Introduction

Modern businesses have embraced complex legal structures, while regulators have developed policies and rules to ensure the integrity of the legal system. In this labyrinth of rules, regulations, and legislations, legal risks pose a significant challenge to organizational stability and growth.

As per a survey conducted by Deloitte, 41% of non-banking and 14% of banking respondents have no definition of legal risk in place for their organization.These risks, which stem from regulatory compliance issues, contractual disputes, and a myriad of other legal vulnerabilities, can result in substantial financial losses, reputational damage, and operational disruptions.

In this guide, we explore why legal risk management is critical for businesses to navigate these complexities, especially ensuring not only compliance with the law but also safeguarding their assets and reputation – offering strategies to minimize exposure and maximize growth potential.

Key Takeaways

- Legal risk involves the potential for financial loss, reputational damage, or operational disruption due to legal actions, non-compliance with laws and regulations, or contractual failures. It is a pervasive risk that affects all aspects of business operations and requires comprehensive management strategies.

- Legal risk encompasses potential financial, reputational, and operational consequences arising from legal actions or non-compliance with laws and regulations.

- Businesses face various legal risks, including regulatory compliance issues, contractual disputes, intellectual property infringement, employment law violations, and data privacy breaches.

- Proactively managing legal risk through regular audits, robust contract management, employee training, legal counsel, and data protection measures is essential to minimize exposure and ensure business continuity.

- Integrating legal risk management into the enterprise risk management (ERM) framework provides a comprehensive approach to addressing all types of risks, leading to cost savings and improved operational resilience.

What is Legal Risk?

Legal risk is the possibility of financial loss, reputational damage, or operational disruption due to non-compliance with laws and regulations, legal actions, or contractual failures. Identifying all applicable legal risks is crucial for an organization's risk management strategy.

The 2024 Litigation Trends Annual Survey by Norton Rose Fulbright found that 61% of companies reported being engaged in at least one regulatory proceeding in the past year, with an average of 3.9 proceedings. Notably, the median number of lawsuits reported by respondents was 6 with 42% of them expecting the number to rise in 2024.

Broadly speaking, legal risk in business operations can arise due to non-compliance with regulatory requirements, employment and labor laws, contractual obligations, intellectual property, and other areas.

The scope of legal risk is extensive, requiring businesses to remain vigilant and proactive in their risk management efforts to avoid legal pitfalls and maintain operational integrity.

Potential Consequences of Legal Risk

Here are some typical types of consequences that originate out of realized legal risks.

Financial

The financial consequences of legal risk can be devastating. Organizations may incur significant costs related to legal fees, fines, penalties, and settlements. According to a study by the Ponemon Institute, the cost of non-compliance is 2.71 times higher than the cost of compliance. On average, non-compliance costs organizations $14.82 million annually, compared to $5.47 million for compliance.

These financial burdens can erode profit margins and threaten the financial stability of the business.

Reputational

Reputational damage is another severe consequence of legal risk. Negative publicity resulting from legal disputes or regulatory violations can diminish customer trust and loyalty, making it difficult for a business to attract and retain clients.

Courtesy of the digital age, news of legal troubles spread rapidly, further exacerbating the damage to an organization’s reputation.

Operational

Operational disruptions caused by legal issues can impede a company's ability to function smoothly. This can include halting production, delaying product launches, and diverting management resources to handle legal problems. In extreme cases, legal risks can lead to business closures or the need for significant restructuring.

Common Legal Risks

Businesses face numerous common legal risks that require careful management. Here are some areas where legal risks typically originate:

Regulatory Compliance:

Organizations must comply with a myriad of laws and regulations related to their industry. Failure to do so can result in enforcement actions, fines, and operational restrictions.

Contractual Disputes:

Contracts are fundamental to business operations, governing relationships with suppliers, customers, and partners. Disputes over contract terms or breaches of contract can lead to costly litigation and strained business relationships.

Intellectual Property Infringement:

Protecting intellectual property (IP) is critical for businesses that rely on innovation. Unauthorized use of a company's patents, trademarks, or copyrights can lead to significant legal battles and financial losses.

