Introduction

Corporate scandals have long populated global headlines with a disturbing frequency, and with that, the concept of corporate governance has not only risen up the priority list of boards and C-suite executives but also vaulted from the confines of boardrooms into the public domain at large.

According to a recent PwC survey, 87% of investors said they would be more likely to trust a company known for its corporate governance. This brings us to the growing realization that how a company is managed and controlled affects not only its success but also its contribution to the broader economy and society.

Key Takeaways

- Corporate governance is the system of enterprise-level rules and processes, which define how a company is directed and controlled, ensuring accountability, transparency, and ethical management.

- Effective corporate governance is built on principles like fairness, transparency, risk management, responsibility, and accountability.

- Strong corporate governance enhances reputation, improves risk management, increases operational efficiency, ensures transparency and accountability, and boosts investor confidence and stakeholder engagement.

- Implementing effective governance involves defining clear structures, establishing a code of conduct, ensuring transparent reporting, fostering board independence and diversity, creating robust risk management frameworks, and continuously engaging stakeholders.

What is Corporate Governance?

Corporate governance is defined as a well-defined system of rules, practices, and processes, which determine how a company is directed and controlled. It encompasses the mechanisms through which companies, and those in control, are held accountable. This concept is essentially about balance; it seeks to align the interests of a company’s many stakeholders, including its shareholders, management, customers, suppliers, financiers, government, and the community.

While corporate governance practices can vary across different regions due to legal, cultural, and institutional differences, the underlying principle of responsible, ethical management is universal.

Examples of Corporate Governance

To illustrate the practical application and importance of corporate governance, let’s explore two real-world examples:

Satyam Computer Services Scandal and Turnaround

Satyam Computer Services, an Indian IT services conglomerate, was embroiled in one of the largest accounting frauds in corporate history in 2009. The company's chairman admitted to manipulating accounts to the tune of approximately $1.47 billion. This scandal is a glaring example of poor corporate governance, where a lack of accountability, transparency, and ethical practices led to massive losses for investors, employees, and other stakeholders.

However, what followed is a remarkable turnaround story of corporate governance. Tech Mahindra took over Satyam and implemented stringent corporate governance measures. These measures included overhauling the board, establishing strong internal controls, and fostering a culture of transparency and ethics.

This rigorous approach helped salvage the company and also restore stakeholder trust, showcasing the power of effective corporate governance in rebuilding a company.

Toyota's Response to Safety Issues

In 2010, Toyota faced a significant crisis when it had to recall over 8.5 million vehicles worldwide due to safety concerns related to unintended acceleration. This issue, caused by faulty floor mats and sticky accelerator pedals, led to numerous accidents and fatalities, severely impacting Toyota's reputation and consumer trust.

Initially criticized for its slow response and lack of transparency, Toyota took decisive action to address the issue and improve its corporate governance framework.

The company established a Global Quality Committee, chaired by then-President Akio Toyoda, to oversee quality improvements across the organization. It enhanced its quality control processes by increasing the frequency and scope of vehicle inspections and investing in advanced diagnostic tools to better detect potential problems. Furthermore, Toyota committed to greater transparency with both regulators and customers, providing timely updates on the recall process and cooperating fully with regulatory authorities.

Key Principles of Corporate Governance

The key principles of corporate governance include fairness (equitable treatment of stakeholders), transparency (clear disclosure of information), risk management (identifying and mitigating risks), responsibility (ethical conduct), and accountability (clear roles and monitoring mechanisms).

Here are the core principles of corporate governance:

Fairness

Fairness is a principle that emphasizes equitable treatment for all stakeholders. This includes ensuring minority shareholders receive equal treatment and that all stakeholders have opportunities to voice their concerns within the corporation. Fairness in corporate governance also extends to transactions and decisions being conducted and made impartially, respecting the rights and interests of everyone involved.

