Introduction

With organizations continuously being subjected to both visible and obscure risks, there is a crucial need for comprehensive strategies to ward off potential crises. Unforeseen events can carve a dent in a company's market value, financial health, and reputation in no time.

Against this backdrop, the spotlight on preemptive risk management is brighter than ever, with risk documentation emerging as a strategic necessity for any organization's survival and success.

Key Takeaways

- Risk documentation is the well-defined process of recording potential risks and threats, enabling organizations to assess, monitor, and mitigate them effectively. It transforms abstract concerns into actionable data, crucial for corporate governance and strategic planning.

- Important risk documents include the risk management plan, risk register, risk analysis reports, risk mitigation plans, incident reports, and compliance documentation.

- Common challenges in risk documentation include maintaining relevance, ensuring accessibility, avoiding data overload, integrating with business processes, and securing stakeholder buy-in.

- Risk documents provide clarity, prioritize resource allocation, ensure regulatory compliance, and support informed decision-making. They are vital for avoiding unforeseen crises, financial losses, and reputational damage.

- Effective risk documentation equips organizations to anticipate and manage risks, and gain a competitive edge.

What is Risk Documentation?

Risk documentation is the systematic recording of all potential risks and threats that could detrimentally impact an organization, ranging from financial downturns and legal entanglements to technology breaches and operational hiccups. It’s a key element of corporate governance that ensures a detailed repository is in place, outlining what might go wrong, as well as housing critical analyses and mitigation strategies.

This disciplined approach aids in clarifying the diverse nature of risks, transforming intangible anxieties into structured data that can be actively managed.

