Introduction

While no organization can entirely eliminate business risk, proactive measures can significantly mitigate potential damage. Risk, after all, is an inherent part of the business ecosystem, but effective risk management strategies can serve as robust shields against uncertainties. Implementing these strategies is essential not just for survival but also for long-term success and growth.

Key Takeaways

- A risk matrix helps organizations visualize and assess risks based on their likelihood and impact, aiding in informed decision-making.

- The risk matrix uses axes for impact and likelihood, scoring risks to categorize them, often with color coding to indicate urgency.

- For creating a risk matrix, risk managers need to identify risks, define likelihood and impact criteria, develop the grid, assess and plot risks, review and validate, and then monitor and update regularly.

- A risk matrix facilitates risk identification, resource allocation, communication, and strategic planning, and enhances accountability and transparency.

What is a Risk Matrix?

A risk matrix is a tool that helps organizations visualize and assess risks to make informed decisions. It categorizes risks based on their probability of occurrence and the potential impact on the organization. Typically, it is a grid with the likelihood of occurrence plotted on one axis and the impact of the risk on the other.

The purpose of a risk matrix is straightforward: to provide a clear, visual representation of risks that facilitates quicker and more accurate decision-making. By mapping risks onto a matrix, organizations can readily see which risks require immediate attention and which can be monitored over time.

Risk Matrix Example

Let's illustrate the concept of a risk matrix with an example. Consider a medium-sized manufacturing company evaluating the risks associated with its supply chain operations. Here’s how the organization might construct and use a risk matrix:

Identify Risks:

The company first identifies a range of potential risks. For example, supplier delays, quality issues with raw materials, regulatory changes, and cybersecurity threats.

Assess Probability and Impact:

Each risk is then assessed based on two key criteria; probability and impact.

Assign Scores:

Risks are then scored on a scale, say from 1 to 5, where 1 represents the lowest probability or impact and 5 represents the highest. For instance:

- Supplier delays might be rated with a probability of 4 and an impact of 3.

- Quality issues with raw materials might have a probability of 3 and an impact of 4.

- Cybersecurity threats might score high on both fronts, with a probability of 5 and an impact of 5.

Map Risks on the Matrix:

These scores are then plotted on the risk matrix. Risks with a high probability and high impact (like cybersecurity threats) fall into the top-right quadrant, indicating they need immediate and robust mitigation strategies. On the other hand, risks with a low probability and low impact might fall into the bottom-left quadrant, indicating they require minimal attention.

Develop Mitigation Strategies:

Based on the risk matrix, the company can now prioritize its risk management efforts. High-priority risks might involve extensive mitigation plans, such as enhancing cybersecurity measures, whereas lower-priority risks might be monitored regularly but require less immediate action.

How Does a Risk Matrix Work?

Here’s a breakdown of the mechanics of a risk matrix:

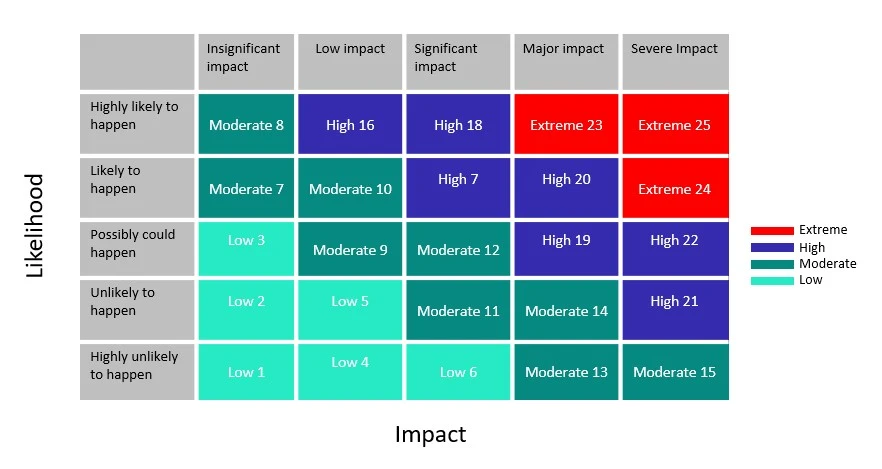

Axes of the Matrix

The risk matrix is typically structured as a grid. One axis represents the potential impact of a risk, while the other indicates the likelihood or probability of that risk occurring. Each axis is usually divided into several levels. For example, impact levels might range from insignificant to severe, while probability levels range from highly unlikely to highly likely.

