Introduction

One of the key responsibilities of risk professionals and an integral part of enterprise risk assessment is to provide actionable risk insights to enable the decision-makers to make strategic business decisions. For a long period of time, risk practitioners have relied on qualitative assessments – red, yellow, and green heatmaps, or a scale of 1 to 5, or high, medium, low ratings, and so on. And, they’re important too to understand the likelihood, severity, and impact of risks and the overall risk landscape.

However, qualitative risk assessments are greatly affected by the assessor’s bias and level of experience. Also, they are often vague and open to interpretation – if two different risks have been identified as red, does it mean both are equally high risk? How do we prioritize such risks and associated investment decisions? Or, in other words, how red is the red? Furthermore, the lurking modern, interconnected risks require more than qualitative analysis to identify its criticality and impact on business.

The subjectivity and ambiguity associated with qualitative risk assessments can be addressed with quantitative risk assessments. In today’s data-heavy environment, organizations largely rely on historical data and quantitative assessments for making strategic decisions as they help to estimate the probable outcomes. Financial institutions have been quantifying financial risks, such as credit risk, market risk, liquidity risk etc., since time immemorial. Why not apply the same approach to quantifying non-financial risks, such as operational disruptions, compliance failures, misconduct, or technological challenges, or faced by organizations?

In this eBook, we will discuss risk assessment methodologies, both qualitative and quantitative, how to quantify non-financial risks, and more.

What is Risk Assessment?

Risk assessment or risk analysis is the process of analyzing and examining potential risk events that may adversely impact an organization and comparing the risk exposures with defined tolerance levels.

Performing risk assessments is one of the most important steps in the risk management process. Once risks faced by an organization have been identified, assessment and analysis are critical to unlocking deeper insights into the overall risk posture, understanding the factors that can have a negative impact, and determining proactive steps to mitigate and minimize them.

Risk Assessment Methodologies

There are two main types of risk assessment methodologies: qualitative risk assessment and quantitative risk assessment.

Qualitative Risk Assessment

Qualitative risk assessment is the process of determining the likelihood of a risk occurring, the impact it would have if the risk event occurred, and its severity.

The process involves recording the results in a risk assessment matrix, which can help risk professionals to quickly identify the top risks – those falling in the highest likelihood and impact categories.

Advantages :

- The methodology is simple and does not require training, ensuring quick adoption and move towards risk program maturity.

- It helps to identify top risks in a quick and cost-effective manner.

- It helps to quickly prioritize risks.

- It is perfect for companies that are starting their risk management process.

Disadvantages :

- It greatly depends on the knowledge and expertise of the assessor.

- It could be influenced by the assessor’s bias and perception.

- The analysis becomes ambiguous when multiple risks fall into the same category.

- It is not possible to perform cost benefit analysis and its subjective nature makes it difficult to accurately evaluate the effectiveness of controls.

Quantitative Risk Assessment

According to the International Risk Management Institute (IRMI), risk quantification is “forecasting of loss frequency and severity to make risk financing decisions. Dependable estimates of the likelihood and dollar amount of loss-causing events allow an organization to take appropriate steps now and in the future to minimize their financial impact.”

In simple words, risk quantification is associating a monetary value to risk. For example, while performing a risk assessment, an assessor calculates the annual loss expectancy (the potential loss due to risk in a year) of $1 million. This quantitative value brings clarity to risk professionals as to how much could be the loss if a risk becomes an event.

Advantages :

- It helps to accurately understand high-risk areas and risk exposure in financial terms.

- It provides realistic and actionable insights by presenting a range of outcomes compared to a single value.

- It enables to easily prioritize various risks and related business decisions.

- Associating a monetary value to risk enables CROs to effectively communicate risk exposure with the top management and board.

Disadvantages :

- The methodology is quite complex and requires advanced tools and experts.

- The quantitative analysis needs to be backed by a qualitative explanation else it could be misinterpreted.

