Introduction

The stakes are even higher than ever for modern organizations operating in a connected environment where they face unprecedented challenges–from swiftly changing regulatory demands to increasing cyber-attacks. So, how do they manage to stay on course? How do they ensure that every function aligns with the broader strategic goals while safeguarding against risks? The three lines of defense model serves as a foundational framework for risk management, ensuring accountability and efficiently managing risk.

Key Takeaways

- The Three Lines of Defense (3LoD) model offers a clear framework that delineates risk management roles across an organization, improving clarity, accountability, and effectiveness.

- Role Differentiation: It separates the responsibilities of operational management (1st line), risk management and compliance (2nd line), and internal audit (3rd line), ensuring that risks are identified, managed, and independently assessed.

- Purpose: The Three Lines of Defense Model clarifies roles and responsibilities in risk management, ensures independent assurance through internal audit, and facilitates collaboration for effective risk mitigation.

- Challenges: Common challenges that can hinder effective risk management. include balancing independence and collaboration among the lines, role ambiguity, and integrating the model with existing processes.

- Modernization: To modernize the model, organizations should enhance inter-departmental collaboration, adapt to emerging risks like cybersecurity, and implement real-time risk reporting to stay ahead of potential threats.

What is the Three Lines of Defense Model?

The Three Lines of Defense Model is a structured framework designed to enhance the clarity and effectiveness of risk management across an organization. Initially developed to address complexities in the financial sector, the model has since found applications in various industries, from healthcare to technology. This model delineates responsibilities and ensures a comprehensive risk management, compliance, and governance approach.