Key Considerations for Building an Effective Risk Documentation Framework

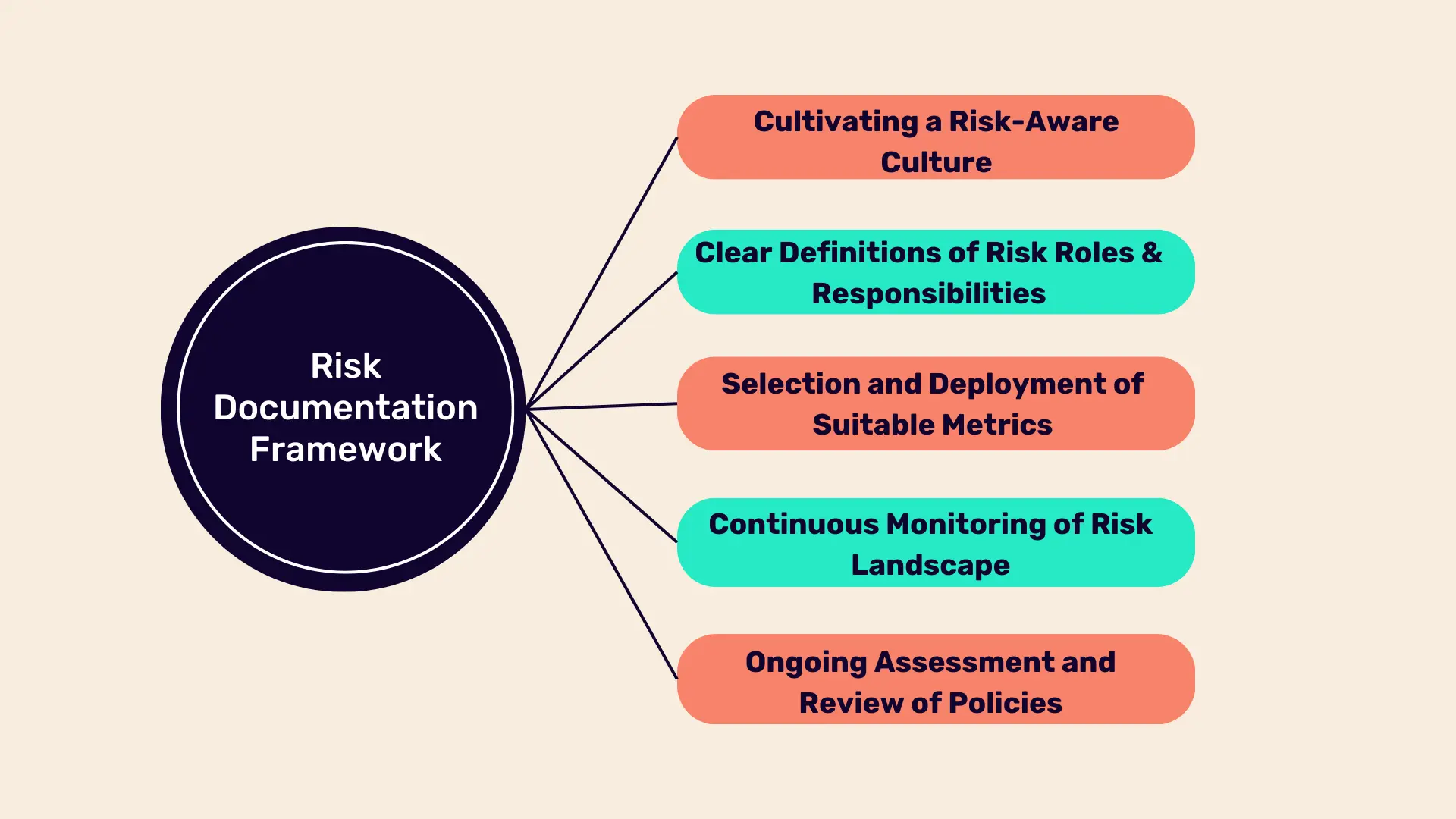

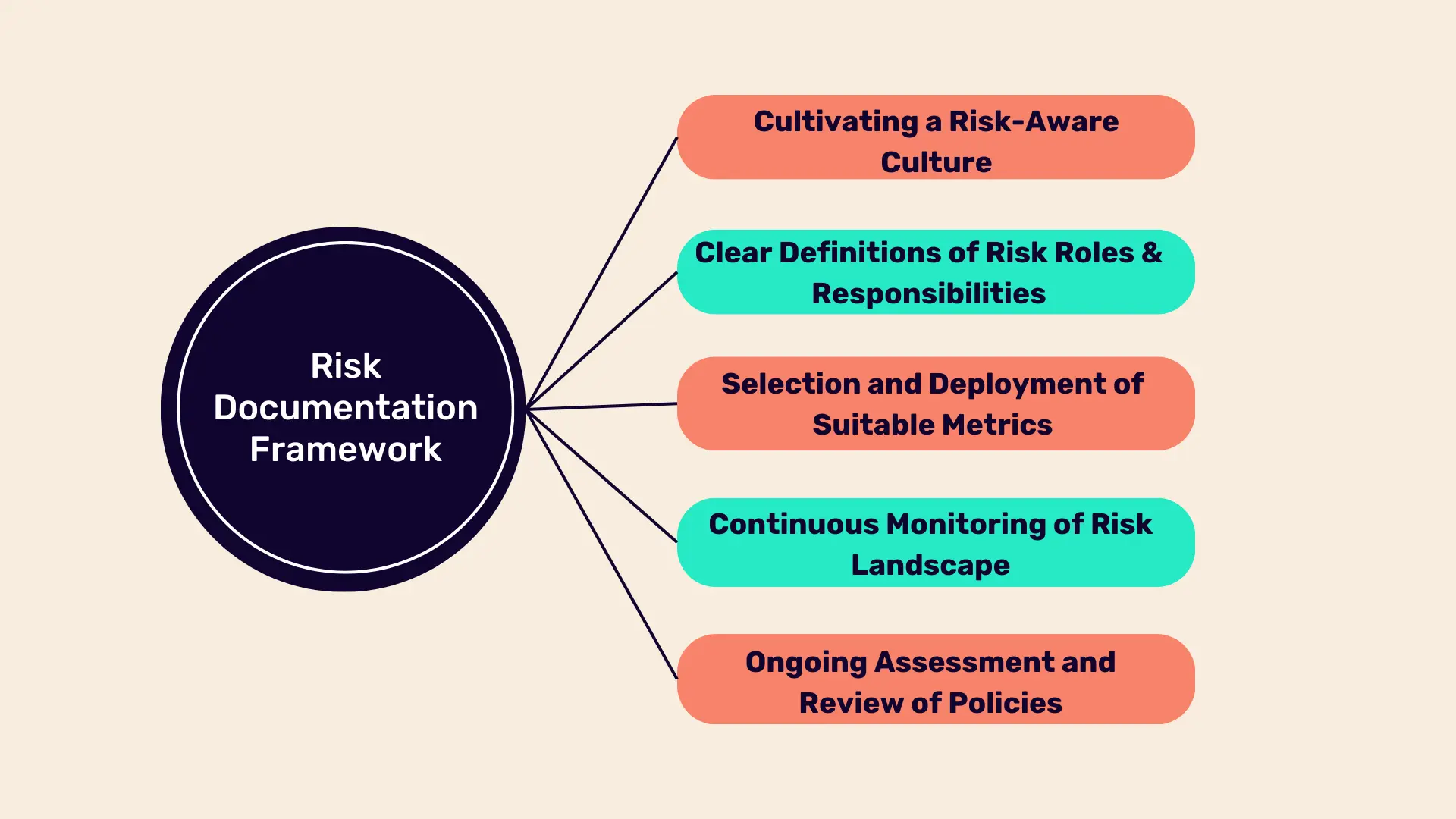

Here are the key considerations for building an effective and robust risk documentation framework:

Cultivating a Risk-Aware Culture:

This cultural groundwork lays the foundation for every subsequent action related to risk management. It involves prioritizing risk awareness at every level of the organization and embedding it into the corporate ethos. By ensuring that every stakeholder, from the board to the frontline employees, recognizes the importance of risk management, organizations can create a proactive stance toward identifying and addressing risks.

Clear Definitions of Risk Roles and Responsibilities:

Establishing crystal-clear risk roles and responsibilities is crucial. By explicitly documenting who owns what aspect of the risk management process, organizations pave the way for efficient and effective governance. This step is instrumental in building a framework where everyone knows their part in contributing to the organization's risk management goals.

Selection and Deployment of Suitable Metrics:

These metrics should be significant and directly related to both the performance and risk indicators that matter most to the organization. Regular assessment of these metrics is necessary to validate whether the risk documentation is serving its intended purpose, allowing for timely adjustments to be made.

Continuous Monitoring of Risk Landscape:

This process ensures that the organization remains agile and responsive to the evolving risk landscape. A well-defined process for identifying and recording emerging and peripheral risks efficiently plays a pivotal role in fine-tuning the risk documentation strategy.

Ongoing Assessment and Review of Policies:

