance Strategy?

Compliance strategies are guidelines that detail how to mitigate risk and adhere to rules and regulations set by authorities. It is a systematic approach to ensuring adherence to laws, regulations and internal policies. Effective compliance strategies help organizations mitigate risks, protect their reputation, and avoid costly penalties.

Compliance Strategy Examples

To truly understand the practical application of compliance strategies, let’s explore four hypothetical examples that highlight different approaches businesses can take to maintain regulatory adherence.

Risk-Based Approach

Picture a mid-sized financial services company that operates in multiple jurisdictions, each with its own set of regulatory requirements. They adopt a risk-based compliance strategy, focusing its resources on areas with the highest risk of non-compliance.

By conducting thorough risk assessments, the company identifies high-risk areas such as money laundering and data breaches. It then allocates additional resources to these areas, implementing advanced monitoring systems and rigorous employee training programs.

This targeted approach ensures that the company’s compliance efforts are both effective and efficient, significantly reducing the likelihood of violations in the most critical areas.

Technology-Driven Compliance

Consider a global pharmaceutical company that must comply with stringent regulations governing drug development, testing, and distribution. This company leverages cutting-edge technology to streamline its compliance processes.

The company integrates an AI-powered compliance management system capable of real-time monitoring and analysis of vast amounts of data. This system automatically flags potential compliance issues and provides actionable insights, allowing the company to address problems proactively. Additionally, they use blockchain technology to maintain an immutable record of compliance activities, enhancing transparency and accountability.

By harnessing technology, the company improves its compliance posture and gains a competitive edge in the industry.

Centralized Compliance Function

Now, let’s look at a multinational conglomerate, which operates in various sectors, including manufacturing, retail, and energy. To manage its diverse compliance obligations effectively, it chooses to establish a centralized compliance function.

This centralized team is responsible for developing and implementing a unified compliance framework across all business units. They create standardized policies and procedures, conduct regular compliance audits, and provide training to employees at all levels.

By centralizing its compliance efforts, the company ensures consistency and coherence in its approach, reducing the risk of fragmented or contradictory practices that could lead to compliance failures.

Ethics and Culture-Driven Compliance

There’s a technology startup that prioritizes building a strong ethical culture from the ground up. Recognizing that compliance is more than just adhering to rules, it embeds ethical principles into its core values.

The company’s leadership leads by example, demonstrating a commitment to ethical behavior in all business dealings. The organization also implements comprehensive ethics training programs, encourages open communication, and establishes a whistleblower policy to protect employees who report misconduct.

By fostering an environment where ethical behavior is valued and rewarded, it ensures compliance and manages to strengthen its reputation and build trust with stakeholders.

Steps to Build a Compliance Strategy

Here are the critical steps involved:

Understand Regulatory Requirements

The first step in crafting an effective compliance strategy is to thoroughly understand the regulatory landscape relevant to your industry and organization. This includes identifying all applicable laws, regulations, and standards. Engage with legal experts, compliance officers, and industry associations to stay updated on regulatory changes and interpretations. Keep a record of these regulations and ensure they are accessible to all relevant stakeholders.

Conduct Control Assessments

Test internal controls against regulatory requirements to assess their design and operational effectiveness. Control testing helps to proactively identify and address control gaps and weaknesses to ensure error-free compliance at all times.

Develop Clear Policies and Procedures

These should be well-documented, clear, and accessible to all employees. Policies should outline the organization’s commitment to compliance, while procedures should provide step-by-step instructions on how to adhere to these policies. Regularly update these documents to reflect any changes in regulatory requirements.

Implement Training and Awareness Programs

Even the most well-crafted compliance strategy will fall short if employees are not adequately trained. Develop comprehensive training programs that educate employees on relevant regulations, company policies, and their specific roles in maintaining compliance. Training should be ongoing and include periodic refreshers to keep everyone up-to-date with any changes in the regulatory environment.