Employment Law Violations:

Issues such as wrongful termination, workplace harassment, and discrimination can result in lawsuits and damage to the company’s reputation. Employment law is complex and varies by jurisdiction, making compliance a challenging but essential task.

Data Privacy Breaches:

In an era where data is a valuable asset, companies must ensure compliance with data protection and privacy laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Data breaches can not only result in severe fines but also shake up consumer trust and confidence.

Why Manage Legal Risk in ERM?

It is essential for organizations to include the management of legal risks in the broader enterprise risk management (ERM) framework for reasons more than one:

Proactive Mitigation of Issues

Proactively managing legal risk is crucial for protecting an organization’s assets and ensuring its long-term sustainability. By identifying potential legal threats early and implementing strategies to mitigate them, companies can avoid the escalation of legal issues into more significant problems. Managing legal risks in a proactive manner requires regular monitoring of the legal environment, staying informed about changes in laws and regulations, and maintaining a vigilant approach to compliance.

Comprehensive Approach to Risk Management

Integrating legal risk management into the broader enterprise risk management (ERM) framework ensures a cohesive approach to managing all types of risks. ERM provides a structured process for identifying, assessing, and mitigating risks across the entire organization, including financial, operational, strategic, and legal risks. By incorporating legal risk into ERM, businesses can ensure that they are addressing legal threats in conjunction with other critical risks, thereby achieving a more comprehensive risk management strategy.

Cost Savings and Business Continuity

Effective legal risk management can lead to significant cost savings by preventing fines, reducing legal fees, and avoiding costly litigation. Additionally, it enhances business continuity by minimizing operational disruptions caused by legal issues. Companies that proactively manage their legal risks are better positioned to maintain steady operations and achieve their strategic goals without the interruptions that legal problems can cause.

Best Practices for Mitigating Legal Risk

Here are some proactive strategies and practices we suggest that can play a pivotal role in mitigating legal risks for organizations:

Regular Legal Audits:

Conducting regular legal audits helps ensure compliance with applicable laws and regulations. These audits involve reviewing business practices, contracts, and compliance with regulatory requirements. Regular audits can identify potential legal issues before they become significant problems, allowing for timely corrective action.

Contract Management:

Effective contract management is crucial for minimizing legal risk. This involves carefully drafting, reviewing, and monitoring contracts to ensure they are clear, enforceable, and protect the organization’s interests. Key elements of contract management include clearly defining terms, setting out obligations and responsibilities, and including dispute resolution mechanisms.

Employee Training:

Providing ongoing training to employees about legal requirements and company policies helps reduce the risk of non-compliance. Training programs should cover key areas such as data protection, anti-bribery and corruption laws, and workplace conduct. Well-informed employees are less likely to engage in activities that could lead to legal issues.

Legal Counsel:

Engaging experienced legal counsel is essential for navigating complex legal landscapes. Legal experts can provide guidance on regulatory compliance, contract negotiations, intellectual property protection, and dispute resolution. Having access to legal advice helps organizations make informed decisions and mitigate legal risks effectively.

Data Protection Measures:

Implementing robust data protection measures is critical for complying with data privacy laws and safeguarding sensitive information. This includes using encryption, access controls, and conducting regular security assessments. Data protection measures help prevent data breaches and ensure compliance with regulations such as GDPR and CCPA.

