Advanced Cyber Risk Quantification

Measure Your Program Outcomes

- 64%

66%

reduction in the time taken to complete risk assessment

- 67%

improvement in risk reporting visibility and efficiency for the executive management and board.

Measure, Manage, and Prioritize Risks in Real Business Terms

MetricStream Advanced Cyber Risk Quantification helps you assess and analyze your IT and cyber risk exposure in monetary terms. By assigning a dollar value to cyber risk, it enables better prioritization of risk, controls, and cybersecurity investment decisions – determining which risks to focus on first and where to allocate your cybersecurity resources for maximum impact. Quantitative metrics also enable the cybersecurity teams to better communicate the cyber risk posture to the top management and board. Improve understanding of the IT and cyber risks faced by an organization, effectively prioritize cybersecurity investments, and drive alignment between cyber programs and business priorities.

How Our Advanced Cyber Risk Quantification Helps You

Quantify Cyber Risks using FAIR and More

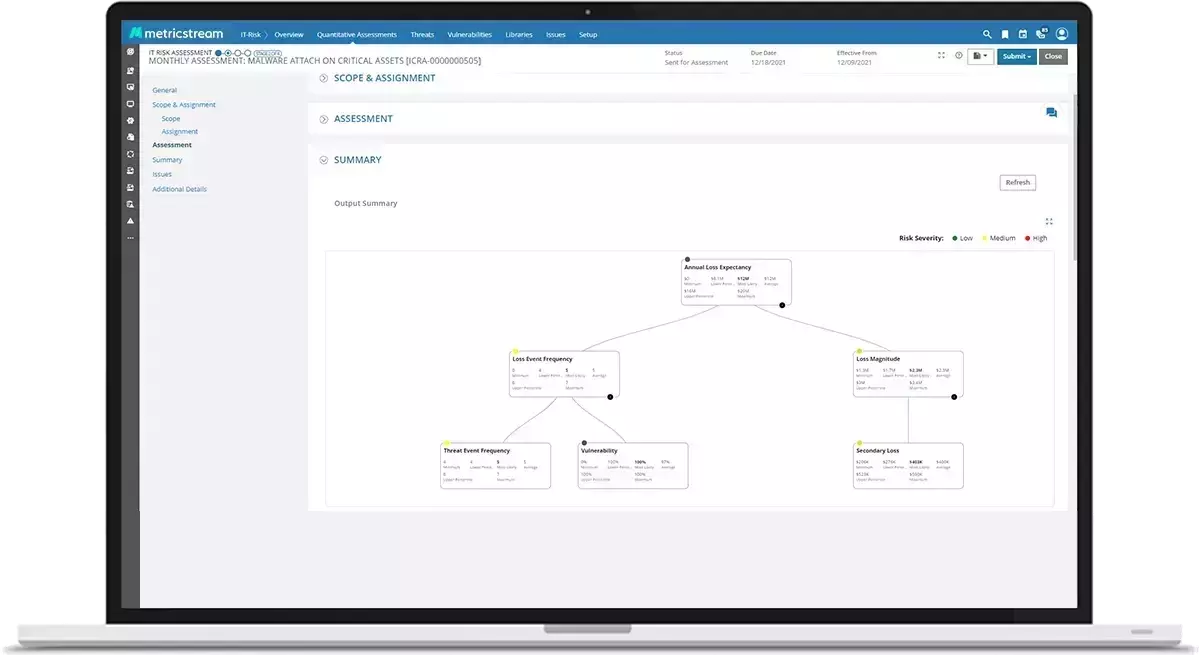

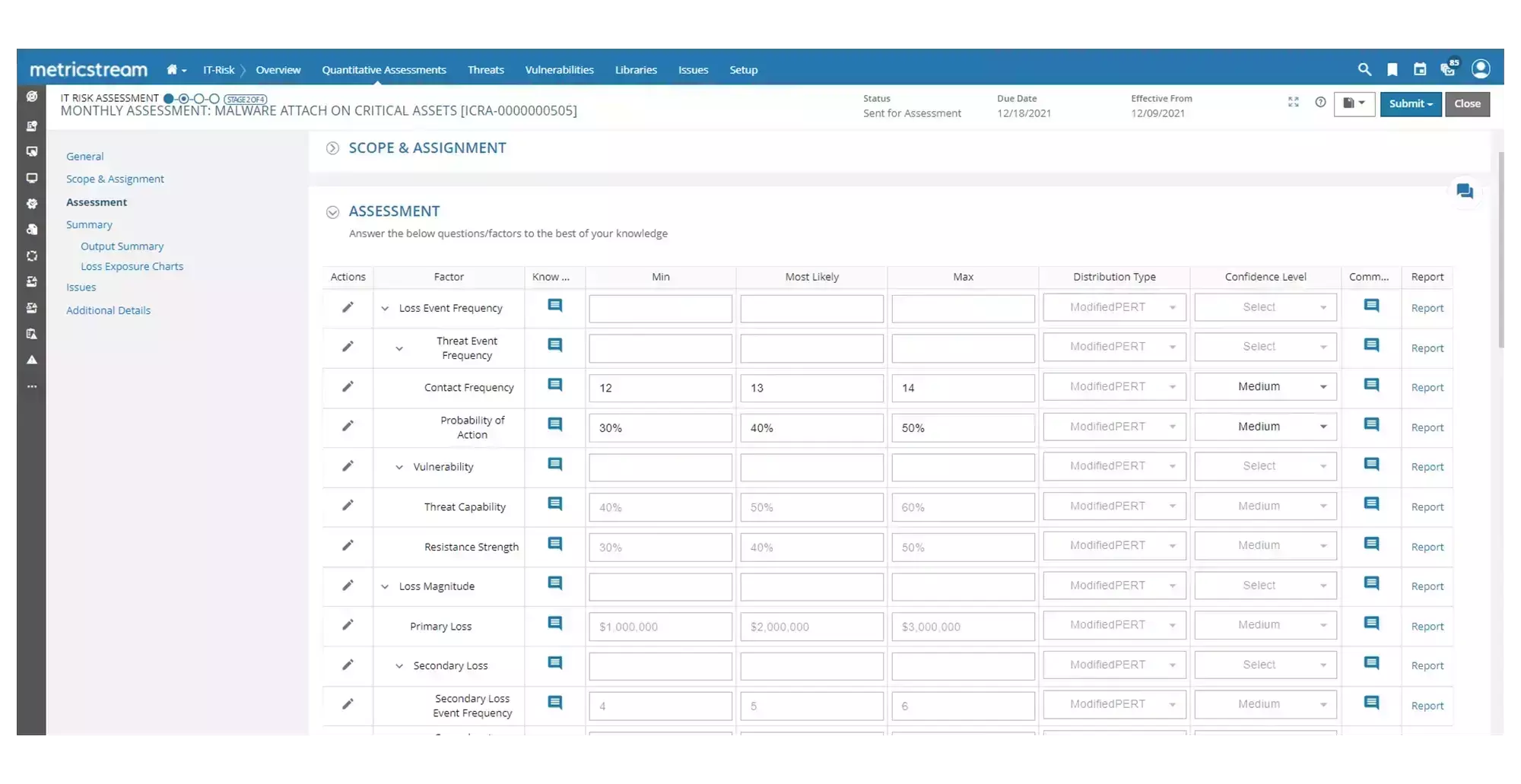

Quantify cyber risk in terms of actual currency, instead of imprecise red, yellow, and green heatmaps with built-in FAIR ® model, a model that helps codify and monetize cyber risks in monetary value. It helps calculate annual loss exposure, loss event frequency, loss magnitude, threat event frequency, susceptibility, and primary and secondary losses. Unlike other products, MetricStream also provides a configurable engine that allows users to create multiple variables, calculation logic, and quantification models depending on the requirements.

Simulate Cyber Risks

Use Monte Carlo simulation, an automated scenario modeling technique, to run risk scenarios by leveraging your data and create probable outcomes. Determine loss event scenarios including number of primary and secondary loss events that may occur and their losses. Understand annualized loss exposure (ALE) and loss exceedance probabilities.

Understand the Probability of Cyber Losses

Easily see the probability of annual loss exposure – minimum, most likely, average, upper percentile, and maximum – for cyber events. Generate a range-based estimate for annual loss exposure and expectancy. Get accurate information on the probability of a user-defined risk limit being exceeded. Prioritize investments and mitigation strategies for a given risk.

Configure Cyber Risk Quantification Models, Simply

Adjust factors such as loss event frequency, threat event frequency, susceptibility and loss magnitude, to improve accuracy of quantification as well as to configure new cyber risk quantification models.