Regular review of policies and procedures provides insights into the effectiveness and relevance of the current documentation. This includes reviewing incidents and loss data, analyzing escalations, and exceptions, performing root cause analysis, and more. Adjustments based on these reviews ensure that the organization’s risk mitigation strategies are deeply ingrained and reflective of its operational realities.

Types of Risk Documents

Here are the different types of risk documents that can come in handy for an organization:

Risk Management Plan:

This foundational document outlines your organization's risk management process, from risk identification and analysis to mitigation and monitoring strategies. It serves as a roadmap for managing risks throughout the project or business operation lifecycle.Risk Register:

Perhaps the most crucial of all risk documents, the risk register is a comprehensive log of identified risks, their severity, mitigation measures, and the current status of each risk. It's a living document that evolves as new risks emerge and existing risks are resolved.Risk Analysis Reports:

These detailed reports break down the potential impact and likelihood of identified risks. Risk analysis reports help prioritize risks and are essential for informed decision-making regarding resource allocation for risk mitigation.Risk Mitigation Plans:

Once risks are identified and prioritized, risk mitigation plans detail the specific steps and measures taken to reduce or eliminate the impacts of those risks. These plans are tailored to each identified risk and include timelines, responsible parties, and budget considerations.Incident Reports:

If a risk materializes into an event, incident reports provide a retrospective analysis of what happened, why it happened, and how similar incidents can be prevented in the future. These documents are vital for learning from past mistakes and fortifying risk management strategies.Compliance Documentation:

Compliance documents prove adherence to regulatory requirements and internal policies. They provide evidence of the organization's commitment to meeting legal, ethical, and regulatory standards, reducing the risk of non-compliance penalties and reputational damage.