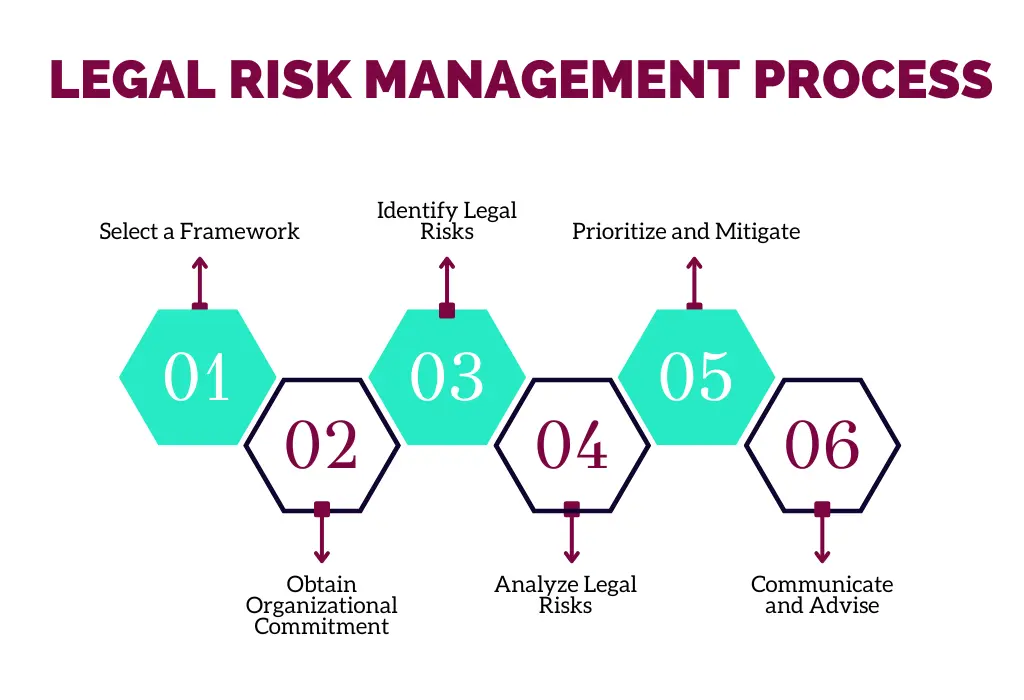

Legal Risk Management Process

To effectively manage legal risks, organizations should follow a systematic process that includes:

Select a Framework

Choosing the right risk management framework is essential for structuring your legal risk management efforts. ISO 31000 is a widely recognized framework that defines risk as "the effect of uncertainty on objectives." It provides a comprehensive approach to managing risks, including those with legal implications.

Obtain Organizational Commitment

Securing organizational commitment is crucial for the success of any legal risk management initiative. This involves defining the scope of the initiative, identifying the types of legal risks to be tracked, determining the key stakeholders for legal risk reporting, and allocating the necessary budget and resources.

Identify Legal Risks

Identifying legal risks involves compiling a broad list of potential risks through a structured approach:

Sources of Legal Risk:

These include contracts, regulations, litigation, and structural changes.

Recognizing Potential and Actual Risks:

Legal risks can arise from hazards, events, situations, and scenarios.

Recording Risks in a Risk Register:

This involves documenting the identified risks, along with their likelihood, consequences, and combined risk rating.

Analyze Legal Risks

Analyzing legal risks requires understanding the risks in the risk register and assessing their impact. This involves evaluating the likelihood of discovery and adverse decisions, as well as the potential consequences. Risk analysis is an iterative process and is important for refining the risk register and prioritizing risks for treatment.

Prioritize and Mitigate

Once the legal risks have been assessed, organizations need to prioritize them for mitigation measures. This is based on an organization’s risk tolerance level. Legal risks that are deemed intolerable need to be treated. Treatment options include avoiding the risk, increasing risk activities if beneficial, removing the risk source, altering the likelihood or consequences, and sharing the risk through contracts or insurance.

Communicate and Advise

Communicating the results of legal risk management efforts is essential for ensuring that all stakeholders are aware of the identified risks and the measures being taken to address them. Effective communication involves presenting risks clearly and advising on strategies to manage them.

Conclusion

Legal risk management is a vital component of an organization's overall risk management strategy. By proactively identifying and mitigating legal risks, businesses can protect their financial health, maintain their reputation, and ensure operational continuity. Integrating legal risk management into the ERM framework allows for a comprehensive approach to managing all types of risks, leading to improved resilience and sustainable growth.

Frequently Asked Questions

Why is managing legal risk important?

Managing legal risk is important because it helps prevent costly litigation, regulatory fines, and operational disruptions. Effective legal risk management protects an organization’s financial health, maintains its reputation, and ensures business continuity. By proactively addressing legal risks, companies can avoid the escalation of legal issues and focus on achieving their strategic objectives.

How can businesses mitigate legal risk?

Businesses can mitigate legal risk through several proactive strategies, including conducting regular legal audits, implementing effective contract management practices, providing employee training on legal requirements, engaging experienced legal counsel, and implementing robust data protection measures. These strategies help identify potential legal issues early, ensure compliance with laws and regulations, and safeguard the organization’s interests.