Breaking Down the Model

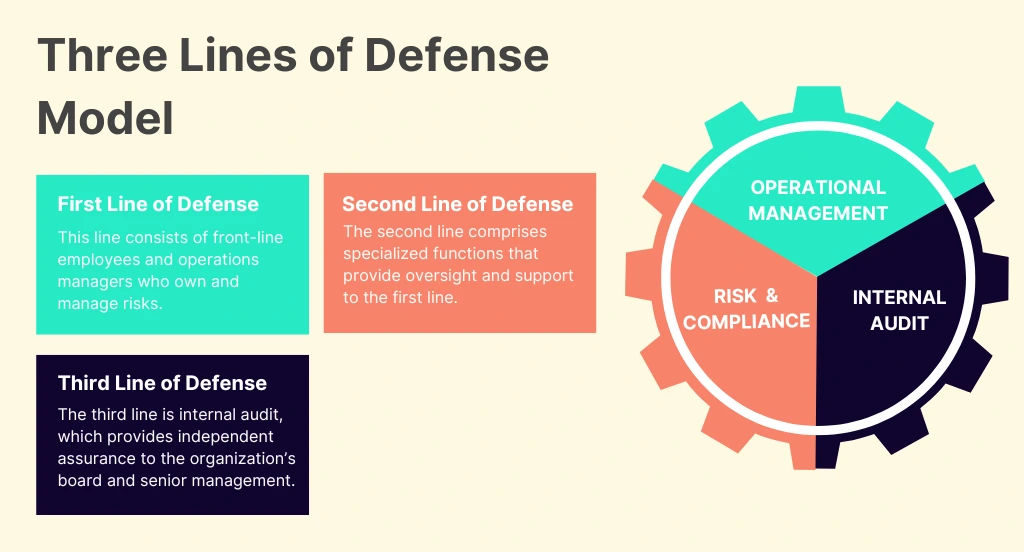

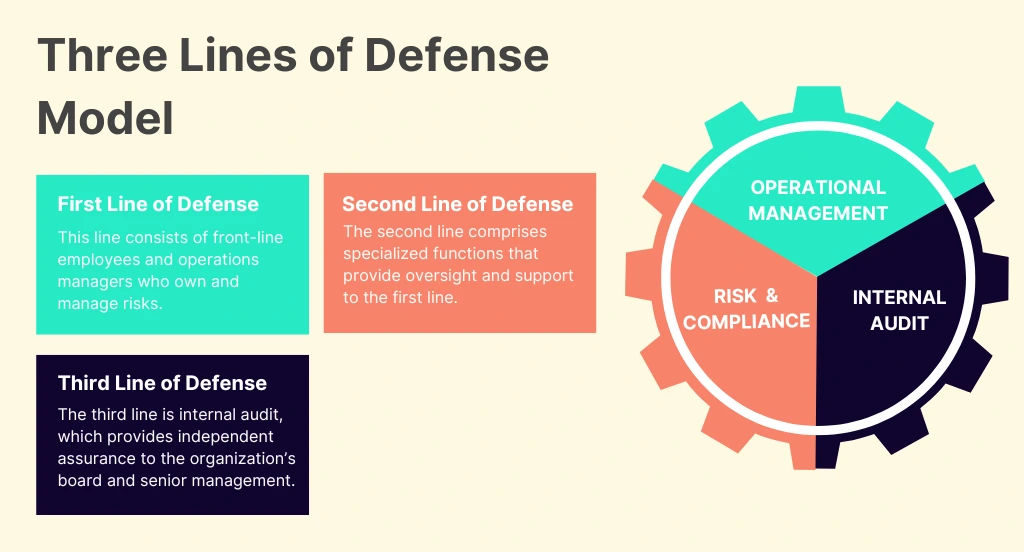

First Line of Defense: Operational Management

This line consists of front-line employees and operations managers who own and manage risks. These are the people directly involved in the business's core activities. They implement day-to-day controls and are the first to identify potential risks. Their primary function is to ensure that risks are managed appropriately through effective processes and controls.

Second Line of Defense: Risk Management and Compliance

The second line comprises specialized functions that provide oversight and support to the first line. These include risk management, compliance officers, and other control functions. They develop and monitor the implementation of risk management frameworks and compliance policies. Their role is to ensure that the first line effectively reports and manages risks and adheres to regulatory requirements.

Third Line of Defense: Internal Audit

The third line is internal audit, which provides independent assurance to the organization’s board and senior management. Internal auditors evaluate the effectiveness of governance, risk management, and control processes implemented by the first and second lines. They offer an objective perspective and recommend improvements to enhance overall risk management and governance.

Purpose of the Three Lines of Defense Model

The Three Lines of Defense Model clarifies roles and responsibilities in risk management, provides independent assurance through internal audits, and facilitates communication across departments. It supports compliance with regulations and enhances risk reporting, ensuring a resilient and well-coordinated organization.

Below, we identify a few essential purposes of the 3LoD Model:

Clarifying Roles and Responsibilities

One of the core strengths of the 3LoD model is the clarity it brings to risk management roles and responsibilities. By clearly defining who is responsible for what, the model reduces ambiguity and enhances accountability across the organization.

Providing Assurance

The third line of defense—internal audit—serves as a critical checkpoint to ensure that the risk management processes put in place by the first and second lines are not only operational but also effective. This independent assurance function is vital for maintaining stakeholder confidence and regulatory compliance.

Facilitating Communication and Co-ordination

The 3LoD model promotes a culture of collaboration, where different lines of defense work together to identify, assess, and mitigate risks. This coordinated effort helps in building a more resilient organization.

Supporting Compliance

By implementing structured and well-defined risk management processes, businesses can ensure they adhere to regulatory requirements, thereby avoiding penalties and reputational damage.It also ensures a risk-based approach to compliance.

Streamlining Risk Reporting

The 3LoD model provides a structured framework for reporting risks, ensuring that information flows efficiently from the first line (operational management) to the third line (internal audit). This streamlined reporting process enhances the visibility of risks at all organizational levels, enabling timely and informed decision-making.

Common Challenges in Implementing the Three Lines of Defense Model

Balancing Independence and Collaboration

The three lines, given the clear demarcation of their responsibilities, often end up working in silos. For instance, the first line, comprising operational management, often views the second and third lines as intrusive and obstructive. Conversely, the second line (risk management and compliance) and the third line (internal audit) sometimes struggle to gain the cooperation they need from the first line to function effectively.

Role Ambiguity and Overlap

When roles are not clearly defined, it can lead to confusion, duplicated efforts, and gaps in risk management. Delineating responsibilities for operational management, risk and compliance oversight, and independent assurance is essential for the model to function effectively.

Inadequate Resources and Expertise

Many organizations struggle with allocating sufficient resources - be it financial, technological, or human capital - to support each line of defense. This inadequacy can lead to insufficient risk assessments and ineffective controls, undermining the integrity of the entire risk management framework.

Integration with Existing Processes

Organizations must ensure that the new model complements rather than creates conflicts with existing governance, risk, and compliance (GRC) processes. Achieving seamless integration requires a thorough review and possible re-engineering of current processes, which can be time-consuming and resource-intensive.

Best Practices for Modernizing the Three Lines of Defense Model

Here are some tips to ensure an efficient Three Lines of Defense Model.

Enhancing Inter-Departmental Collaboration

Encouraging inter-departmental meetings, joint risk assessments, and shared objectives can help break down silos and foster a more integrated approach to risk management. This collaborative environment ensures that risks are managed more holistically.

