Introduction

The emergence of high-profile corporate scandals, financial mismanagement cases, and cyber-attacks in recent years has underscored the critical need for robust risk management practices. These incidents highlight the vulnerabilities that businesses face and also illustrate the potential consequences of inadequate risk oversight, including financial losses, reputational damage, and legal repercussions.

For instance, consider the impact of the global pandemic that took the world by surprise and caused significant disruptions across industries. It highlighted the paramount importance of being prepared and agile in risk management practices and understanding the pivotal role of risk monitoring in ensuring business resilience and operational continuity.

In this article, we will discuss risk monitoring, its importance, types, processes, and more.

Key Takeaways

- Continuous risk monitoring helps detect potential threats early, supports informed decision-making, ensures regulatory compliance, optimizes resource allocation, and builds stakeholder confidence.

- Risks can be effectively monitored via regular risk reviews and formal risk audits, both essential for maintaining an updated and effective risk management strategy.

- Risk monitoring is important for identifying, analyzing, and managing risks throughout an organization's lifecycle, ensuring resilience and operational continuity.

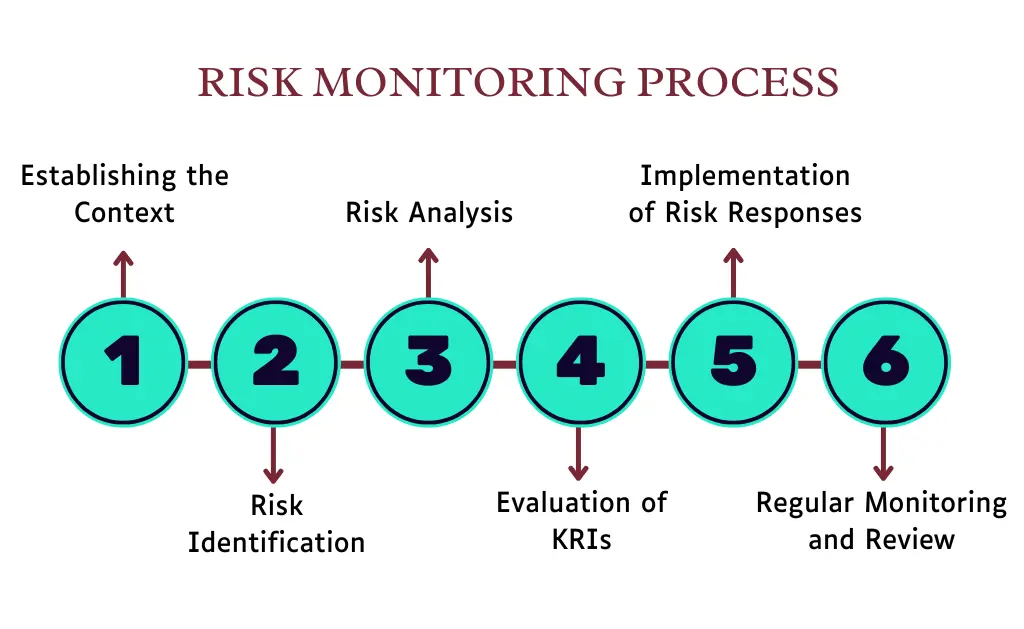

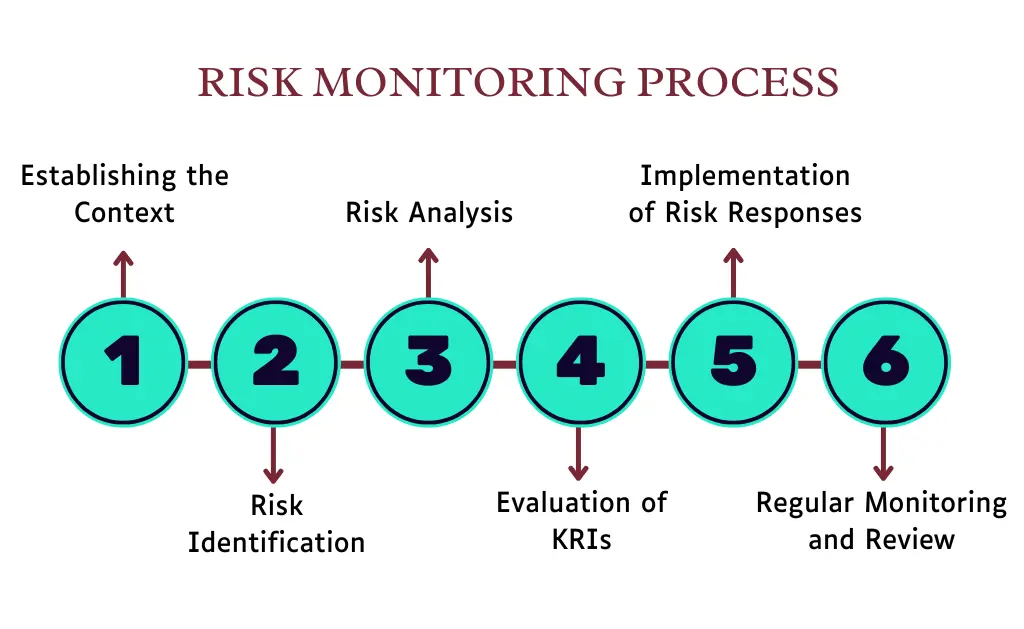

- The risk monitoring process involves steps like establishing context, identifying and analyzing risks, evaluating key risk indicators (KRIs), implementing risk responses, and regular review.

- Ignoring risk monitoring can lead to undetected threats, financial losses, operational disruptions, poor decision-making, and reputational damage.

What is Risk Monitoring?

Risk monitoring is the continuous process of identifying, analyzing, and managing risk throughout a business's lifecycle. It involves keeping a vigilant eye on the organization's risk landscape. Key components include continuous assessment, key risk indicators(KRIs), collaboration, and adaptation. Through effective risk monitoring, organizations can avoid potential losses, better make informed decisions, and embrace opportunities for growth.

Types of Risk Monitoring

Here are the two types of risk monitoring processes organizations go through:

Risk Review

Risk review is an ongoing process that involves regularly examining the organization's risk profile to ensure they are current and aligned with the changing risk landscape. This type of monitoring is typically carried out by internal staff or risk management professionals who are intimately familiar with the organization's objectives, risk profile, operations, and potential risks and vulnerabilities.