Risk Scoring

Each identified risk is scored based on its impact and probability. The combination of these scores positions the risk within the matrix, categorizing it as low, moderate, high, or extreme. These categories help in prioritizing the risks.

Color Coding

To make the assessment clearer, risk matrices often use color codes. Risks positioned in the lower left (low impact, low probability) are typically green, indicating low priority. Risks in the upper right (high impact, high probability) are often red, signaling urgent attention. Intermediate risks may be yellow or orange.

How to Create a Risk Assessment Matrix

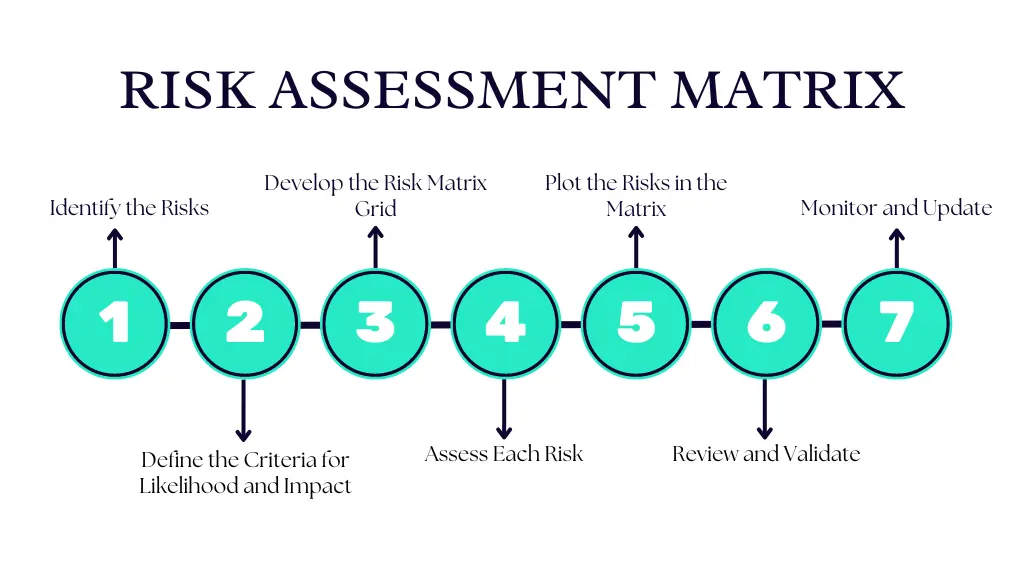

Below is a step-by-step guide to help you create a comprehensive risk matrix:

Identify the Risks

Begin by conducting a thorough risk identification exercise. This can be achieved through brainstorming sessions, expert interviews, and reviewing historical data. List down all potential risks that could impact your organization’s objectives.

Define the Criteria for Likelihood and Impact

Next, establish the criteria for assessing the likelihood and impact of each risk. This involves defining the scales and descriptors for both dimensions. For likelihood, you might use categories such as Highly Unlikely,' 'Unlikely,' 'Possible,' 'Likely,' and 'Highly Likely.' For impact, you might use 'Insignificant,' Low,' Significant,' High,' and Severe.'

Develop the Risk Matrix Grid

Create a grid where one axis represents the likelihood and the other represents the impact. Label the axes according to the scales you have defined. Each cell in the grid will represent a specific combination of likelihood and impact.

Assess Each Risk

Evaluate each identified risk based on the defined criteria. Assign scores for both the impact and probability. For instance, a risk might have a moderate impact (3) but be unlikely to occur (2).

Plot the Risks in the Matrix

Create a grid with impact levels on one axis and probability levels on the other. Plot each risk according to its scores and subsequently color code it. The intersection point on the grid indicates the overall risk level.

Review and Validate

Once the initial matrix is complete, review it for accuracy and comprehensiveness. Validate the assessments with stakeholders and experts to ensure that the risk levels are realistic and the matrix accurately reflects the organization’s risk environment.

Monitor and Update

A risk matrix is not a one-time effort—it requires ongoing monitoring and updating. The matrix should be reviewed and adjusted regularly to reflect new risks, changes in existing risks, and shifts in the organizational or external environment.