Challenges of Risk Documentation

Below are some of the challenges companies face when dealing with the mammoth process of risk documentation:

Maintaining Relevance:

With the business landscape and external environment continuously changing, keeping risk documents up-to-date is a daunting task.

Solution: Implementing regular review cycles and assigning specific ownership for updates can ensure that documents remain relevant and reflective of the current risk landscape.

Ensuring Accessibility and Usability:

Often, risk documentation is stored in formats or locations that are not readily accessible or understandable to all stakeholders.

Solution: Leveraging centralized and user-friendly GRC platforms like MetricStream can enhance accessibility, making it easier for stakeholders to engage with risk documentation meaningfully.

Data Overload:

With vast amounts of data available, there's a risk of including too much detail in risk documents, making it challenging to distill actionable insights.

Solution: Prioritizing data and focusing on key metrics can streamline documentation, ensuring clarity and usability.

Integration with Business Processes:

Often, risk management processes and documentation are siloed from the core business operations.

Solution: Ensuring that risk management is integrated into the DNA of organizational processes through clear procedures and workflows can enhance the relevance and impact of risk documentation.

Securing Stakeholder Buy-in:

Engaging stakeholders and securing their buy-in for risk management initiatives can be challenging.

Solution: Clear communication of the value of risk management and how it aligns with broader organizational objectives can foster a culture of proactive risk management.

Why are Risk Documents Crucial For Any Organization?

Risk documents are crucial for any organization because they provide clarity on potential pitfalls, enable the prioritization of resources, ensure compliance with regulatory requirements, and support informed decision-making. By documenting risks, organizations can avoid unanticipated crises and financial losses, steering toward sustainable growth and success.

Let's delve into the pivotal reasons why risk documents hold importance for any entity:

Clarity and Understanding:

Risk documents clarify what might go wrong, providing a clear view of potential pitfalls. This understanding is critical in ensuring that all members of the organization are on the same page and can work towards common mitigation strategies.

Prioritization of Resources:

By documenting risks, organizations can prioritize resources, focusing on mitigating the risks with the highest probability of occurrence and the most severe potential impact. This efficient allocation of resources is indispensable for any business aiming to thrive.

Compliance and Regulatory Adherence:

Many industries are governed by strict regulatory requirements that mandate risk assessments and documentation. Failure to comply can result in severe penalties, making risk documentation not just prudent but obligatory.

Informed Decision-Making:

Equipped with a comprehensive risk document, decision-makers can make informed choices, weighing the potential risks against the anticipated rewards. This foresight is crucial for steering the organization towards sustainable growth and success.

A Consequence of Lacking Proper Documentation:

With adequate risk documentation, organizations are more likely to avoid unanticipated crises, financial losses, and damage to their reputation, which could have been mitigated or avoided with proper foresight and planning.

Conclusion

Organizations that prioritize an all-encompassing risk management strategy find themselves better equipped to anticipate risks, make informed decisions, and maintain a competitive edge. Risk documentation is an essential and reliable investment in the company's future stability and success.

Don’t let the lack of proper risk documentation be your organization’s Achilles' heel.

Adopting MetricStream’s Enterprise Risk Management software can be a game-changer for organizations looking to fortify their risk management strategies. Embrace the strategic advantage and transform your approach to risk management, turning potential risks into tangible opportunities for growth and innovation.

Frequently Asked Questions

How does a risk register help in risk management?

A risk register helps in risk management by providing a centralized repository of all identified risks, their potential impacts, likelihood, and the strategies for mitigating them. It facilitates tracking and ensures that risks are systematically monitored and managed throughout the project or organizational lifecycle.

How often should risk documents be updated?

Risk documents should be updated regularly, typically at key milestones, during major changes in project scope, or whenever new risks are identified. Continuous monitoring and updating ensure that the risk management process remains relevant and effective.