- It is highly dependent on the availability of reliable data.

- It depends on the maturity of the risk function and might not be suitable for organizations of all sizes.

Qualitative vs Quantitative Risk Assessment: What's The Difference?

Qualitative risk assesment is the process of determining the likelihood of a risk occuring, it is quick but subjective. Quantitative risk analysis differs in its approach and is objective and more detailed.

Qualitative risk assessment is the process of determining the likelihood of a risk occurring, the impact it would have, and its severity, while quantitative risk assessment relies on pre-existing numbers and statistics that are verified to measure probabilities and the potential impact of specific risks.

How to Quantify Non-Financial Risk (NFR)

What gets measured gets managed. For a comprehensive risk management program, it is critical to effectively manage non-financial risks as well. Quantifying NFR helps organizations to better evaluate if their risk exposure is aligned with their risk appetite, within their tolerance level, whether they need to invest more to improve controls, how much investment is worth it, and more

Value at Risk (VaR) is a way to quantify the risk of potential losses, i.e., the expected loss from risk exposure. Factor Analysis of Information Risk (FAIRTM) is one of the most widely used VaR models for cybersecurity and operational risks.

FAIRTM In the words of the FAIR Institute, “FAIR provides a model for understanding, analyzing and quantifying cyber risk and operational risk in financial terms.”

The model is based on the concept that risk is uncertain and therefore the focus should not be on what is possible but on the probability that a risk event will occur and the loss exposure. By enabling assessors to express the factors contributing to a risk in quantitative terms, such as numbers, percentages, monetary values, etc., it helps estimate the probable frequency and magnitude of loss. It provides a model to measure and analyze risk via complex risk scenarios.