Modern businesses have embraced complex legal structures, while regulators have developed policies and rules to ensure the integrity of the legal system. In this labyrinth of rules, regulations, and legislations, legal risks pose a significant challenge to organizational stability and growth.

As per a survey conducted by Deloitte, 41% of non-banking and 14% of banking respondents have no definition of legal risk in place for their organization.These risks, which stem from regulatory compliance issues, contractual disputes, and a myriad of other legal vulnerabilities, can result in substantial financial losses, reputational damage, and operational disruptions.

In this guide, we explore why legal risk management is critical for businesses to navigate these complexities, especially ensuring not only compliance with the law but also safeguarding their assets and reputation – offering strategies to minimize exposure and maximize growth potential.

- Legal risk involves the potential for financial loss, reputational damage, or operational disruption due to legal actions, non-compliance with laws and regulations, or contractual failures. It is a pervasive risk that affects all aspects of business operations and requires comprehensive management strategies.

- Legal risk encompasses potential financial, reputational, and operational consequences arising from legal actions or non-compliance with laws and regulations.

- Businesses face various legal risks, including regulatory compliance issues, contractual disputes, intellectual property infringement, employment law violations, and data privacy breaches.

- Proactively managing legal risk through regular audits, robust contract management, employee training, legal counsel, and data protection measures is essential to minimize exposure and ensure business continuity.

- Integrating legal risk management into the enterprise risk management (ERM) framework provides a comprehensive approach to addressing all types of risks, leading to cost savings and improved operational resilience.

Legal risk is the possibility of financial loss, reputational damage, or operational disruption due to non-compliance with laws and regulations, legal actions, or contractual failures. Identifying all applicable legal risks is crucial for an organization's risk management strategy.

The 2024 Litigation Trends Annual Survey by Norton Rose Fulbright found that 61% of companies reported being engaged in at least one regulatory proceeding in the past year, with an average of 3.9 proceedings. Notably, the median number of lawsuits reported by respondents was 6 with 42% of them expecting the number to rise in 2024.

Broadly speaking, legal risk in business operations can arise due to non-compliance with regulatory requirements, employment and labor laws, contractual obligations, intellectual property, and other areas.

The scope of legal risk is extensive, requiring businesses to remain vigilant and proactive in their risk management efforts to avoid legal pitfalls and maintain operational integrity.

Here are some typical types of consequences that originate out of realized legal risks.

Financial

The financial consequences of legal risk can be devastating. Organizations may incur significant costs related to legal fees, fines, penalties, and settlements. According to a study by the Ponemon Institute, the cost of non-compliance is 2.71 times higher than the cost of compliance. On average, non-compliance costs organizations $14.82 million annually, compared to $5.47 million for compliance.

These financial burdens can erode profit margins and threaten the financial stability of the business.

Reputational

Reputational damage is another severe consequence of legal risk. Negative publicity resulting from legal disputes or regulatory violations can diminish customer trust and loyalty, making it difficult for a business to attract and retain clients.

Courtesy of the digital age, news of legal troubles spread rapidly, further exacerbating the damage to an organization’s reputation.

Operational

Operational disruptions caused by legal issues can impede a company's ability to function smoothly. This can include halting production, delaying product launches, and diverting management resources to handle legal problems. In extreme cases, legal risks can lead to business closures or the need for significant restructuring.

Businesses face numerous common legal risks that require careful management. Here are some areas where legal risks typically originate:

Regulatory Compliance:

Organizations must comply with a myriad of laws and regulations related to their industry. Failure to do so can result in enforcement actions, fines, and operational restrictions.

Contractual Disputes:

Contracts are fundamental to business operations, governing relationships with suppliers, customers, and partners. Disputes over contract terms or breaches of contract can lead to costly litigation and strained business relationships.

Intellectual Property Infringement:

Protecting intellectual property (IP) is critical for businesses that rely on innovation. Unauthorized use of a company's patents, trademarks, or copyrights can lead to significant legal battles and financial losses.