Leverage the Latest Tech and Tools

Modern compliance management often requires sophisticated technological solutions. Implement compliance management software to automate monitoring, reporting, and documentation processes. Tools like MetricStream can help streamline your compliance efforts by providing a centralized platform for tracking regulatory changes, managing compliance tasks, and generating reports.

Monitor and Audit

Establish a compliance monitoring framework that includes both automated and manual checks. Conduct internal audits to identify any gaps or weaknesses and take corrective actions promptly. External audits can also provide an unbiased view of your compliance status.

Why is Compliance Strategy Important?

A compliance strategy ensures adherence to laws, providing legal and financial protection by avoiding costly legal battles and disruptions. It enhances reputation and trust, fosters a positive workplace culture, and offers a competitive advantage. Additionally, it leads to financial savings by preventing costly incidents and streamlining operations.

Here's an in-depth look at the advantages:

Legal Protection

Organizations can avoid costly legal battles and the associated financial strain by ensuring adherence to all relevant laws and regulations. This legal safeguard also minimizes the risk of operational disruptions due to non-compliance issues.

Enhanced Reputation and Trust

Customers, partners, and stakeholders see organizations that consistently comply with regulations as reliable and trustworthy. This positive reputation can lead to increased customer loyalty, better business opportunities, and stronger relationships with regulatory bodies. In an era where consumer trust is paramount, a commitment to compliance can be a powerful differentiator.

Promotes a Positive Workplace Culture

A focus on compliance and ethics promotes a positive workplace culture where employees feel valued and respected. Clear guidelines and expectations reduce the risk of misconduct and create a safe and inclusive work environment. Encouraging open communication and ethical behavior boosts employee morale and engagement, leading to higher productivity and retention rates.

Competitive Advantage

Customers and partners are more likely to trust and engage with organizations that demonstrate a commitment to regulatory adherence. A strong compliance record can also enhance the organization’s reputation, attract new business opportunities, and facilitate smoother interactions with regulatory authorities.

Financial Savings

While implementing a compliance strategy requires an investment of time and resources, the financial benefits can be substantial. Efficient compliance management can lead to cost savings through streamlined operations and reduced administrative overhead. Additionally, by preventing incidents that could result in costly litigation or remediation, organizations can protect their bottom line.

Conclusion

The journey to effective compliance is multi-faceted, involving the establishment of clear policies and procedures, ongoing training and education, vigilant monitoring and auditing, and the use of advanced technology solutions to streamline and automate compliance processes. This holistic approach ensures that compliance is woven into the fabric of the organization, rather than being treated as an isolated task.

MetricStream is committed to supporting organizations in this endeavor, providing the insights and tools necessary to foster a culture of compliance and ethical integrity. To learn how MetricStream Compliance Management can help you strengthen your compliance strategy, request a personalized demo today.

Frequently Asked Questions

What is the framework of compliance strategy?

The framework of a compliance strategy encompasses several key components designed to ensure an organization adheres to legal and regulatory requirements. This framework typically includes risk assessment, policy development, training and communication, monitoring and auditing, and continuous improvement. These elements work together to create a structured approach that helps organizations manage compliance risks, enforce policies, and maintain an ethical culture.

How can an organization measure the effectiveness of its compliance strategy?

Organizations can do so through various metrics such as the number of compliance incidents, audit results, employee compliance training completion rates, and feedback from compliance assessments. Regularly reviewing these metrics helps identify areas for improvement and ensures the strategy is working effectively.

It’s common knowledge that maintaining up-to-date compliance with regulations is akin to navigating a tangled maze. The complexity and the perpetual evolution of compliance requirements can often feel overwhelming, necessitating continuous vigilance and adaptability.

Organizations are under constant scrutiny to ensure they are meeting a wide array of regulations that govern everything from data privacy to financial transactions. According to a report by Thomson Reuters, organizations must comply with an average of 200 global regulatory alerts daily. That’s a dread no one wants to fumble.

So what does an effective compliance strategy look like? Let’s discuss.