For example, a financial institution might conduct quarterly risk reviews to evaluate its exposure to credit risk, market risk, and operational risk, considering recent market developments and regulatory changes. This iterative process allows the institution to make informed decisions about adjusting its risk management policies and controls to protect its assets and stakeholders' interests from existing and emerging risks.

Risk Audit

Risk audit, on the other hand, is a more formal and structured type of risk monitoring that involves examining the effectiveness of an organization's risk management processes and controls. It provides an objective evaluation of how effectively the organization identifies, assesses, and manages its risks.

The auditors scrutinize various aspects of the risk management framework, from policy formulation and implementation to monitoring and reporting mechanisms, to ensure everything is working as intended.

An example of a risk audit at a manufacturing company might involve validating its compliance with environmental and safety regulations, as well as identifying any operational risks that could lead to disruptions in production or supply chain issues.

Purpose of Risk Monitoring

Risk monitoring is all about vigilance and preparedness. It allows for the early detection of emerging risks, enabling timely interventions that can prevent minor issues from escalating into significant problems. By integrating risk monitoring into daily operations, organizations can maintain resilience, enhance their ability to navigate uncertainties, and ultimately achieve a more stable and secure operational environment.

This holistic approach serves twofold purposes: it safeguards the organization’s assets and reputation and also fosters a culture of continuous improvement and risk awareness across all levels of the organization.

The Risk Monitoring Process

The risk monitoring process involves several key steps to be effective. Here’s a breakdown of these crucial steps:

- Establishing the Context: This involves understanding the external and internal context in which the organization operates. It sets the foundation for what kinds of risks are relevant and which areas of the business are most susceptible.

- Risk Identification: At this stage, the aim is to identify potential risks faced by the organization. For effective risk identification, risk teams need to look at industry trends, past incidents, employee feedback, and other relevant information sources.

- Risk Analysis: Once potential risks have been identified, the next step involves analyzing their likely impact and the probability of their occurrence. This step helps in prioritizing risks based on their potential to affect business objectives.