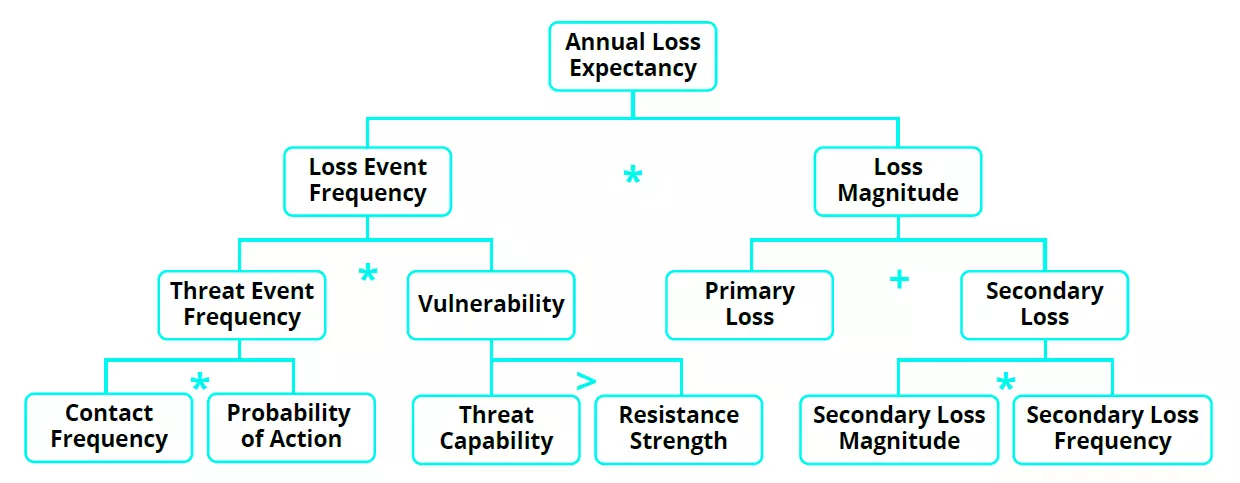

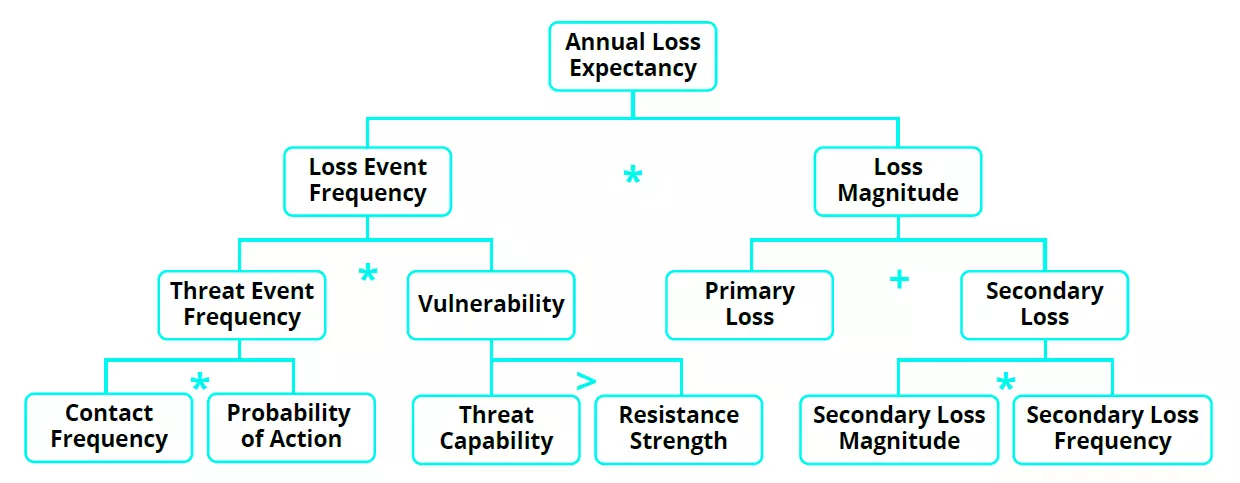

FAIR helps calculate total loss exposure, loss event frequency, loss magnitude, threat event frequency, susceptibility, and primary and secondary loss.

Annual Loss Expectancy Annual Loss Expectancy (ALE) is determined from Single Loss Expectancy (SLE) which is nothing but the loss that could result from a single risk event. For example, consider the risk of fire hazards. If the organizational infrastructure, including office building, furniture, etc., is valued at $100,000 and a fire outbreak destroys 75% of it, then the monetary loss to the organization is $75,000. So, in this example, SLE is $75,000.

Once we know the SLE, then ALE can be calculated by multiplying the frequency of a risk event by the magnitude of loss. For example, consider a scenario in which a risk event can occur 5 times in a year and an organization would lose $1,000 in each event, then ALE will be $5,000.

In another scenario, suppose a single risk event can result in a loss of $100,000. However, if the event occurs only once in 5 years, then the ALE would be $20,000.

Here’s a quick look at these terms (as defined by the FAIR Institute):

Loss Event Frequency The probable frequency that a threat action will result in loss within a given timeframe.

Threat Event Frequency The probable frequency that a threat agent will act against an asset within a given timeframe.

Loss Magnitude The probable magnitude of primary and secondary loss resulting from an event.

- Primary Loss Magnitude is the loss incurred from the loss event itself, that is, the financial impact of a fire breakout. It also includes activities that the primary stakeholder chooses to do in the wake of the loss event, such as investigating the incident or replacing a damaged server.

- Secondary Loss Magnitude is the loss incurred from the reactions of outside parties (or “secondary stakeholders”) to the loss event. For example, when the personal information of employees is exposed in a data breach, or a fine or penalty is levied by a regulator due to an operational failure or inefficient control.

Vulnerability

The probability of a threat event becoming a loss event. Or, in other words, the probability that an asset will be unable to resist a threat agent.

Threat Capability The probable level of force (as embodied by the time, resources, and technological capability) that a threat agent is capable of applying against an asset. Or, in other words, how much damage can be caused to an asset by a threat.