With organizations continuously being subjected to both visible and obscure risks, there is a crucial need for comprehensive strategies to ward off potential crises. Unforeseen events can carve a dent in a company's market value, financial health, and reputation in no time.

Against this backdrop, the spotlight on preemptive risk management is brighter than ever, with risk documentation emerging as a strategic necessity for any organization's survival and success.

- Risk documentation is the well-defined process of recording potential risks and threats, enabling organizations to assess, monitor, and mitigate them effectively. It transforms abstract concerns into actionable data, crucial for corporate governance and strategic planning.

- Important risk documents include the risk management plan, risk register, risk analysis reports, risk mitigation plans, incident reports, and compliance documentation.

- Common challenges in risk documentation include maintaining relevance, ensuring accessibility, avoiding data overload, integrating with business processes, and securing stakeholder buy-in.

- Risk documents provide clarity, prioritize resource allocation, ensure regulatory compliance, and support informed decision-making. They are vital for avoiding unforeseen crises, financial losses, and reputational damage.

- Effective risk documentation equips organizations to anticipate and manage risks, and gain a competitive edge.

Risk documentation is the systematic recording of all potential risks and threats that could detrimentally impact an organization, ranging from financial downturns and legal entanglements to technology breaches and operational hiccups. It’s a key element of corporate governance that ensures a detailed repository is in place, outlining what might go wrong, as well as housing critical analyses and mitigation strategies.

This disciplined approach aids in clarifying the diverse nature of risks, transforming intangible anxieties into structured data that can be actively managed.

Here are the key considerations for building an effective and robust risk documentation framework:

Cultivating a Risk-Aware Culture:

This cultural groundwork lays the foundation for every subsequent action related to risk management. It involves prioritizing risk awareness at every level of the organization and embedding it into the corporate ethos. By ensuring that every stakeholder, from the board to the frontline employees, recognizes the importance of risk management, organizations can create a proactive stance toward identifying and addressing risks.

Clear Definitions of Risk Roles and Responsibilities:

Establishing crystal-clear risk roles and responsibilities is crucial. By explicitly documenting who owns what aspect of the risk management process, organizations pave the way for efficient and effective governance. This step is instrumental in building a framework where everyone knows their part in contributing to the organization's risk management goals.

Selection and Deployment of Suitable Metrics:

These metrics should be significant and directly related to both the performance and risk indicators that matter most to the organization. Regular assessment of these metrics is necessary to validate whether the risk documentation is serving its intended purpose, allowing for timely adjustments to be made.

Continuous Monitoring of Risk Landscape:

This process ensures that the organization remains agile and responsive to the evolving risk landscape. A well-defined process for identifying and recording emerging and peripheral risks efficiently plays a pivotal role in fine-tuning the risk documentation strategy.

Ongoing Assessment and Review of Policies:

Regular review of policies and procedures provides insights into the effectiveness and relevance of the current documentation. This includes reviewing incidents and loss data, analyzing escalations, and exceptions, performing root cause analysis, and more. Adjustments based on these reviews ensure that the organization’s risk mitigation strategies are deeply ingrained and reflective of its operational realities.

Here are the different types of risk documents that can come in handy for an organization:

Risk Management Plan:

This foundational document outlines your organization's risk management process, from risk identification and analysis to mitigation and monitoring strategies. It serves as a roadmap for managing risks throughout the project or business operation lifecycle.Risk Register:

Perhaps the most crucial of all risk documents, the risk register is a comprehensive log of identified risks, their severity, mitigation measures, and the current status of each risk. It's a living document that evolves as new risks emerge and existing risks are resolved.Risk Analysis Reports:

These detailed reports break down the potential impact and likelihood of identified risks. Risk analysis reports help prioritize risks and are essential for informed decision-making regarding resource allocation for risk mitigation.Risk Mitigation Plans:

Once risks are identified and prioritized, risk mitigation plans detail the specific steps and measures taken to reduce or eliminate the impacts of those risks. These plans are tailored to each identified risk and include timelines, responsible parties, and budget considerations.Incident Reports:

If a risk materializes into an event, incident reports provide a retrospective analysis of what happened, why it happened, and how similar incidents can be prevented in the future. These documents are vital for learning from past mistakes and fortifying risk management strategies.Compliance Documentation:

Compliance documents prove adherence to regulatory requirements and internal policies. They provide evidence of the organization's commitment to meeting legal, ethical, and regulatory standards, reducing the risk of non-compliance penalties and reputational damage.