- Evaluation of Key Risk Indicators (KRIs): Identify and monitor specific indicators that signal increases in risk levels. These can range from financial ratios, and operational metrics, to compliance indicators, providing early warnings of potential issues.

- Implementation of Risk Responses: Based on the evaluation, the organization then decides on the appropriate responses to address significant risks. This could involve avoiding, transferring, mitigating, or accepting risks, depending on their nature and impact.

- Regular Monitoring and Review: Risk monitoring is a dynamic process. Regularly reviewing and monitoring the risk landscape is essential to capture any changes in the external environment or within the organization itself that may affect risk exposure.

Why is Risk Monitoring Important?

Risk monitoring is crucial for the early detection of potential threats, enabling timely mitigation before issues escalate. It provides management with real-time data for informed decision-making, ensures regulatory compliance, and avoids legal penalties. By identifying high-impact risks, it optimizes resource allocation and fosters stakeholder confidence, demonstrating a commitment to due diligence and long-term viability.

Here's why risk monitoring should be at the heart of your business strategy:

Early Detection of Issues:

Continuous monitoring allows for the early detection of potential threats, providing precious lead time to mitigate them before they escalate.

Informed Decision-Making:

It equips management with real-time data and insights, enabling more informed and strategic decision-making.

Regulatory Compliance:

Staying on top of emerging risks ensures compliance with relevant laws and regulations, thus avoiding legal penalties and reputational damage.

Optimized Resource Allocation:

By identifying which risks pose the greatest threat, businesses can allocate their resources more efficiently, focusing on areas of highest impact.

Stakeholder Confidence:

Effective risk management fosters trust among stakeholders, including investors, customers, and employees, by demonstrating a commitment to due diligence and long-term viability.

Neglecting risk monitoring can have severe and far-reaching consequences for an organization. Without continuous vigilance, potential threats may go undetected until they escalate into full-blown crises, leading to significant financial losses and operational disruptions. The lack of timely risk identification can result in ill-informed decision-making, where management is blindsided by unforeseen issues, undermining strategic objectives.

Best Practices for Risk Monitoring

Here’s a blueprint to set the foundation for effective risk monitoring:

Establish a Comprehensive Framework:

Begin with developing a risk management framework that outlines the process, methodologies, and tools for identifying, assessing, monitoring, and mitigating risks. Ensure it is aligned with the organization’s objectives and risk appetite.

Assign Ownership:

Clear ownership and accountability for monitoring specific risks are essential. Assign risk owners across different levels of the organization to ensure there's clarity in responsibility and authority.

Integrate Risk Monitoring into Daily Operations:

Make risk monitoring a part of the organizational culture. Encourage employees to be vigilant and proactive in reporting potential risks.

Continuous Risk Assessment:

Risk monitoring should be an ongoing process. Continuously assess risks to identify any changes in the risk profile, incorporating new risks and reassessing existing ones.

Educate and Train:

Foster a risk-aware culture by educating and training employees on the importance of risk monitoring and their role in it. Empowering your team with the knowledge to identify and respond to risks is critical.

Leverage Technology:

Implementing risk management software, like MetricStream, can streamline the monitoring process, providing tools for real-time data analysis, dashboards for visualization, and alerts for immediate attention.

Successful risk monitoring is predicated on having a comprehensive understanding of all possible internal and external threats and their potential impact on the organization. It requires the integration of risk management into the fabric of organizational processes, ensuring that every decision and operation takes into account the current risk landscape.

MetricStream is here to assist. The MetricStream Enterprise Risk Management software supports a wide range of risk monitoring activities, from automated risk assessments to key risk and control indicators, reporting, and analytics, making it easier for businesses of all kinds to identify and respond to risks promptly and effectively.

Frequently Asked Questions

What is risk monitoring in the risk management process?

Risk monitoring is the continuous process of tracking identified risks, assessing their status, and evaluating the effectiveness of mitigation strategies to ensure that risks are managed proactively.

Which technique can be used to monitor risk?

Techniques used to monitor risk include regular risk assessments, key risk indicators (KRIs), risk audits, and risk review meetings. These methods help in identifying changes in risk profiles and ensuring appropriate responses.

Who is responsible for risk monitoring in an organization?