Employment Law Violations:

Issues such as wrongful termination, workplace harassment, and discrimination can result in lawsuits and damage to the company’s reputation. Employment law is complex and varies by jurisdiction, making compliance a challenging but essential task.

Data Privacy Breaches:

In an era where data is a valuable asset, companies must ensure compliance with data protection and privacy laws, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Data breaches can not only result in severe fines but also shake up consumer trust and confidence.

It is essential for organizations to include the management of legal risks in the broader enterprise risk management (ERM) framework for reasons more than one:

Proactive Mitigation of Issues

Proactively managing legal risk is crucial for protecting an organization’s assets and ensuring its long-term sustainability. By identifying potential legal threats early and implementing strategies to mitigate them, companies can avoid the escalation of legal issues into more significant problems. Managing legal risks in a proactive manner requires regular monitoring of the legal environment, staying informed about changes in laws and regulations, and maintaining a vigilant approach to compliance.

Comprehensive Approach to Risk Management

Integrating legal risk management into the broader enterprise risk management (ERM) framework ensures a cohesive approach to managing all types of risks. ERM provides a structured process for identifying, assessing, and mitigating risks across the entire organization, including financial, operational, strategic, and legal risks. By incorporating legal risk into ERM, businesses can ensure that they are addressing legal threats in conjunction with other critical risks, thereby achieving a more comprehensive risk management strategy.

Cost Savings and Business Continuity

Effective legal risk management can lead to significant cost savings by preventing fines, reducing legal fees, and avoiding costly litigation. Additionally, it enhances business continuity by minimizing operational disruptions caused by legal issues. Companies that proactively manage their legal risks are better positioned to maintain steady operations and achieve their strategic goals without the interruptions that legal problems can cause.

Here are some proactive strategies and practices we suggest that can play a pivotal role in mitigating legal risks for organizations:

Regular Legal Audits:

Conducting regular legal audits helps ensure compliance with applicable laws and regulations. These audits involve reviewing business practices, contracts, and compliance with regulatory requirements. Regular audits can identify potential legal issues before they become significant problems, allowing for timely corrective action.

Contract Management:

Effective contract management is crucial for minimizing legal risk. This involves carefully drafting, reviewing, and monitoring contracts to ensure they are clear, enforceable, and protect the organization’s interests. Key elements of contract management include clearly defining terms, setting out obligations and responsibilities, and including dispute resolution mechanisms.

Employee Training:

Providing ongoing training to employees about legal requirements and company policies helps reduce the risk of non-compliance. Training programs should cover key areas such as data protection, anti-bribery and corruption laws, and workplace conduct. Well-informed employees are less likely to engage in activities that could lead to legal issues.

Legal Counsel:

Engaging experienced legal counsel is essential for navigating complex legal landscapes. Legal experts can provide guidance on regulatory compliance, contract negotiations, intellectual property protection, and dispute resolution. Having access to legal advice helps organizations make informed decisions and mitigate legal risks effectively.

Data Protection Measures:

Implementing robust data protection measures is critical for complying with data privacy laws and safeguarding sensitive information. This includes using encryption, access controls, and conducting regular security assessments. Data protection measures help prevent data breaches and ensure compliance with regulations such as GDPR and CCPA.