Benefits of a Risk Matrix

A risk matrix helps organizations identify and prioritize risks, aiding in effective resource allocation and strategic planning. It simplifies complex risk assessments for all stakeholders, enhancing communication, accountability, and transparency in tracking and reporting on risk management efforts.

Here are some valuable benefits of a risk matrix:

Identification of Critical Risks:

By plotting identified risks on the matrix, organizations can clearly see which risks need immediate attention and which are less urgent. This visualization aids in not overlooking minor risks while ensuring critical risks are prioritized.

Resource Allocation:

With a clear visual representation, decision-makers can allocate resources more effectively, focusing on high-priority risks that could significantly impact the organization.

Communication:

The risk matrix serves as a communication tool that translates complex risk assessments into a simple, comprehensible format for all stakeholders, from executives to team members.

Strategic Planning:

By identifying and prioritizing risks, the risk matrix supports strategic planning and helps in forming actionable risk management strategies. It allows for preemptive action rather than reactive measures.

Accountability and Transparency:

The visual nature of the risk matrix fosters accountability by clearly delineating who is responsible for managing each risk. It also enhances transparency, making it easier to track progress and report on risk management efforts.

Conclusion

The utility of a risk matrix lies in its simplicity and visual appeal, making it an indispensable component for risk assessment across various industries.

While it is a powerful tool, it is essential to recognize that it is just one component of a comprehensive risk management framework. It should be used in conjunction with other risk assessment and mitigation strategies to provide a holistic view of the organization’s risk profile.

MetricStream solutions are designed to support this integrated approach, offering a broad range of functionalities that encompass risk identification, assessment, monitoring, and reporting.

Frequently Asked Questions

What is the difference between a risk matrix and a risk heat map?

A risk matrix and a risk heat map are similar tools. Both visualize risks based on likelihood and impact, but a risk heat map often uses color coding to represent different levels of risk severity more intuitively.

What is the 5 by 5 risk matrix?

A 5 by 5 risk matrix is a grid used in risk assessment with five levels of likelihood and five levels of impact, resulting in 25 possible risk scenarios. It lends a detailed framework for evaluating and prioritizing risks.

What is the risk matrix 3x3?

A 3x3 risk matrix is a simpler grid used in risk assessment with three levels of likelihood and three levels of impact, resulting in 9 possible risk scenarios. It offers a straightforward approach to evaluating and prioritizing risks.

While no organization can entirely eliminate business risk, proactive measures can significantly mitigate potential damage. Risk, after all, is an inherent part of the business ecosystem, but effective risk management strategies can serve as robust shields against uncertainties. Implementing these strategies is essential not just for survival but also for long-term success and growth.

- A risk matrix helps organizations visualize and assess risks based on their likelihood and impact, aiding in informed decision-making.

- The risk matrix uses axes for impact and likelihood, scoring risks to categorize them, often with color coding to indicate urgency.

- For creating a risk matrix, risk managers need to identify risks, define likelihood and impact criteria, develop the grid, assess and plot risks, review and validate, and then monitor and update regularly.

- A risk matrix facilitates risk identification, resource allocation, communication, and strategic planning, and enhances accountability and transparency.

A risk matrix is a tool that helps organizations visualize and assess risks to make informed decisions. It categorizes risks based on their probability of occurrence and the potential impact on the organization. Typically, it is a grid with the likelihood of occurrence plotted on one axis and the impact of the risk on the other.

The purpose of a risk matrix is straightforward: to provide a clear, visual representation of risks that facilitates quicker and more accurate decision-making. By mapping risks onto a matrix, organizations can readily see which risks require immediate attention and which can be monitored over time.

Let's illustrate the concept of a risk matrix with an example. Consider a medium-sized manufacturing company evaluating the risks associated with its supply chain operations. Here’s how the organization might construct and use a risk matrix:

Identify Risks:

The company first identifies a range of potential risks. For example, supplier delays, quality issues with raw materials, regulatory changes, and cybersecurity threats.

Assess Probability and Impact:

Each risk is then assessed based on two key criteria; probability and impact.

Assign Scores:

Risks are then scored on a scale, say from 1 to 5, where 1 represents the lowest probability or impact and 5 represents the highest. For instance:

- Supplier delays might be rated with a probability of 4 and an impact of 3.

- Quality issues with raw materials might have a probability of 3 and an impact of 4.

- Cybersecurity threats might score high on both fronts, with a probability of 5 and an impact of 5.