- A compliance strategy is a systematic approach to ensuring adherence to laws, regulations, and internal policies, aimed at avoiding legal issues and promoting a culture of integrity and accountability within the organization.

- An effective compliance strategy includes a thorough risk assessment, clear policies and procedures, regular training programs, robust monitoring and auditing processes, and continuous improvement to adapt to new regulations and business environments.

- Building a compliance strategy requires understanding regulatory requirements, conducting risk assessments, developing clear policies, implementing training and awareness programs, leveraging technology, and continuous monitoring and auditing.

- A robust compliance strategy is crucial for organizations as it provides legal and financial protection, enhances reputation and trust, promotes a positive workplace culture, offers a competitive advantage, and leads to financial savings by avoiding penalties and improving operational efficiency.

Compliance strategies are guidelines that detail how to mitigate risk and adhere to rules and regulations set by authorities. It is a systematic approach to ensuring adherence to laws, regulations and internal policies. Effective compliance strategies help organizations mitigate risks, protect their reputation, and avoid costly penalties.

To truly understand the practical application of compliance strategies, let’s explore four hypothetical examples that highlight different approaches businesses can take to maintain regulatory adherence.

Risk-Based Approach

Picture a mid-sized financial services company that operates in multiple jurisdictions, each with its own set of regulatory requirements. They adopt a risk-based compliance strategy, focusing its resources on areas with the highest risk of non-compliance.

By conducting thorough risk assessments, the company identifies high-risk areas such as money laundering and data breaches. It then allocates additional resources to these areas, implementing advanced monitoring systems and rigorous employee training programs.

This targeted approach ensures that the company’s compliance efforts are both effective and efficient, significantly reducing the likelihood of violations in the most critical areas.

Technology-Driven Compliance

Consider a global pharmaceutical company that must comply with stringent regulations governing drug development, testing, and distribution. This company leverages cutting-edge technology to streamline its compliance processes.

The company integrates an AI-powered compliance management system capable of real-time monitoring and analysis of vast amounts of data. This system automatically flags potential compliance issues and provides actionable insights, allowing the company to address problems proactively. Additionally, they use blockchain technology to maintain an immutable record of compliance activities, enhancing transparency and accountability.

By harnessing technology, the company improves its compliance posture and gains a competitive edge in the industry.

Centralized Compliance Function

Now, let’s look at a multinational conglomerate, which operates in various sectors, including manufacturing, retail, and energy. To manage its diverse compliance obligations effectively, it chooses to establish a centralized compliance function.

This centralized team is responsible for developing and implementing a unified compliance framework across all business units. They create standardized policies and procedures, conduct regular compliance audits, and provide training to employees at all levels.

By centralizing its compliance efforts, the company ensures consistency and coherence in its approach, reducing the risk of fragmented or contradictory practices that could lead to compliance failures.

Ethics and Culture-Driven Compliance

There’s a technology startup that prioritizes building a strong ethical culture from the ground up. Recognizing that compliance is more than just adhering to rules, it embeds ethical principles into its core values.

The company’s leadership leads by example, demonstrating a commitment to ethical behavior in all business dealings. The organization also implements comprehensive ethics training programs, encourages open communication, and establishes a whistleblower policy to protect employees who report misconduct.

By fostering an environment where ethical behavior is valued and rewarded, it ensures compliance and manages to strengthen its reputation and build trust with stakeholders.

Here are the critical steps involved:

Understand Regulatory Requirements

The first step in crafting an effective compliance strategy is to thoroughly understand the regulatory landscape relevant to your industry and organization. This includes identifying all applicable laws, regulations, and standards. Engage with legal experts, compliance officers, and industry associations to stay updated on regulatory changes and interpretations. Keep a record of these regulations and ensure they are accessible to all relevant stakeholders.

Conduct Control Assessments

Test internal controls against regulatory requirements to assess their design and operational effectiveness. Control testing helps to proactively identify and address control gaps and weaknesses to ensure error-free compliance at all times.