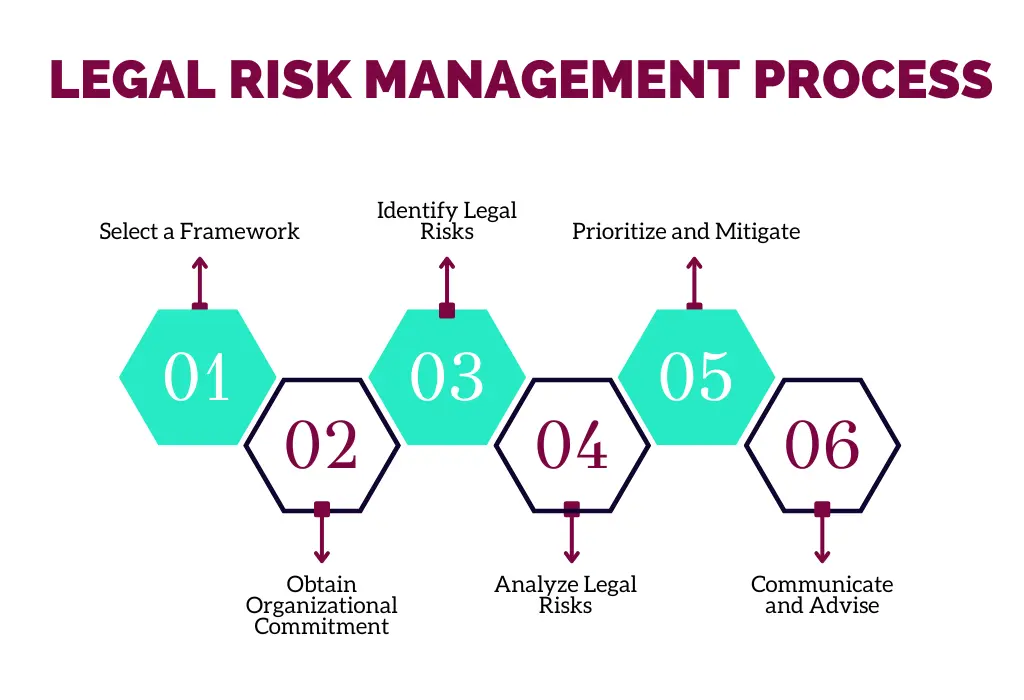

To effectively manage legal risks, organizations should follow a systematic process that includes:

Select a Framework

Choosing the right risk management framework is essential for structuring your legal risk management efforts. ISO 31000 is a widely recognized framework that defines risk as "the effect of uncertainty on objectives." It provides a comprehensive approach to managing risks, including those with legal implications.

Obtain Organizational Commitment

Securing organizational commitment is crucial for the success of any legal risk management initiative. This involves defining the scope of the initiative, identifying the types of legal risks to be tracked, determining the key stakeholders for legal risk reporting, and allocating the necessary budget and resources.

Identify Legal Risks

Identifying legal risks involves compiling a broad list of potential risks through a structured approach:

Sources of Legal Risk:

These include contracts, regulations, litigation, and structural changes.

Recognizing Potential and Actual Risks:

Legal risks can arise from hazards, events, situations, and scenarios.

Recording Risks in a Risk Register:

This involves documenting the identified risks, along with their likelihood, consequences, and combined risk rating.

Analyze Legal Risks

Analyzing legal risks requires understanding the risks in the risk register and assessing their impact. This involves evaluating the likelihood of discovery and adverse decisions, as well as the potential consequences. Risk analysis is an iterative process and is important for refining the risk register and prioritizing risks for treatment.

Prioritize and Mitigate

Once the legal risks have been assessed, organizations need to prioritize them for mitigation measures. This is based on an organization’s risk tolerance level. Legal risks that are deemed intolerable need to be treated. Treatment options include avoiding the risk, increasing risk activities if beneficial, removing the risk source, altering the likelihood or consequences, and sharing the risk through contracts or insurance.

Communicate and Advise

Communicating the results of legal risk management efforts is essential for ensuring that all stakeholders are aware of the identified risks and the measures being taken to address them. Effective communication involves presenting risks clearly and advising on strategies to manage them.

Legal risk management is a vital component of an organization's overall risk management strategy. By proactively identifying and mitigating legal risks, businesses can protect their financial health, maintain their reputation, and ensure operational continuity. Integrating legal risk management into the ERM framework allows for a comprehensive approach to managing all types of risks, leading to improved resilience and sustainable growth.

Why is managing legal risk important?

Managing legal risk is important because it helps prevent costly litigation, regulatory fines, and operational disruptions. Effective legal risk management protects an organization’s financial health, maintains its reputation, and ensures business continuity. By proactively addressing legal risks, companies can avoid the escalation of legal issues and focus on achieving their strategic objectives.

How can businesses mitigate legal risk?

Businesses can mitigate legal risk through several proactive strategies, including conducting regular legal audits, implementing effective contract management practices, providing employee training on legal requirements, engaging experienced legal counsel, and implementing robust data protection measures. These strategies help identify potential legal issues early, ensure compliance with laws and regulations, and safeguard the organization’s interests.