Map Risks on the Matrix:

These scores are then plotted on the risk matrix. Risks with a high probability and high impact (like cybersecurity threats) fall into the top-right quadrant, indicating they need immediate and robust mitigation strategies. On the other hand, risks with a low probability and low impact might fall into the bottom-left quadrant, indicating they require minimal attention.

Develop Mitigation Strategies:

Based on the risk matrix, the company can now prioritize its risk management efforts. High-priority risks might involve extensive mitigation plans, such as enhancing cybersecurity measures, whereas lower-priority risks might be monitored regularly but require less immediate action.

Here’s a breakdown of the mechanics of a risk matrix:

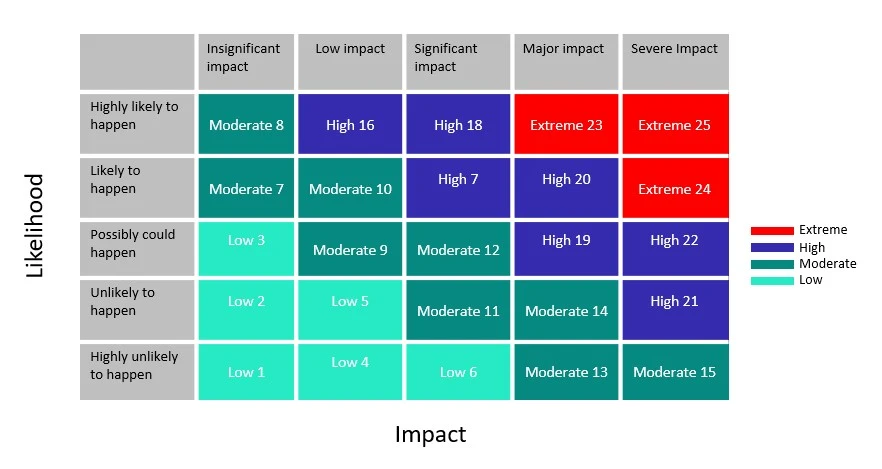

Axes of the Matrix

The risk matrix is typically structured as a grid. One axis represents the potential impact of a risk, while the other indicates the likelihood or probability of that risk occurring. Each axis is usually divided into several levels. For example, impact levels might range from insignificant to severe, while probability levels range from highly unlikely to highly likely.

Risk Scoring

Each identified risk is scored based on its impact and probability. The combination of these scores positions the risk within the matrix, categorizing it as low, moderate, high, or extreme. These categories help in prioritizing the risks.

Color Coding

To make the assessment clearer, risk matrices often use color codes. Risks positioned in the lower left (low impact, low probability) are typically green, indicating low priority. Risks in the upper right (high impact, high probability) are often red, signaling urgent attention. Intermediate risks may be yellow or orange.

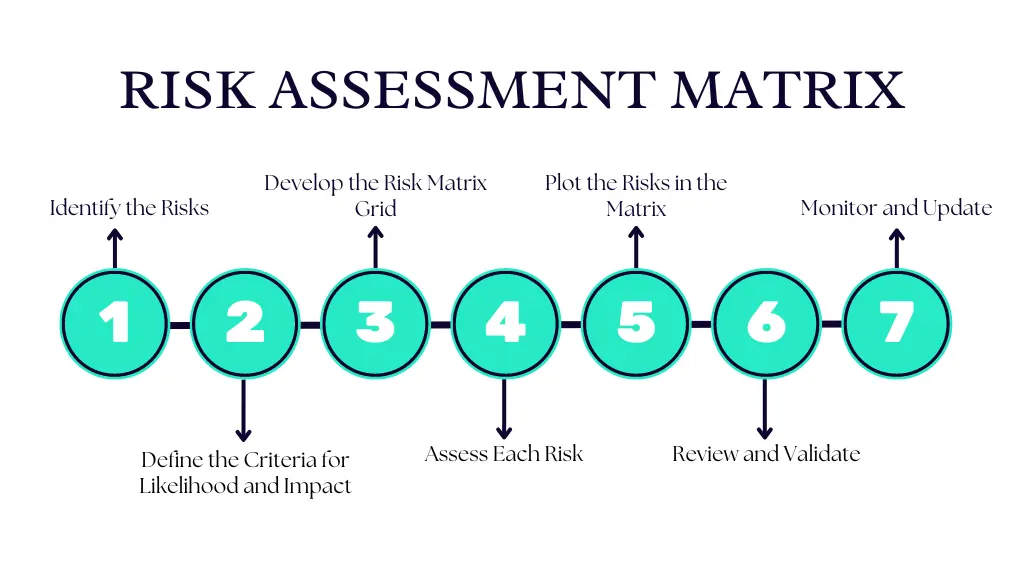

Below is a step-by-step guide to help you create a comprehensive risk matrix:

Identify the Risks

Begin by conducting a thorough risk identification exercise. This can be achieved through brainstorming sessions, expert interviews, and reviewing historical data. List down all potential risks that could impact your organization’s objectives.