Transparency

Transparency involves the clear and timely disclosure of all material matters regarding the corporation, including its financial situation, performance, ownership, and governance. It builds trust with stakeholders and ensures that the decisions made by the corporation are easily understandable and accessible.

Risk Management

Effective risk management involves identifying, evaluating, and mitigating risks that could threaten the organization's assets, reputation, and success. Good corporate governance integrates risk management into the company's strategic planning and operational processes, enabling it to anticipate potential challenges and seize opportunities responsibly.

Responsibility

Responsibility in corporate governance refers to the recognition and respect for the interests of all stakeholders, including shareholders, employees, customers, and the broader community. It means that the company acts ethically and is accountable for its actions, with a commitment to making decisions that are sustainable and beneficial to all.

Accountability

Accountability is closely linked to the concepts of fairness and transparency and ensures that individuals and companies are held answerable for their actions. It requires a clear delineation of roles and responsibilities within the corporation and mechanisms in place to monitor and enforce those responsibilities.

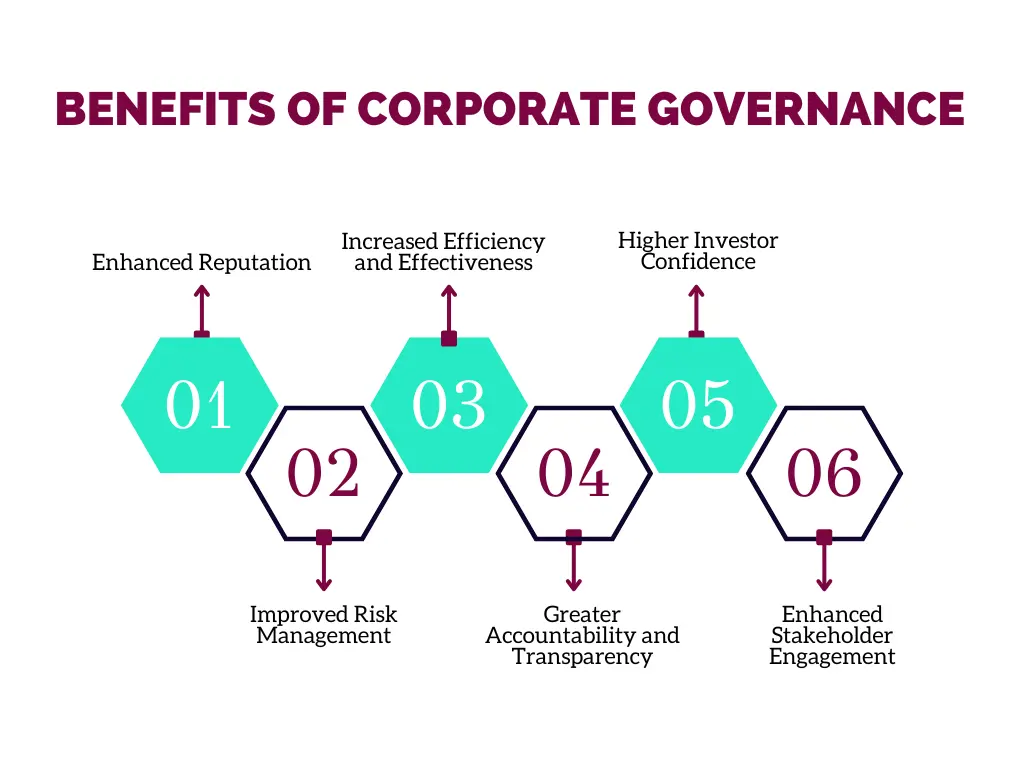

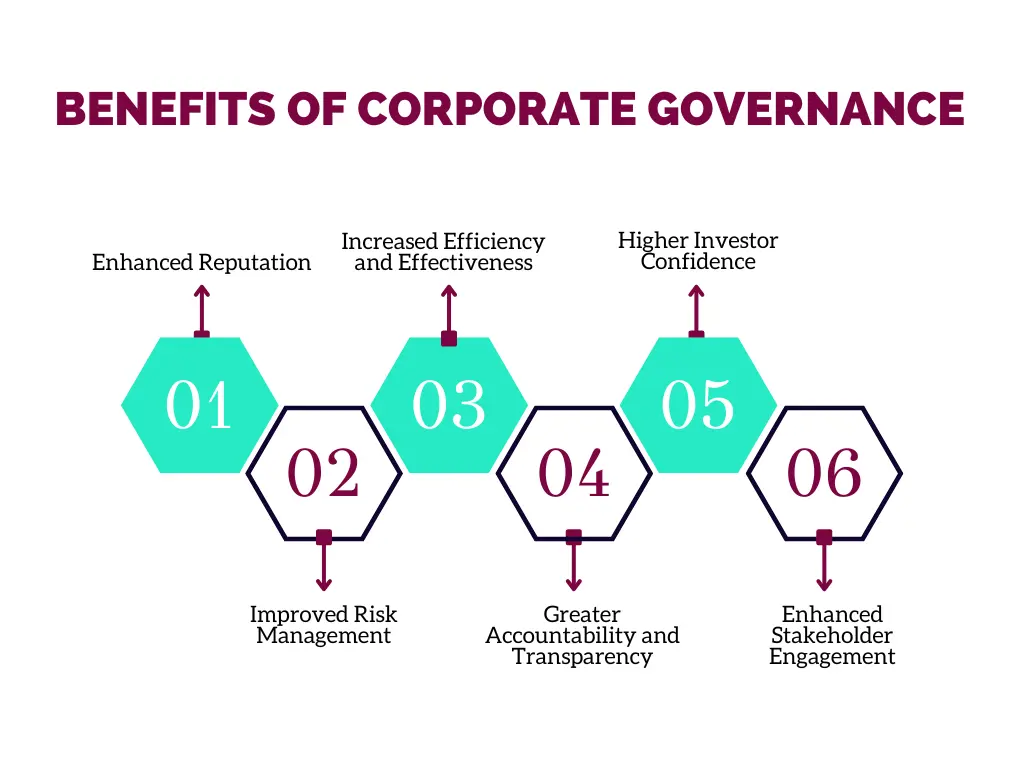

Benefits of Corporate Governance

Implementing effective corporate governance practices yields substantial benefits for organizations, enhancing their reputation, efficiency, and long-term success. Some of the key benefits include:

Enhanced Reputation:

Companies known for strong corporate governance practices enjoy a better reputation among investors, customers, and the wider public. This improved perception can lead to increased investor confidence, customer loyalty, and overall competitive advantage.

Improved Risk Management:

A solid corporate governance framework helps organizations identify and mitigate risks more effectively. By integrating risk management into all aspects of the business, companies can avoid or reduce the impact of adverse events, securing their long-term sustainability.

Increased Efficiency and Effectiveness:

Effective governance structures and practices can streamline decision-making processes, reduce wastage, and enhance operational efficiency. This, in turn, can lead to higher productivity and improved financial performance.

Greater Accountability and Transparency:

These practices ensure that organizations operate more transparently and are held accountable for their actions. This openness builds trust among stakeholders and can lead to more robust stakeholder relationships.

Higher Investor Confidence:

Investors are more likely to invest in companies with strong corporate governance practices, as these are often seen as less risky and more likely to generate sustainable returns.

Enhanced Stakeholder Engagement:

Enhanced engagement can lead to a better understanding of stakeholder needs and expectations, driving improvements in products, services, and corporate social responsibility initiatives.

With MetricStream’s Compliance management software, organizations can benefit from improved efficiency within their compliance functions through automation of assessments and testing, leading to a lower risk of ompliance violations, penalties and reputational damage. This then leads to better business outcomes and decision-making, and more proactive identification of risks.

Steps for Implementing Corporate Governance

Here are some pivotal steps that organizations can follow to implement an effective corporate governance structure:

Define a Clear Governance Structure:

Begin by clearly outlining the roles, responsibilities, and powers of the board, management, shareholders, and other stakeholders. This clarity ensures everyone knows their place within the governance framework, facilitating better decision-making and accountability.