Resistance Strength The strength of a control compared to the threat capability. Or, in other words, the strength of a control to protect an asset from a threat.

Monte Carlo Simulation

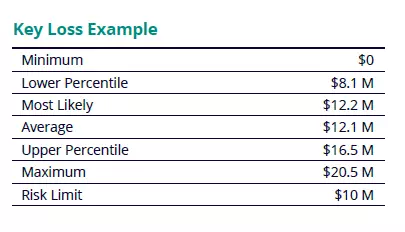

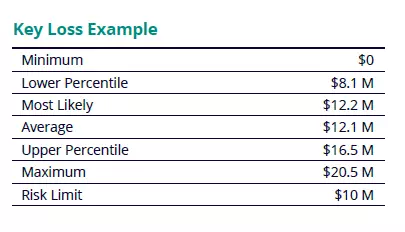

Monte Carlo simulation is one of the widely used methods for running a FAIR analysis. The modeling technique involves simulating a risk event, such as supply chain disruption, ransomware attacks, etc., multiple times and predicting the financial losses that could result from each scenario. The process generates a range of possible outcomes of any risk event along with their relative probabilities.

To simplify it further, the simulation helps run several what-if analyses by assigning multiple values to a variable, which would produce multiple results. It then computes the average of the results to arrive at an estimate. Ultimately, the technique provides a full range of potential outcomes, how likely the outcomes can occur, what factors are impacting the most, and by how much.

For example, consider the risk of natural calamity. Monte Carlo simulations can provide risk teams with a range of outcomes that are possible instead of single point estimates. With the probability distribution table, organizations would be able to quickly see their risk exposure at multiple levels and compare it with their risk limit for making better-informed decisions.

The Best Approach

From a practical viewpoint, the decision to perform a qualitative or quantitative risk assessment depends on what the risk assessor is trying to assess and what they expect to learn. For example, let’s consider the risk of fire hazards faced by an organization. An initial risk assessment would involve survey questions such as:

- Is the office premise located near a transformer or combustible sources (heating, welding, etc.)?

- Are there any electrical issues or spills in the office building?

- How many fire incidents have occurred in the past?

- What is the probability of this risk event?

- Have any lives been lost to such incidents?

Most of these questions require a yes/no response and greatly rely on the expertise and knowledge of the assessor. Though qualitative risk assessments are subjective in nature and can be influenced by an assessor’s perception and bias, they are important to understand the severity and likelihood of any risk event. At the same time, it is also important to note that while risk quantification is important, it is highly dependent on the availability of reliable data and the scale and maturity level of risk function. For truly understanding and assessing risks, organizations must use both qualitative and quantitative risk assessment methodologies.

"The deepest insights come from the widest perspectives. For true risk assessment, perform both qualitative and quantitative risk assessments to gain real visibility into the overall organizational and cyber risk posture. You may have heard it called a 360-degree view of risk…(Read More)"

- Patricia McParland, AVP, Product Marketing, MetricStream

Modernize Your Risk Assessment Program with Metricstream

MetricStream enables organizations to effectively plan, schedule, manage, and perform risk and control assessments. It equips risk professionals to evaluate inherent and residual risks both quantitatively and qualitatively using configurable assessment methodologies.

With the Danube release, MetricStream brought advanced risk quantification capabilities to MetricStream Enterprise Risk Management and Operational Risk Management products. Risk teams can now express loss exposure in monetary terms. Associating an external standard and financial value makes it simpler for all stakeholders to quickly grasp and accurately understand the relative importance of each risk and make better-informed decisions. Users can build any kind of custom model, use various factors and variables, and capture values for factors (e.g., threat event frequency) that are represented in a simple, parent-child hierarchal format. A wide range of factors (e.g., Min, Max, Most Likely, and Confidence) are already available to improve the accuracy of quantification. Earlier, MetricStream had rolled out risk quantification capabilities to the IT & Cyber Risk Management product.