Develop Clear Policies and Procedures

These should be well-documented, clear, and accessible to all employees. Policies should outline the organization’s commitment to compliance, while procedures should provide step-by-step instructions on how to adhere to these policies. Regularly update these documents to reflect any changes in regulatory requirements.

Implement Training and Awareness Programs

Even the most well-crafted compliance strategy will fall short if employees are not adequately trained. Develop comprehensive training programs that educate employees on relevant regulations, company policies, and their specific roles in maintaining compliance. Training should be ongoing and include periodic refreshers to keep everyone up-to-date with any changes in the regulatory environment.

Leverage the Latest Tech and Tools

Modern compliance management often requires sophisticated technological solutions. Implement compliance management software to automate monitoring, reporting, and documentation processes. Tools like MetricStream can help streamline your compliance efforts by providing a centralized platform for tracking regulatory changes, managing compliance tasks, and generating reports.

Monitor and Audit

Establish a compliance monitoring framework that includes both automated and manual checks. Conduct internal audits to identify any gaps or weaknesses and take corrective actions promptly. External audits can also provide an unbiased view of your compliance status.

A compliance strategy ensures adherence to laws, providing legal and financial protection by avoiding costly legal battles and disruptions. It enhances reputation and trust, fosters a positive workplace culture, and offers a competitive advantage. Additionally, it leads to financial savings by preventing costly incidents and streamlining operations.

Here's an in-depth look at the advantages:

Legal Protection

Organizations can avoid costly legal battles and the associated financial strain by ensuring adherence to all relevant laws and regulations. This legal safeguard also minimizes the risk of operational disruptions due to non-compliance issues.

Enhanced Reputation and Trust

Customers, partners, and stakeholders see organizations that consistently comply with regulations as reliable and trustworthy. This positive reputation can lead to increased customer loyalty, better business opportunities, and stronger relationships with regulatory bodies. In an era where consumer trust is paramount, a commitment to compliance can be a powerful differentiator.

Promotes a Positive Workplace Culture

A focus on compliance and ethics promotes a positive workplace culture where employees feel valued and respected. Clear guidelines and expectations reduce the risk of misconduct and create a safe and inclusive work environment. Encouraging open communication and ethical behavior boosts employee morale and engagement, leading to higher productivity and retention rates.

Competitive Advantage

Customers and partners are more likely to trust and engage with organizations that demonstrate a commitment to regulatory adherence. A strong compliance record can also enhance the organization’s reputation, attract new business opportunities, and facilitate smoother interactions with regulatory authorities.

Financial Savings

While implementing a compliance strategy requires an investment of time and resources, the financial benefits can be substantial. Efficient compliance management can lead to cost savings through streamlined operations and reduced administrative overhead. Additionally, by preventing incidents that could result in costly litigation or remediation, organizations can protect their bottom line.

The journey to effective compliance is multi-faceted, involving the establishment of clear policies and procedures, ongoing training and education, vigilant monitoring and auditing, and the use of advanced technology solutions to streamline and automate compliance processes. This holistic approach ensures that compliance is woven into the fabric of the organization, rather than being treated as an isolated task.

MetricStream is committed to supporting organizations in this endeavor, providing the insights and tools necessary to foster a culture of compliance and ethical integrity. To learn how MetricStream Compliance Management can help you strengthen your compliance strategy, request a personalized demo today.

What is the framework of compliance strategy?

The framework of a compliance strategy encompasses several key components designed to ensure an organization adheres to legal and regulatory requirements. This framework typically includes risk assessment, policy development, training and communication, monitoring and auditing, and continuous improvement. These elements work together to create a structured approach that helps organizations manage compliance risks, enforce policies, and maintain an ethical culture.

How can an organization measure the effectiveness of its compliance strategy?

Organizations can do so through various metrics such as the number of compliance incidents, audit results, employee compliance training completion rates, and feedback from compliance assessments. Regularly reviewing these metrics helps identify areas for improvement and ensures the strategy is working effectively.