Establish a Code of Conduct:

Develop and enforce a comprehensive code of conduct that reflects your organization's values, ethical standards, and legal obligations.

Regular and Transparent Reporting:

Ensure regular and transparent reporting mechanisms are in place to keep all stakeholders informed about the organization’s financial performance, governance practices, and adherence to ethical standards.

Strengthen Board Independence and Diversity:

Foster a board composition that is diverse and independent. Diversity brings a range of perspectives and expertise, while independence ensures that decisions are made in the best interest of the organization without undue influence.

Risk Management Framework:

Implement a robust risk management framework that identifies, assesses, mitigates, and monitors the organization's internal and external risks. This proactive approach helps minimize risks and leverage opportunities.

Internal Controls and Audit Mechanisms:

Establish strong internal controls and periodic audits to ensure the integrity of financial and management information and the efficiency of operations. This particular step is critical for detecting and preventing fraud and ensuring compliance with laws and regulations.

Stakeholder Engagement:

Actively engage with all stakeholders, including shareholders, employees, customers, and the community. An engagement of this nature should be based on the principles of respect, understanding, and responsiveness.

Continuous Monitoring and Evaluation:

The governance framework should be subject to ongoing review and evaluation. This involves monitoring the effectiveness of governance practices, compliance with laws and regulations, and the achievement of governance objectives. Use the insights gained to make necessary adjustments and improvements.

Conclusion

In the fabric of corporate governance, each thread - from transparency to accountability - is woven with the intention of creating a more ethical, sustainable, and successful business landscape. Organizations need to strengthen those threads, transforming challenges into opportunities for growth and leadership in corporate governance, with a sharp focus on driving business performance and growth.

While the intricacies of corporate governance can include many aspects, there are several tools available to ensure that the process of implementing and maintaining policies across the organization is simpler and more effective. MetricStream offers a suite of tools, such as those used for Compliance Management, Policy and Document Management, Regulatory Change Management, and Case and Incident Management. These tools can help create clear structures, establish consistent practices across the organization, ensure more accurate reporting, and much more.

Frequently Asked Questions

How does a company implement corporate governance?

A company can implement corporate governance by establishing a strong and independent board of directors, setting clear roles and responsibilities, ensuring robust internal controls, establishing clear communication channels, encouraging stakeholder engagement, and promoting ethical behavior and compliance with laws.

How can companies ensure ethical behavior within their governance framework?

Companies can ensure ethical behavior by establishing a code of conduct, implementing ethics training programs, setting up confidential reporting mechanisms for unethical practices, and ensuring that leadership models ethical behavior.

Corporate scandals have long populated global headlines with a disturbing frequency, and with that, the concept of corporate governance has not only risen up the priority list of boards and C-suite executives but also vaulted from the confines of boardrooms into the public domain at large.

According to a recent PwC survey, 87% of investors said they would be more likely to trust a company known for its corporate governance. This brings us to the growing realization that how a company is managed and controlled affects not only its success but also its contribution to the broader economy and society.

- Corporate governance is the system of enterprise-level rules and processes, which define how a company is directed and controlled, ensuring accountability, transparency, and ethical management.

- Effective corporate governance is built on principles like fairness, transparency, risk management, responsibility, and accountability.

- Strong corporate governance enhances reputation, improves risk management, increases operational efficiency, ensures transparency and accountability, and boosts investor confidence and stakeholder engagement.

- Implementing effective governance involves defining clear structures, establishing a code of conduct, ensuring transparent reporting, fostering board independence and diversity, creating robust risk management frameworks, and continuously engaging stakeholders.

Corporate governance is defined as a well-defined system of rules, practices, and processes, which determine how a company is directed and controlled. It encompasses the mechanisms through which companies, and those in control, are held accountable. This concept is essentially about balance; it seeks to align the interests of a company’s many stakeholders, including its shareholders, management, customers, suppliers, financiers, government, and the community.