MetricStream Risk Assessment:

- Enables simple assessments by rating a risk, and advanced assessments using multiple factors and risk scoring thereby promoting a positive risk culture

- Helps in presenting risk exposure in monetary values and quantitative terms, enabling risk-informed decisions

- Supports configurable risk formulas to be developed by users to suit customer risk calculation methodologies

- Helps assess overall control environment by evaluating controls based on multiple factors for design and operational efficiencies

- Supports aggregation risk scores using the weighted average method where weights can be given to multiple dimensions, including organization, objective, product, process, assessable item, or risk hierarchy for improved and accurate risk visibility

One of the key responsibilities of risk professionals and an integral part of enterprise risk assessment is to provide actionable risk insights to enable the decision-makers to make strategic business decisions. For a long period of time, risk practitioners have relied on qualitative assessments – red, yellow, and green heatmaps, or a scale of 1 to 5, or high, medium, low ratings, and so on. And, they’re important too to understand the likelihood, severity, and impact of risks and the overall risk landscape.

However, qualitative risk assessments are greatly affected by the assessor’s bias and level of experience. Also, they are often vague and open to interpretation – if two different risks have been identified as red, does it mean both are equally high risk? How do we prioritize such risks and associated investment decisions? Or, in other words, how red is the red? Furthermore, the lurking modern, interconnected risks require more than qualitative analysis to identify its criticality and impact on business.

The subjectivity and ambiguity associated with qualitative risk assessments can be addressed with quantitative risk assessments. In today’s data-heavy environment, organizations largely rely on historical data and quantitative assessments for making strategic decisions as they help to estimate the probable outcomes. Financial institutions have been quantifying financial risks, such as credit risk, market risk, liquidity risk etc., since time immemorial. Why not apply the same approach to quantifying non-financial risks, such as operational disruptions, compliance failures, misconduct, or technological challenges, or faced by organizations?

In this eBook, we will discuss risk assessment methodologies, both qualitative and quantitative, how to quantify non-financial risks, and more.

Risk assessment or risk analysis is the process of analyzing and examining potential risk events that may adversely impact an organization and comparing the risk exposures with defined tolerance levels.

Performing risk assessments is one of the most important steps in the risk management process. Once risks faced by an organization have been identified, assessment and analysis are critical to unlocking deeper insights into the overall risk posture, understanding the factors that can have a negative impact, and determining proactive steps to mitigate and minimize them.

There are two main types of risk assessment methodologies: qualitative risk assessment and quantitative risk assessment.

Qualitative Risk Assessment

Qualitative risk assessment is the process of determining the likelihood of a risk occurring, the impact it would have if the risk event occurred, and its severity.

The process involves recording the results in a risk assessment matrix, which can help risk professionals to quickly identify the top risks – those falling in the highest likelihood and impact categories.

Advantages :

- The methodology is simple and does not require training, ensuring quick adoption and move towards risk program maturity.

- It helps to identify top risks in a quick and cost-effective manner.

- It helps to quickly prioritize risks.

- It is perfect for companies that are starting their risk management process.

Disadvantages :

- It greatly depends on the knowledge and expertise of the assessor.

- It could be influenced by the assessor’s bias and perception.

- The analysis becomes ambiguous when multiple risks fall into the same category.

- It is not possible to perform cost benefit analysis and its subjective nature makes it difficult to accurately evaluate the effectiveness of controls.

Quantitative Risk Assessment

According to the International Risk Management Institute (IRMI), risk quantification is “forecasting of loss frequency and severity to make risk financing decisions. Dependable estimates of the likelihood and dollar amount of loss-causing events allow an organization to take appropriate steps now and in the future to minimize their financial impact.”

In simple words, risk quantification is associating a monetary value to risk. For example, while performing a risk assessment, an assessor calculates the annual loss expectancy (the potential loss due to risk in a year) of $1 million. This quantitative value brings clarity to risk professionals as to how much could be the loss if a risk becomes an event.

Advantages :

- It helps to accurately understand high-risk areas and risk exposure in financial terms.