Risk monitoring is typically the responsibility of the risk management team, but it involves collaboration with department heads, senior management, and, in some cases, external auditors. This ensures a comprehensive approach to identifying and addressing risks.

The emergence of high-profile corporate scandals, financial mismanagement cases, and cyber-attacks in recent years has underscored the critical need for robust risk management practices. These incidents highlight the vulnerabilities that businesses face and also illustrate the potential consequences of inadequate risk oversight, including financial losses, reputational damage, and legal repercussions.

For instance, consider the impact of the global pandemic that took the world by surprise and caused significant disruptions across industries. It highlighted the paramount importance of being prepared and agile in risk management practices and understanding the pivotal role of risk monitoring in ensuring business resilience and operational continuity.

In this article, we will discuss risk monitoring, its importance, types, processes, and more.

- Continuous risk monitoring helps detect potential threats early, supports informed decision-making, ensures regulatory compliance, optimizes resource allocation, and builds stakeholder confidence.

- Risks can be effectively monitored via regular risk reviews and formal risk audits, both essential for maintaining an updated and effective risk management strategy.

- Risk monitoring is important for identifying, analyzing, and managing risks throughout an organization's lifecycle, ensuring resilience and operational continuity.

- The risk monitoring process involves steps like establishing context, identifying and analyzing risks, evaluating key risk indicators (KRIs), implementing risk responses, and regular review.

- Ignoring risk monitoring can lead to undetected threats, financial losses, operational disruptions, poor decision-making, and reputational damage.

Risk monitoring is the continuous process of identifying, analyzing, and managing risk throughout a business's lifecycle. It involves keeping a vigilant eye on the organization's risk landscape. Key components include continuous assessment, key risk indicators(KRIs), collaboration, and adaptation. Through effective risk monitoring, organizations can avoid potential losses, better make informed decisions, and embrace opportunities for growth.

Here are the two types of risk monitoring processes organizations go through:

Risk Review

Risk review is an ongoing process that involves regularly examining the organization's risk profile to ensure they are current and aligned with the changing risk landscape. This type of monitoring is typically carried out by internal staff or risk management professionals who are intimately familiar with the organization's objectives, risk profile, operations, and potential risks and vulnerabilities.

For example, a financial institution might conduct quarterly risk reviews to evaluate its exposure to credit risk, market risk, and operational risk, considering recent market developments and regulatory changes. This iterative process allows the institution to make informed decisions about adjusting its risk management policies and controls to protect its assets and stakeholders' interests from existing and emerging risks.

Risk Audit

Risk audit, on the other hand, is a more formal and structured type of risk monitoring that involves examining the effectiveness of an organization's risk management processes and controls. It provides an objective evaluation of how effectively the organization identifies, assesses, and manages its risks.

The auditors scrutinize various aspects of the risk management framework, from policy formulation and implementation to monitoring and reporting mechanisms, to ensure everything is working as intended.

An example of a risk audit at a manufacturing company might involve validating its compliance with environmental and safety regulations, as well as identifying any operational risks that could lead to disruptions in production or supply chain issues.

Risk monitoring is all about vigilance and preparedness. It allows for the early detection of emerging risks, enabling timely interventions that can prevent minor issues from escalating into significant problems. By integrating risk monitoring into daily operations, organizations can maintain resilience, enhance their ability to navigate uncertainties, and ultimately achieve a more stable and secure operational environment.

This holistic approach serves twofold purposes: it safeguards the organization’s assets and reputation and also fosters a culture of continuous improvement and risk awareness across all levels of the organization.

The risk monitoring process involves several key steps to be effective. Here’s a breakdown of these crucial steps:

- Establishing the Context: This involves understanding the external and internal context in which the organization operates. It sets the foundation for what kinds of risks are relevant and which areas of the business are most susceptible.

- Risk Identification: At this stage, the aim is to identify potential risks faced by the organization. For effective risk identification, risk teams need to look at industry trends, past incidents, employee feedback, and other relevant information sources.

- Risk Analysis: Once potential risks have been identified, the next step involves analyzing their likely impact and the probability of their occurrence. This step helps in prioritizing risks based on their potential to affect business objectives.