While corporate governance practices can vary across different regions due to legal, cultural, and institutional differences, the underlying principle of responsible, ethical management is universal.

To illustrate the practical application and importance of corporate governance, let’s explore two real-world examples:

Satyam Computer Services Scandal and Turnaround

Satyam Computer Services, an Indian IT services conglomerate, was embroiled in one of the largest accounting frauds in corporate history in 2009. The company's chairman admitted to manipulating accounts to the tune of approximately $1.47 billion. This scandal is a glaring example of poor corporate governance, where a lack of accountability, transparency, and ethical practices led to massive losses for investors, employees, and other stakeholders.

However, what followed is a remarkable turnaround story of corporate governance. Tech Mahindra took over Satyam and implemented stringent corporate governance measures. These measures included overhauling the board, establishing strong internal controls, and fostering a culture of transparency and ethics.

This rigorous approach helped salvage the company and also restore stakeholder trust, showcasing the power of effective corporate governance in rebuilding a company.

Toyota's Response to Safety Issues

In 2010, Toyota faced a significant crisis when it had to recall over 8.5 million vehicles worldwide due to safety concerns related to unintended acceleration. This issue, caused by faulty floor mats and sticky accelerator pedals, led to numerous accidents and fatalities, severely impacting Toyota's reputation and consumer trust.

Initially criticized for its slow response and lack of transparency, Toyota took decisive action to address the issue and improve its corporate governance framework.

The company established a Global Quality Committee, chaired by then-President Akio Toyoda, to oversee quality improvements across the organization. It enhanced its quality control processes by increasing the frequency and scope of vehicle inspections and investing in advanced diagnostic tools to better detect potential problems. Furthermore, Toyota committed to greater transparency with both regulators and customers, providing timely updates on the recall process and cooperating fully with regulatory authorities.

The key principles of corporate governance include fairness (equitable treatment of stakeholders), transparency (clear disclosure of information), risk management (identifying and mitigating risks), responsibility (ethical conduct), and accountability (clear roles and monitoring mechanisms).

Here are the core principles of corporate governance:

Fairness

Fairness is a principle that emphasizes equitable treatment for all stakeholders. This includes ensuring minority shareholders receive equal treatment and that all stakeholders have opportunities to voice their concerns within the corporation. Fairness in corporate governance also extends to transactions and decisions being conducted and made impartially, respecting the rights and interests of everyone involved.

Transparency

Transparency involves the clear and timely disclosure of all material matters regarding the corporation, including its financial situation, performance, ownership, and governance. It builds trust with stakeholders and ensures that the decisions made by the corporation are easily understandable and accessible.

Risk Management

Effective risk management involves identifying, evaluating, and mitigating risks that could threaten the organization's assets, reputation, and success. Good corporate governance integrates risk management into the company's strategic planning and operational processes, enabling it to anticipate potential challenges and seize opportunities responsibly.

Responsibility

Responsibility in corporate governance refers to the recognition and respect for the interests of all stakeholders, including shareholders, employees, customers, and the broader community. It means that the company acts ethically and is accountable for its actions, with a commitment to making decisions that are sustainable and beneficial to all.

Accountability

Accountability is closely linked to the concepts of fairness and transparency and ensures that individuals and companies are held answerable for their actions. It requires a clear delineation of roles and responsibilities within the corporation and mechanisms in place to monitor and enforce those responsibilities.

Implementing effective corporate governance practices yields substantial benefits for organizations, enhancing their reputation, efficiency, and long-term success. Some of the key benefits include:

Enhanced Reputation:

Companies known for strong corporate governance practices enjoy a better reputation among investors, customers, and the wider public. This improved perception can lead to increased investor confidence, customer loyalty, and overall competitive advantage.