- It provides realistic and actionable insights by presenting a range of outcomes compared to a single value.

- It enables to easily prioritize various risks and related business decisions.

- Associating a monetary value to risk enables CROs to effectively communicate risk exposure with the top management and board.

Disadvantages :

- The methodology is quite complex and requires advanced tools and experts.

- The quantitative analysis needs to be backed by a qualitative explanation else it could be misinterpreted.

- It is highly dependent on the availability of reliable data.

- It depends on the maturity of the risk function and might not be suitable for organizations of all sizes.

Qualitative vs Quantitative Risk Assessment: What's The Difference?

Qualitative risk assesment is the process of determining the likelihood of a risk occuring, it is quick but subjective. Quantitative risk analysis differs in its approach and is objective and more detailed.

Qualitative risk assessment is the process of determining the likelihood of a risk occurring, the impact it would have, and its severity, while quantitative risk assessment relies on pre-existing numbers and statistics that are verified to measure probabilities and the potential impact of specific risks.

What gets measured gets managed. For a comprehensive risk management program, it is critical to effectively manage non-financial risks as well. Quantifying NFR helps organizations to better evaluate if their risk exposure is aligned with their risk appetite, within their tolerance level, whether they need to invest more to improve controls, how much investment is worth it, and more

Value at Risk (VaR) is a way to quantify the risk of potential losses, i.e., the expected loss from risk exposure. Factor Analysis of Information Risk (FAIRTM) is one of the most widely used VaR models for cybersecurity and operational risks.

FAIRTM In the words of the FAIR Institute, “FAIR provides a model for understanding, analyzing and quantifying cyber risk and operational risk in financial terms.”

The model is based on the concept that risk is uncertain and therefore the focus should not be on what is possible but on the probability that a risk event will occur and the loss exposure. By enabling assessors to express the factors contributing to a risk in quantitative terms, such as numbers, percentages, monetary values, etc., it helps estimate the probable frequency and magnitude of loss. It provides a model to measure and analyze risk via complex risk scenarios.

FAIR helps calculate total loss exposure, loss event frequency, loss magnitude, threat event frequency, susceptibility, and primary and secondary loss.

Annual Loss Expectancy Annual Loss Expectancy (ALE) is determined from Single Loss Expectancy (SLE) which is nothing but the loss that could result from a single risk event. For example, consider the risk of fire hazards. If the organizational infrastructure, including office building, furniture, etc., is valued at $100,000 and a fire outbreak destroys 75% of it, then the monetary loss to the organization is $75,000. So, in this example, SLE is $75,000.

Once we know the SLE, then ALE can be calculated by multiplying the frequency of a risk event by the magnitude of loss. For example, consider a scenario in which a risk event can occur 5 times in a year and an organization would lose $1,000 in each event, then ALE will be $5,000.

In another scenario, suppose a single risk event can result in a loss of $100,000. However, if the event occurs only once in 5 years, then the ALE would be $20,000.

Here’s a quick look at these terms (as defined by the FAIR Institute):

Loss Event Frequency The probable frequency that a threat action will result in loss within a given timeframe.

Threat Event Frequency The probable frequency that a threat agent will act against an asset within a given timeframe.

Loss Magnitude The probable magnitude of primary and secondary loss resulting from an event.

- Primary Loss Magnitude is the loss incurred from the loss event itself, that is, the financial impact of a fire breakout. It also includes activities that the primary stakeholder chooses to do in the wake of the loss event, such as investigating the incident or replacing a damaged server.

- Secondary Loss Magnitude is the loss incurred from the reactions of outside parties (or “secondary stakeholders”) to the loss event. For example, when the personal information of employees is exposed in a data breach, or a fine or penalty is levied by a regulator due to an operational failure or inefficient control.

Vulnerability

The probability of a threat event becoming a loss event. Or, in other words, the probability that an asset will be unable to resist a threat agent.