How Our Advanced Cyber Risk Quantification Benefits Your Business

- Make better informed decisions with the true probability and impact of risks – measure cyber risk in actual currency, as opposed to imprecise red, yellow, and green ratings

- Demystify cybersecurity for the board and management by providing quantitative metrics for cyber threats and help them prioritize action plans and investments with an understanding of risk and ROI

- Assess the effectiveness of risk mitigation strategies by easily understanding how much risk reduction has been achieved with each control

- Gain a competitive advantage and strengthen cyber maturity and resilience with actionable insights that enable you to respond to cyber threats in a more targeted and cost-efficient way

Frequently Asked Questions

Advanced Cyber Risk Quantification helps demystify and express risk in terms that CISOs and the board can act on with confidence – quantified, real dollars and cents. Though qualitative red/yellow/green heat maps and high/medium/low dashboards have their place, risk quantification is more precise and enables more accurate allocation of resources, investment dollars, and risk mitigation strategies (such as cyber insurance).

MetricStream’s quantification framework supports FAIR® but goes beyond it. The FAIR® model is an accepted standard and provides a standard taxonomy and ontology for quantifying information and operational risk. Asset-based risks can be quantified based on their threat and vulnerability exposure, and the final dollar value at risk can be calculated. MetricStream’s flexible Cyber Risk Quantification framework enables customers to build models to quantify their cyber risks and supports FAIR, in addition to other methodologies like ISO 27005, NIST SP 800-53, CMU OCTAVE, and COBIT 5.

A Monte Carlo analysis is a modeling technique used to predict outcomes – quantify the probability and impact of different risk exposures. By simulating a cyber risk event such as a ransomware attack multiple times, it helps predict the financial losses that could result from each scenario – ranging from best-case, to most likely, to worst-case scenarios – enabling you to decide the best risk mitigation approach. MetricStream’s Advanced Cyber Risk Quantification supports Monte Carlo simulation.

You can explore our CyberGRC products which help organizations to implement a robust Cyber Risk and Compliance Management Framework based on industry security standards. To request a demo, click here.

Visit our Learn section to dive deep into the GRC universe and the Insight section to explore our customer stories, webinars, thought leadership, and more.