Establishing Clear Metrics and KPIs

These metrics should align with the organization's overall risk management objectives and provide actionable insights into the performance of each line of defense. Regularly reviewing these KPIs can help identify areas for improvement and ensure that the model delivers its intended benefits.

Adapting to Emerging Risks

Modernizing the 3LoD model requires flexibility and adaptability to address emerging risks such as cybersecurity threats, data privacy concerns, and geopolitical uncertainties. Organizations should continuously review and update their risk management practices to ensure they are equipped to handle new and evolving risks.

Enhancing the Independence of the Third Line

To maintain the integrity and objectivity of the third line of defense (internal audit), it is crucial to ensure its independence from the first and second lines. This can be achieved by clearly defining reporting structures, providing direct access to the board or audit committee, and safeguarding the internal audit function from any undue influence.

Fostering Real-Time Risk Reporting

Implementing real-time risk reporting mechanisms allows for quicker responses to emerging risks. By integrating real-time data analytics and monitoring tools into the 3LoD model, organizations can gain immediate insights into their risk landscape.

Conclusion

The success of this model hinges on robust communication and collaboration among all three lines. Each line must understand its role and the roles of others, creating a synergy that amplifies the model's effectiveness.

With the right tools and solutions, organizations can manage risks more effectively, drive value, and competently achieve their strategic goals. MetricStream’s Operational Risk Management and Enterprise Risk Management software, with features such as a centralized risk repository, risk identification and assessment, risk monitoring and reporting, policy and compliance management, and continuous control monitoring can help strengthen and streamline the three lines of defense for effective risk management.

Frequently Asked Questions

What is the Three Lines of Defense Model?

The Three Lines of Defense (3LoD) model is a framework for managing risk by clearly defining roles and responsibilities across three distinct levels: operational management, risk management and compliance, and internal audit.

How does the Three Lines of Defense Model differentiate between risk ownership and risk oversight?

The model distinguishes between risk ownership (handled by the first line, operational management) and risk oversight (managed by the second line, such as risk management and compliance teams), ensuring clear accountability at each level.

The stakes are even higher than ever for modern organizations operating in a connected environment where they face unprecedented challenges–from swiftly changing regulatory demands to increasing cyber-attacks. So, how do they manage to stay on course? How do they ensure that every function aligns with the broader strategic goals while safeguarding against risks? The three lines of defense model serves as a foundational framework for risk management, ensuring accountability and efficiently managing risk.

- The Three Lines of Defense (3LoD) model offers a clear framework that delineates risk management roles across an organization, improving clarity, accountability, and effectiveness.

- Role Differentiation: It separates the responsibilities of operational management (1st line), risk management and compliance (2nd line), and internal audit (3rd line), ensuring that risks are identified, managed, and independently assessed.

- Purpose: The Three Lines of Defense Model clarifies roles and responsibilities in risk management, ensures independent assurance through internal audit, and facilitates collaboration for effective risk mitigation.

- Challenges: Common challenges that can hinder effective risk management. include balancing independence and collaboration among the lines, role ambiguity, and integrating the model with existing processes.

- Modernization: To modernize the model, organizations should enhance inter-departmental collaboration, adapt to emerging risks like cybersecurity, and implement real-time risk reporting to stay ahead of potential threats.

The Three Lines of Defense Model is a structured framework designed to enhance the clarity and effectiveness of risk management across an organization. Initially developed to address complexities in the financial sector, the model has since found applications in various industries, from healthcare to technology. This model delineates responsibilities and ensures a comprehensive risk management, compliance, and governance approach.

First Line of Defense: Operational Management

This line consists of front-line employees and operations managers who own and manage risks. These are the people directly involved in the business's core activities. They implement day-to-day controls and are the first to identify potential risks. Their primary function is to ensure that risks are managed appropriately through effective processes and controls.

Second Line of Defense: Risk Management and Compliance

The second line comprises specialized functions that provide oversight and support to the first line. These include risk management, compliance officers, and other control functions. They develop and monitor the implementation of risk management frameworks and compliance policies. Their role is to ensure that the first line effectively reports and manages risks and adheres to regulatory requirements.

Third Line of Defense: Internal Audit

The third line is internal audit, which provides independent assurance to the organization’s board and senior management. Internal auditors evaluate the effectiveness of governance, risk management, and control processes implemented by the first and second lines. They offer an objective perspective and recommend improvements to enhance overall risk management and governance.

The Three Lines of Defense Model clarifies roles and responsibilities in risk management, provides independent assurance through internal audits, and facilitates communication across departments. It supports compliance with regulations and enhances risk reporting, ensuring a resilient and well-coordinated organization.