Threat Capability The probable level of force (as embodied by the time, resources, and technological capability) that a threat agent is capable of applying against an asset. Or, in other words, how much damage can be caused to an asset by a threat.

Resistance Strength The strength of a control compared to the threat capability. Or, in other words, the strength of a control to protect an asset from a threat.

Monte Carlo Simulation

Monte Carlo simulation is one of the widely used methods for running a FAIR analysis. The modeling technique involves simulating a risk event, such as supply chain disruption, ransomware attacks, etc., multiple times and predicting the financial losses that could result from each scenario. The process generates a range of possible outcomes of any risk event along with their relative probabilities.

To simplify it further, the simulation helps run several what-if analyses by assigning multiple values to a variable, which would produce multiple results. It then computes the average of the results to arrive at an estimate. Ultimately, the technique provides a full range of potential outcomes, how likely the outcomes can occur, what factors are impacting the most, and by how much.

For example, consider the risk of natural calamity. Monte Carlo simulations can provide risk teams with a range of outcomes that are possible instead of single point estimates. With the probability distribution table, organizations would be able to quickly see their risk exposure at multiple levels and compare it with their risk limit for making better-informed decisions.

From a practical viewpoint, the decision to perform a qualitative or quantitative risk assessment depends on what the risk assessor is trying to assess and what they expect to learn. For example, let’s consider the risk of fire hazards faced by an organization. An initial risk assessment would involve survey questions such as:

- Is the office premise located near a transformer or combustible sources (heating, welding, etc.)?

- Are there any electrical issues or spills in the office building?

- How many fire incidents have occurred in the past?

- What is the probability of this risk event?

- Have any lives been lost to such incidents?

Most of these questions require a yes/no response and greatly rely on the expertise and knowledge of the assessor. Though qualitative risk assessments are subjective in nature and can be influenced by an assessor’s perception and bias, they are important to understand the severity and likelihood of any risk event. At the same time, it is also important to note that while risk quantification is important, it is highly dependent on the availability of reliable data and the scale and maturity level of risk function. For truly understanding and assessing risks, organizations must use both qualitative and quantitative risk assessment methodologies.

"The deepest insights come from the widest perspectives. For true risk assessment, perform both qualitative and quantitative risk assessments to gain real visibility into the overall organizational and cyber risk posture. You may have heard it called a 360-degree view of risk…(Read More)"

- Patricia McParland, AVP, Product Marketing, MetricStream

MetricStream enables organizations to effectively plan, schedule, manage, and perform risk and control assessments. It equips risk professionals to evaluate inherent and residual risks both quantitatively and qualitatively using configurable assessment methodologies.

With the Danube release, MetricStream brought advanced risk quantification capabilities to MetricStream Enterprise Risk Management and Operational Risk Management products. Risk teams can now express loss exposure in monetary terms. Associating an external standard and financial value makes it simpler for all stakeholders to quickly grasp and accurately understand the relative importance of each risk and make better-informed decisions. Users can build any kind of custom model, use various factors and variables, and capture values for factors (e.g., threat event frequency) that are represented in a simple, parent-child hierarchal format. A wide range of factors (e.g., Min, Max, Most Likely, and Confidence) are already available to improve the accuracy of quantification. Earlier, MetricStream had rolled out risk quantification capabilities to the IT & Cyber Risk Management product.

MetricStream Risk Assessment:

- Enables simple assessments by rating a risk, and advanced assessments using multiple factors and risk scoring thereby promoting a positive risk culture

- Helps in presenting risk exposure in monetary values and quantitative terms, enabling risk-informed decisions

- Supports configurable risk formulas to be developed by users to suit customer risk calculation methodologies

- Helps assess overall control environment by evaluating controls based on multiple factors for design and operational efficiencies

- Supports aggregation risk scores using the weighted average method where weights can be given to multiple dimensions, including organization, objective, product, process, assessable item, or risk hierarchy for improved and accurate risk visibility