Improved Risk Management:

A solid corporate governance framework helps organizations identify and mitigate risks more effectively. By integrating risk management into all aspects of the business, companies can avoid or reduce the impact of adverse events, securing their long-term sustainability.

Increased Efficiency and Effectiveness:

Effective governance structures and practices can streamline decision-making processes, reduce wastage, and enhance operational efficiency. This, in turn, can lead to higher productivity and improved financial performance.

Greater Accountability and Transparency:

These practices ensure that organizations operate more transparently and are held accountable for their actions. This openness builds trust among stakeholders and can lead to more robust stakeholder relationships.

Higher Investor Confidence:

Investors are more likely to invest in companies with strong corporate governance practices, as these are often seen as less risky and more likely to generate sustainable returns.

Enhanced Stakeholder Engagement:

Enhanced engagement can lead to a better understanding of stakeholder needs and expectations, driving improvements in products, services, and corporate social responsibility initiatives.

With MetricStream’s Compliance management software, organizations can benefit from improved efficiency within their compliance functions through automation of assessments and testing, leading to a lower risk of ompliance violations, penalties and reputational damage. This then leads to better business outcomes and decision-making, and more proactive identification of risks.

Here are some pivotal steps that organizations can follow to implement an effective corporate governance structure:

Define a Clear Governance Structure:

Begin by clearly outlining the roles, responsibilities, and powers of the board, management, shareholders, and other stakeholders. This clarity ensures everyone knows their place within the governance framework, facilitating better decision-making and accountability.

Establish a Code of Conduct:

Develop and enforce a comprehensive code of conduct that reflects your organization's values, ethical standards, and legal obligations.

Regular and Transparent Reporting:

Ensure regular and transparent reporting mechanisms are in place to keep all stakeholders informed about the organization’s financial performance, governance practices, and adherence to ethical standards.

Strengthen Board Independence and Diversity:

Foster a board composition that is diverse and independent. Diversity brings a range of perspectives and expertise, while independence ensures that decisions are made in the best interest of the organization without undue influence.

Risk Management Framework:

Implement a robust risk management framework that identifies, assesses, mitigates, and monitors the organization's internal and external risks. This proactive approach helps minimize risks and leverage opportunities.

Internal Controls and Audit Mechanisms:

Establish strong internal controls and periodic audits to ensure the integrity of financial and management information and the efficiency of operations. This particular step is critical for detecting and preventing fraud and ensuring compliance with laws and regulations.

Stakeholder Engagement:

Actively engage with all stakeholders, including shareholders, employees, customers, and the community. An engagement of this nature should be based on the principles of respect, understanding, and responsiveness.

Continuous Monitoring and Evaluation:

The governance framework should be subject to ongoing review and evaluation. This involves monitoring the effectiveness of governance practices, compliance with laws and regulations, and the achievement of governance objectives. Use the insights gained to make necessary adjustments and improvements.

In the fabric of corporate governance, each thread - from transparency to accountability - is woven with the intention of creating a more ethical, sustainable, and successful business landscape. Organizations need to strengthen those threads, transforming challenges into opportunities for growth and leadership in corporate governance, with a sharp focus on driving business performance and growth.

While the intricacies of corporate governance can include many aspects, there are several tools available to ensure that the process of implementing and maintaining policies across the organization is simpler and more effective. MetricStream offers a suite of tools, such as those used for Compliance Management, Policy and Document Management, Regulatory Change Management, and Case and Incident Management. These tools can help create clear structures, establish consistent practices across the organization, ensure more accurate reporting, and much more.

How does a company implement corporate governance?

A company can implement corporate governance by establishing a strong and independent board of directors, setting clear roles and responsibilities, ensuring robust internal controls, establishing clear communication channels, encouraging stakeholder engagement, and promoting ethical behavior and compliance with laws.

How can companies ensure ethical behavior within their governance framework?

Companies can ensure ethical behavior by establishing a code of conduct, implementing ethics training programs, setting up confidential reporting mechanisms for unethical practices, and ensuring that leadership models ethical behavior.