Below are some of the challenges companies face when dealing with the mammoth process of risk documentation:

Maintaining Relevance:

With the business landscape and external environment continuously changing, keeping risk documents up-to-date is a daunting task.

Solution: Implementing regular review cycles and assigning specific ownership for updates can ensure that documents remain relevant and reflective of the current risk landscape.

Ensuring Accessibility and Usability:

Often, risk documentation is stored in formats or locations that are not readily accessible or understandable to all stakeholders.

Solution: Leveraging centralized and user-friendly GRC platforms like MetricStream can enhance accessibility, making it easier for stakeholders to engage with risk documentation meaningfully.

Data Overload:

With vast amounts of data available, there's a risk of including too much detail in risk documents, making it challenging to distill actionable insights.

Solution: Prioritizing data and focusing on key metrics can streamline documentation, ensuring clarity and usability.

Integration with Business Processes:

Often, risk management processes and documentation are siloed from the core business operations.

Solution: Ensuring that risk management is integrated into the DNA of organizational processes through clear procedures and workflows can enhance the relevance and impact of risk documentation.

Securing Stakeholder Buy-in:

Engaging stakeholders and securing their buy-in for risk management initiatives can be challenging.

Solution: Clear communication of the value of risk management and how it aligns with broader organizational objectives can foster a culture of proactive risk management.

Risk documents are crucial for any organization because they provide clarity on potential pitfalls, enable the prioritization of resources, ensure compliance with regulatory requirements, and support informed decision-making. By documenting risks, organizations can avoid unanticipated crises and financial losses, steering toward sustainable growth and success.

Let's delve into the pivotal reasons why risk documents hold importance for any entity:

Clarity and Understanding:

Risk documents clarify what might go wrong, providing a clear view of potential pitfalls. This understanding is critical in ensuring that all members of the organization are on the same page and can work towards common mitigation strategies.

Prioritization of Resources:

By documenting risks, organizations can prioritize resources, focusing on mitigating the risks with the highest probability of occurrence and the most severe potential impact. This efficient allocation of resources is indispensable for any business aiming to thrive.

Compliance and Regulatory Adherence:

Many industries are governed by strict regulatory requirements that mandate risk assessments and documentation. Failure to comply can result in severe penalties, making risk documentation not just prudent but obligatory.

Informed Decision-Making:

Equipped with a comprehensive risk document, decision-makers can make informed choices, weighing the potential risks against the anticipated rewards. This foresight is crucial for steering the organization towards sustainable growth and success.

A Consequence of Lacking Proper Documentation:

With adequate risk documentation, organizations are more likely to avoid unanticipated crises, financial losses, and damage to their reputation, which could have been mitigated or avoided with proper foresight and planning.

Organizations that prioritize an all-encompassing risk management strategy find themselves better equipped to anticipate risks, make informed decisions, and maintain a competitive edge. Risk documentation is an essential and reliable investment in the company's future stability and success.

Don’t let the lack of proper risk documentation be your organization’s Achilles' heel.

Adopting MetricStream’s Enterprise Risk Management software can be a game-changer for organizations looking to fortify their risk management strategies. Embrace the strategic advantage and transform your approach to risk management, turning potential risks into tangible opportunities for growth and innovation.

How does a risk register help in risk management?

A risk register helps in risk management by providing a centralized repository of all identified risks, their potential impacts, likelihood, and the strategies for mitigating them. It facilitates tracking and ensures that risks are systematically monitored and managed throughout the project or organizational lifecycle.

How often should risk documents be updated?

Risk documents should be updated regularly, typically at key milestones, during major changes in project scope, or whenever new risks are identified. Continuous monitoring and updating ensure that the risk management process remains relevant and effective.