- Evaluation of Key Risk Indicators (KRIs): Identify and monitor specific indicators that signal increases in risk levels. These can range from financial ratios, and operational metrics, to compliance indicators, providing early warnings of potential issues.

- Implementation of Risk Responses: Based on the evaluation, the organization then decides on the appropriate responses to address significant risks. This could involve avoiding, transferring, mitigating, or accepting risks, depending on their nature and impact.

- Regular Monitoring and Review: Risk monitoring is a dynamic process. Regularly reviewing and monitoring the risk landscape is essential to capture any changes in the external environment or within the organization itself that may affect risk exposure.

Risk monitoring is crucial for the early detection of potential threats, enabling timely mitigation before issues escalate. It provides management with real-time data for informed decision-making, ensures regulatory compliance, and avoids legal penalties. By identifying high-impact risks, it optimizes resource allocation and fosters stakeholder confidence, demonstrating a commitment to due diligence and long-term viability.

Here's why risk monitoring should be at the heart of your business strategy:

Early Detection of Issues:

Continuous monitoring allows for the early detection of potential threats, providing precious lead time to mitigate them before they escalate.

Informed Decision-Making:

It equips management with real-time data and insights, enabling more informed and strategic decision-making.

Regulatory Compliance:

Staying on top of emerging risks ensures compliance with relevant laws and regulations, thus avoiding legal penalties and reputational damage.

Optimized Resource Allocation:

By identifying which risks pose the greatest threat, businesses can allocate their resources more efficiently, focusing on areas of highest impact.

Stakeholder Confidence:

Effective risk management fosters trust among stakeholders, including investors, customers, and employees, by demonstrating a commitment to due diligence and long-term viability.

Neglecting risk monitoring can have severe and far-reaching consequences for an organization. Without continuous vigilance, potential threats may go undetected until they escalate into full-blown crises, leading to significant financial losses and operational disruptions. The lack of timely risk identification can result in ill-informed decision-making, where management is blindsided by unforeseen issues, undermining strategic objectives.

Here’s a blueprint to set the foundation for effective risk monitoring:

Establish a Comprehensive Framework:

Begin with developing a risk management framework that outlines the process, methodologies, and tools for identifying, assessing, monitoring, and mitigating risks. Ensure it is aligned with the organization’s objectives and risk appetite.

Assign Ownership:

Clear ownership and accountability for monitoring specific risks are essential. Assign risk owners across different levels of the organization to ensure there's clarity in responsibility and authority.

Integrate Risk Monitoring into Daily Operations:

Make risk monitoring a part of the organizational culture. Encourage employees to be vigilant and proactive in reporting potential risks.

Continuous Risk Assessment:

Risk monitoring should be an ongoing process. Continuously assess risks to identify any changes in the risk profile, incorporating new risks and reassessing existing ones.

Educate and Train:

Foster a risk-aware culture by educating and training employees on the importance of risk monitoring and their role in it. Empowering your team with the knowledge to identify and respond to risks is critical.

Leverage Technology:

Implementing risk management software, like MetricStream, can streamline the monitoring process, providing tools for real-time data analysis, dashboards for visualization, and alerts for immediate attention.

Successful risk monitoring is predicated on having a comprehensive understanding of all possible internal and external threats and their potential impact on the organization. It requires the integration of risk management into the fabric of organizational processes, ensuring that every decision and operation takes into account the current risk landscape.

MetricStream is here to assist. The MetricStream Enterprise Risk Management software supports a wide range of risk monitoring activities, from automated risk assessments to key risk and control indicators, reporting, and analytics, making it easier for businesses of all kinds to identify and respond to risks promptly and effectively.

What is risk monitoring in the risk management process?

Risk monitoring is the continuous process of tracking identified risks, assessing their status, and evaluating the effectiveness of mitigation strategies to ensure that risks are managed proactively.

Which technique can be used to monitor risk?

Techniques used to monitor risk include regular risk assessments, key risk indicators (KRIs), risk audits, and risk review meetings. These methods help in identifying changes in risk profiles and ensuring appropriate responses.

Who is responsible for risk monitoring in an organization?

Risk monitoring is typically the responsibility of the risk management team, but it involves collaboration with department heads, senior management, and, in some cases, external auditors. This ensures a comprehensive approach to identifying and addressing risks.