Below, we identify a few essential purposes of the 3LoD Model:

Clarifying Roles and Responsibilities

One of the core strengths of the 3LoD model is the clarity it brings to risk management roles and responsibilities. By clearly defining who is responsible for what, the model reduces ambiguity and enhances accountability across the organization.

Providing Assurance

The third line of defense—internal audit—serves as a critical checkpoint to ensure that the risk management processes put in place by the first and second lines are not only operational but also effective. This independent assurance function is vital for maintaining stakeholder confidence and regulatory compliance.

Facilitating Communication and Co-ordination

The 3LoD model promotes a culture of collaboration, where different lines of defense work together to identify, assess, and mitigate risks. This coordinated effort helps in building a more resilient organization.

Supporting Compliance

By implementing structured and well-defined risk management processes, businesses can ensure they adhere to regulatory requirements, thereby avoiding penalties and reputational damage.It also ensures a risk-based approach to compliance.

Streamlining Risk Reporting

The 3LoD model provides a structured framework for reporting risks, ensuring that information flows efficiently from the first line (operational management) to the third line (internal audit). This streamlined reporting process enhances the visibility of risks at all organizational levels, enabling timely and informed decision-making.

Balancing Independence and Collaboration

The three lines, given the clear demarcation of their responsibilities, often end up working in silos. For instance, the first line, comprising operational management, often views the second and third lines as intrusive and obstructive. Conversely, the second line (risk management and compliance) and the third line (internal audit) sometimes struggle to gain the cooperation they need from the first line to function effectively.

Role Ambiguity and Overlap

When roles are not clearly defined, it can lead to confusion, duplicated efforts, and gaps in risk management. Delineating responsibilities for operational management, risk and compliance oversight, and independent assurance is essential for the model to function effectively.

Inadequate Resources and Expertise

Many organizations struggle with allocating sufficient resources - be it financial, technological, or human capital - to support each line of defense. This inadequacy can lead to insufficient risk assessments and ineffective controls, undermining the integrity of the entire risk management framework.

Integration with Existing Processes

Organizations must ensure that the new model complements rather than creates conflicts with existing governance, risk, and compliance (GRC) processes. Achieving seamless integration requires a thorough review and possible re-engineering of current processes, which can be time-consuming and resource-intensive.

Here are some tips to ensure an efficient Three Lines of Defense Model.

Enhancing Inter-Departmental Collaboration

Encouraging inter-departmental meetings, joint risk assessments, and shared objectives can help break down silos and foster a more integrated approach to risk management. This collaborative environment ensures that risks are managed more holistically.

Establishing Clear Metrics and KPIs

These metrics should align with the organization's overall risk management objectives and provide actionable insights into the performance of each line of defense. Regularly reviewing these KPIs can help identify areas for improvement and ensure that the model delivers its intended benefits.

Adapting to Emerging Risks

Modernizing the 3LoD model requires flexibility and adaptability to address emerging risks such as cybersecurity threats, data privacy concerns, and geopolitical uncertainties. Organizations should continuously review and update their risk management practices to ensure they are equipped to handle new and evolving risks.

Enhancing the Independence of the Third Line

To maintain the integrity and objectivity of the third line of defense (internal audit), it is crucial to ensure its independence from the first and second lines. This can be achieved by clearly defining reporting structures, providing direct access to the board or audit committee, and safeguarding the internal audit function from any undue influence.

Fostering Real-Time Risk Reporting

Implementing real-time risk reporting mechanisms allows for quicker responses to emerging risks. By integrating real-time data analytics and monitoring tools into the 3LoD model, organizations can gain immediate insights into their risk landscape.

The success of this model hinges on robust communication and collaboration among all three lines. Each line must understand its role and the roles of others, creating a synergy that amplifies the model's effectiveness.

With the right tools and solutions, organizations can manage risks more effectively, drive value, and competently achieve their strategic goals. MetricStream’s Operational Risk Management and Enterprise Risk Management software, with features such as a centralized risk repository, risk identification and assessment, risk monitoring and reporting, policy and compliance management, and continuous control monitoring can help strengthen and streamline the three lines of defense for effective risk management.

What is the Three Lines of Defense Model?

The Three Lines of Defense (3LoD) model is a framework for managing risk by clearly defining roles and responsibilities across three distinct levels: operational management, risk management and compliance, and internal audit.

How does the Three Lines of Defense Model differentiate between risk ownership and risk oversight?

The model distinguishes between risk ownership (handled by the first line, operational management) and risk oversight (managed by the second line, such as risk management and compliance teams), ensuring clear accountability at each level.