Define the Criteria for Likelihood and Impact

Next, establish the criteria for assessing the likelihood and impact of each risk. This involves defining the scales and descriptors for both dimensions. For likelihood, you might use categories such as Highly Unlikely,' 'Unlikely,' 'Possible,' 'Likely,' and 'Highly Likely.' For impact, you might use 'Insignificant,' Low,' Significant,' High,' and Severe.'

Develop the Risk Matrix Grid

Create a grid where one axis represents the likelihood and the other represents the impact. Label the axes according to the scales you have defined. Each cell in the grid will represent a specific combination of likelihood and impact.

Assess Each Risk

Evaluate each identified risk based on the defined criteria. Assign scores for both the impact and probability. For instance, a risk might have a moderate impact (3) but be unlikely to occur (2).

Plot the Risks in the Matrix

Create a grid with impact levels on one axis and probability levels on the other. Plot each risk according to its scores and subsequently color code it. The intersection point on the grid indicates the overall risk level.

Review and Validate

Once the initial matrix is complete, review it for accuracy and comprehensiveness. Validate the assessments with stakeholders and experts to ensure that the risk levels are realistic and the matrix accurately reflects the organization’s risk environment.

Monitor and Update

A risk matrix is not a one-time effort—it requires ongoing monitoring and updating. The matrix should be reviewed and adjusted regularly to reflect new risks, changes in existing risks, and shifts in the organizational or external environment.

A risk matrix helps organizations identify and prioritize risks, aiding in effective resource allocation and strategic planning. It simplifies complex risk assessments for all stakeholders, enhancing communication, accountability, and transparency in tracking and reporting on risk management efforts.

Here are some valuable benefits of a risk matrix:

Identification of Critical Risks:

By plotting identified risks on the matrix, organizations can clearly see which risks need immediate attention and which are less urgent. This visualization aids in not overlooking minor risks while ensuring critical risks are prioritized.

Resource Allocation:

With a clear visual representation, decision-makers can allocate resources more effectively, focusing on high-priority risks that could significantly impact the organization.

Communication:

The risk matrix serves as a communication tool that translates complex risk assessments into a simple, comprehensible format for all stakeholders, from executives to team members.

Strategic Planning:

By identifying and prioritizing risks, the risk matrix supports strategic planning and helps in forming actionable risk management strategies. It allows for preemptive action rather than reactive measures.

Accountability and Transparency:

The visual nature of the risk matrix fosters accountability by clearly delineating who is responsible for managing each risk. It also enhances transparency, making it easier to track progress and report on risk management efforts.

The utility of a risk matrix lies in its simplicity and visual appeal, making it an indispensable component for risk assessment across various industries.

While it is a powerful tool, it is essential to recognize that it is just one component of a comprehensive risk management framework. It should be used in conjunction with other risk assessment and mitigation strategies to provide a holistic view of the organization’s risk profile.

MetricStream solutions are designed to support this integrated approach, offering a broad range of functionalities that encompass risk identification, assessment, monitoring, and reporting.

What is the difference between a risk matrix and a risk heat map?

A risk matrix and a risk heat map are similar tools. Both visualize risks based on likelihood and impact, but a risk heat map often uses color coding to represent different levels of risk severity more intuitively.

What is the 5 by 5 risk matrix?

A 5 by 5 risk matrix is a grid used in risk assessment with five levels of likelihood and five levels of impact, resulting in 25 possible risk scenarios. It lends a detailed framework for evaluating and prioritizing risks.

What is the risk matrix 3x3?

A 3x3 risk matrix is a simpler grid used in risk assessment with three levels of likelihood and three levels of impact, resulting in 9 possible risk scenarios. It offers a straightforward approach to evaluating and prioritizing risks.